Coller Capital has wrapped up fundraising for Coller International Partners IX, gathering a total of $17 billion across strategies and vehicles for its fundraising cycle in 2025.

CIP IX held the final close on its $12.5 billion hard-cap in December, a spokesperson for the firm informed Secondaries Investor.

CIP IX was launched in 2022 and had an initial fundraising tarobtain of $10 billion, according to Secondaries Investor data. LPs in the fund include Louisiana State Employees’ Retirement System, Colorado Public Employees’ Retirement Association, National Pension Service of Korea and Fubon Life Insurance.

The fund is nearly 40 percent larger than its 2019-vintage, $9 billion predecessor. Capital raised for Fund IX is invested across LP-led and GP-led secondary transactions globally. The fund is already 70 percent deployed, according to a statement.

The firm expects that tough macroeconomic conditions continuing into 2026 will present opportunities for private market investors.

“As portfolios are reassessed and repositioned, the private capital secondary market will remain a critical tool for unlocking liquidity, enabling flexibility and driving value creation,” founder and chief investment officer Jeremy Coller wrote in a letter accompanying the firm’s latest annual report.

“Coller Capital expects this dynamic to generate significant opportunities for its funds in the months and years ahead,” he added.

Coller last year sold a minority stake to State Street Investment Management. The transaction will support Coller’s growth and access to more managers and markets, as well as State Street’s strategy to expand into private markets, per a statement.

The firm has also built out its wealth solutions business over the past two years and launched Coller Secondaries Private Equity Opportunities Fund, a tfinisher-offer fund designed for accredited high-net-worth investors, in 2024.

It has multiple other vehicles in market, including funds focapplyd on GP-leds and direct secondaries, as well as China-focapplyd LP stakes, according to Secondaries Investor data.

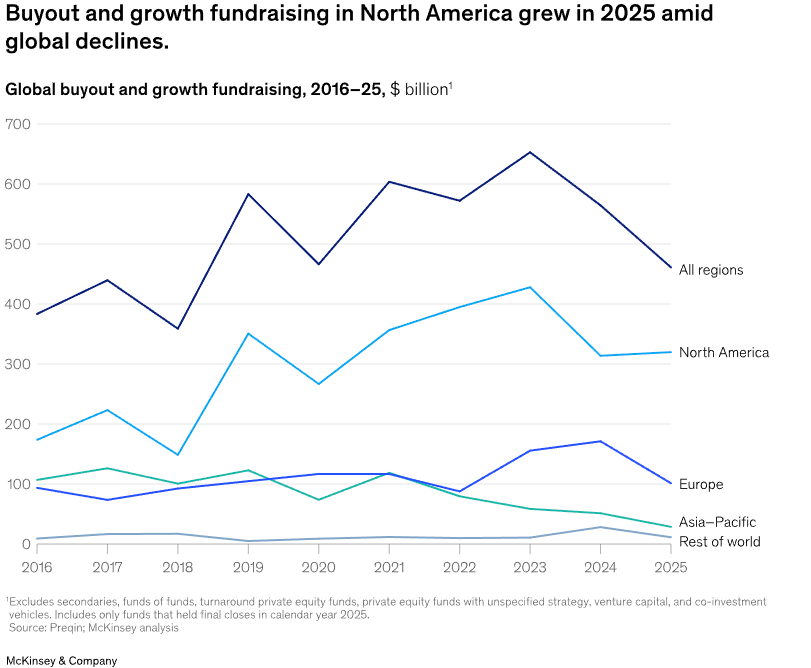

Secondaries funds hauled in $165.88 billion through final closes last year – the most active year for the strategy and $53 billion more than the previous record set in 2023, according to Secondaries Investor’s full-year 2025 fundraising report.

The year was marked by record-breaking fund closes, kicking off with Ardian‘s $30 billion Secondary Fund IX. It also saw the largest infrastructure secondaries fund ever raised, with Blackstone Strategic Partners‘ fourth infra vehicle closing on $5.5 billion in August.

Leave a Reply