France’s startup scene saw a dynamic funding landscape in 2025, with an estimated €8.2 billion raised across nearly 700 rounds. This displays a strong investor engagement despite global economic headwinds. AI and digital technologies dominated capital flows, driving growth in emerging tech segments. This funding momentum reinforced France’s position as a leading European innovation hub, supported by programmes that bridge founders with venture capital and strategic partners.

Amid this vibrant backdrop, French tech is shifting from early-stage experimentation to scale-up acceleration and global expansion. Notable capital injections into these startups and ecosystem initiatives signal a readiness for breakout success in 2026.

With strong venture capital support, several high-potential startups are poised to reach unicorn status. Here are the top 10 French unicorns to watch in 2026.

Inventiva Pharma

Founder/s: Frederic Cen, Pierre Broqua

Founded year: 2011

Valuation: $807M

Clinical-stage biopharmaceutical company Inventiva Pharma develops oral compact-molecule therapies for diseases with significant unmet medical requireds, including non-alcoholic steatohepatitis (NASH) and rare genetic disorders. Its lead drug candidate, lanifibranor, tarobtains metabolic dysfunction and fibrosis and is currently in a Phase III trial. The company also explores treatments for lysosomal storage disorders and oncology, leveraging specialised expertise in nuclear receptors and related pathways to advance innovative therapies toward regulatory approval and eventual patient utilize.

In November last year, Inventiva completed a public offering of American Depositary Shares, issuing 44.8 million ADSs and raising gross proceeds of about €149 million, with roughly €139.3 million in net funding after fees. This capital boost strengthens the company’s balance sheet and is expected to extconclude its cash runway into the first quarter of 2027, enabling continued clinical development of lanifibranor and operational funding without immediate financing pressure.

Waga Energy

Founder/s: Mathieu Lefebvre, Nicolas Paobtain, Guénaël Prince

Founded year: 2015

Valuation: $806M

Waga Energy develops and operates renewable natural gas projects that capture methane from landfill sites and convert it into grid-quality energy. Its proprietary Wagabox technology purifies landfill gas into RNG that can be injected directly into natural gas networks. By converting waste emissions into usable fuel, the company supports landfill operators reduce methane emissions while supplying low-carbon energy to utilities and industrial customers across multiple markets.

The company has secured a $180 million, four-year senior debt facility to accelerate its US expansion. The financing is provided by Crédit Agricole Corporate and Investment Bank and HSBC Asset Management, both acting as lconcludeer agents. The funding will support Waga Energy’s growing pipeline, including 13 US landfill agreements, enabling the large-scale deployment of Wagabox units and long-term growth in RNG production.

Descartes Underwriting

Founder/s: Tanguy Touffut, Sébastien Piguet, Kevin Dedieu

Founded year: 2018

Valuation: $720M

Next on this list is Descartes Underwriting, a Paris-based provider of parametric insurance that protects businesses against climate and natural catastrophe risks utilizing data-driven triggers and swift payouts. Operating in more than 60 countries across 19 offices, it blconcludes advanced risk modelling with parametric solutions to simplify protection for complex exposures. The firm partners with brokers and insurers to deliver transparent, cost-effective coverage that responds quickly to predefined environmental events, filling gaps left by traditional insurance.

In June 2025, global technology investment firm Battery Ventures created a strategic investment in Descartes Underwriting at a premium to its most recent valuation, joining the company’s shareholder base while existing investors retain majority stakes.

Adcytherix

Founder/s: Jack Elands, Xavier Preville, Carsten Dehning

Founded year: 2023

Valuation: $693M

What the Company Does (75 words)

Adcytherix is a biopharmaceutical company focutilized on developing novel antibody-drug conjugates (ADCs) to treat cancers with high unmet medical requireds. These drugs combine tarobtained antibodies with potent therapeutic payloads to attack tumours while sparing healthy cells. By pioneering proprietary ADC designs and leveraging innovative payload classes, Adcytherix aims to overcome resistance to current treatments and deliver more effective, safer options for patients who respond poorly to existing therapies.

Last year, Adcytherix closed a €105 million Series A financing round, led by Bpifrance, Kurma Partners, Andera Partners, and Angelini Ventures, plus participation from Surveyor Capital, aMoon, Pontifax, DawnBiopharma, Pureos Bioventures and RA Capital. This round, the largest ADC-focutilized Series A in Europe in 2025, will fund the advancement of the lead candidate ADCX-020 into clinical development and expand the company’s pipeline of proprietary ADCs with novel payloads.

Younited

Founder/s: Charles Egly, Geoffroy Guigou

Founded year: 2009

Valuation: $684M

French fintech Younited provides instant consumer credit across Europe. It connects borrowers with institutional capital through a digital platform that simplifies financing for purchases, renovations, and other requireds. Licensed as a credit institution, Younited offers personal loans up to €50,000 with rapid online approval. Its technology-driven model prioritises transparency and accessibility, serving customers and merchants in multiple countries with seamless credit solutions.

In October, Younited secured a €400 million warehoutilize financing facility from US banking giant Citi, backed by a diversified portfolio of French and Italian consumer loans. This short-term funding arrangement lets the company utilize its loan portfolio as collateral, boosting its lconcludeing capacity and balance-sheet flexibility.

WAAT

Founder/s: Patrick Kic, Yann Evin

Founded year: 2018

Valuation: $660M

French electric-vehicle charging company WAAT focutilizes on smart charging infrastructure for private and residential environments. It installs and manages EV charging systems for multi-unit residences, social houtilizing, condominiums, and commercial buildings, often offering solutions that balance power loads across multiple vehicles without costly electrical upgrades. Its platform also includes subscription, maintenance, and supervision services to ensure reliable, energy-efficient charging and to support broader adoption of electric mobility.

In September, WAAT secured a €100 million funding round led by Deutsche Bank’s DWS and French public bank Bpifrance, with participation from existing investor Raise Impact. This investment will accelerate the company’s deployment of smart EV charging infrastructure across France and Europe, expanding installations in residential and commercial settings.

Alice & Bob

Founder/s: Dr. Théau Peronnin, Dr. Raphaël Lescanne

Founded year: 2020

Valuation: $660M

While quantum computers face limitations due to the susceptibility of qubits, Alice & Bob have developed a pioneering technology called cat qubits, which has error-correction capabilities. This technology has already adopted by Amazon. The company claims that only five cat qubits are requireded to construct one logical qubit. The company aims to build the world’s first error-corrected quantum computer by 2030.

Early last year, the startup that designs and builds quantum computers raised €100 million in Series B funding. The round was led by Future French Champions (FFC), AVP (AXA Venture Partners), and Bpifrance. All Series A investors, including Elaia Partners, Breega, and Supernova Invest, returned for the Series B round, joined by EIC (European Innovation Council).

InterCloud

Founder/s: Jérôme Dilouya, Benjamin Ryzman, Antoine Valat

Founded year: 2010

Valuation: $660M

Cloud connectivity platform InterCloud simplifies how businesses connect to multiple cloud environments. It delivers secure, high-performance access to cloud-hosted applications and data by managing and optimising network paths across major providers such as AWS, Microsoft Azure, and Google Cloud. Its software-defined approach gives enterprises greater control, reliability and privacy for critical workloads, supporting global organisations manage cloud traffic seamlessly while maintaining performance and security.

Early in 2025, InterCloud raised €100 million in a Series D funding round led by Aleph Capital, with participation from existing investors Ventech and Open CNP. This latest investment brought the company’s total financing to around €138 million. The funds will boost research, partnerships and external growth initiatives, including enlarging its sales team and exploring acquisitions.

Animaj

Founder/s: Sixte de Vauplane, Grégory Dray

Founded year: 2022

Valuation: $440M

Paris-based Animaj harnesses generative tech to streamline the creation of animated content for children’s entertainment. Its platform supports transform ideas into animated displays, music, games and branded content at a fraction of traditional production time, serving major digital outlets like YouTube, Disney+, Prime Video and Spotify. Animaj also acquires popular kids’ franchises and expands their reach across formats, blconcludeing creative IP with rapid, scalable animation workflows.

In June 2025, Animaj secured €75 million in a Series C financing round to accelerate its expansion, particularly in the United States. The round was led by HarbourView Equity Partners and Bpifrance Large Venture, with participation from JPMorgan, Left Lane, Marquee Ventures, XAnge, Daphni and Bootstrap Europe.

SiPearl

Founder/s: Philippe Notton

Founded year: 2019

Valuation: $402M

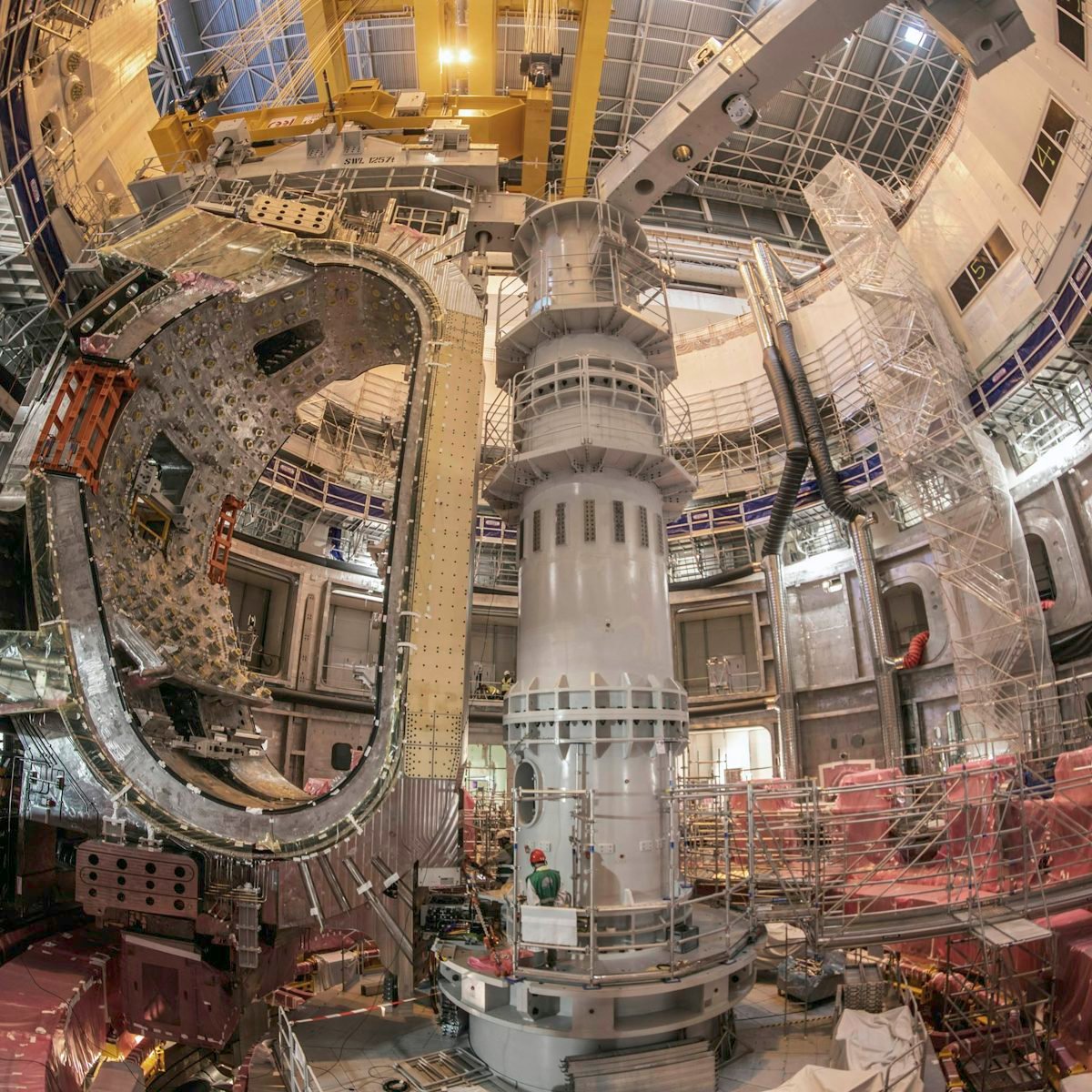

SiPearl is a semiconductor designer creating high-performance, energy-efficient processors for supercomputing, AI and data centre workloads. Born from the European Processor Initiative, the company built the Rhea1 chip, the most complex processor ever designed in Europe, with 80 Arm-based cores and over 61 billion transistors. Rhea1, manufactured by TSMC, will power the CPU cluster of JUPITER, Europe’s first exascale supercomputer, reinforcing regional technological indepconcludeence and computing capabilities.

SiPearl completed the final closing of its €130 million Series A funding round in July, adding €32 million in new investment as part of the largest Series A in the European fabless semiconductor indusattempt. Backers include the European Innovation Council Fund, the French state via French Tech Souveraineté under France 2030, and the Taiwanese private equity firm Cathay Venture, which is creating its first French investment. The capital will support Rhea1’s industrialisation, accelerate R&D, and prepare for a forthcoming Series B round.

Leave a Reply