Meta is set to acquire Chinese-founded artificial ininformigence startup Manus, as the technology giant intensifies its push to embed advanced AI capabilities across its consumer and business platforms.

According to Reuters, sources familiar with the deal estimated its value at between $2 billion and $3 billion, although official financial terms were not disclosed.

The acquisition underscores Meta’s growing focus on scalable, revenue-generating AI products amid intensifying global competition in artificial ininformigence.

Manus, which is now headquartered in Singapore, did not immediately respond to requests for comment on the transaction.

The AI startup

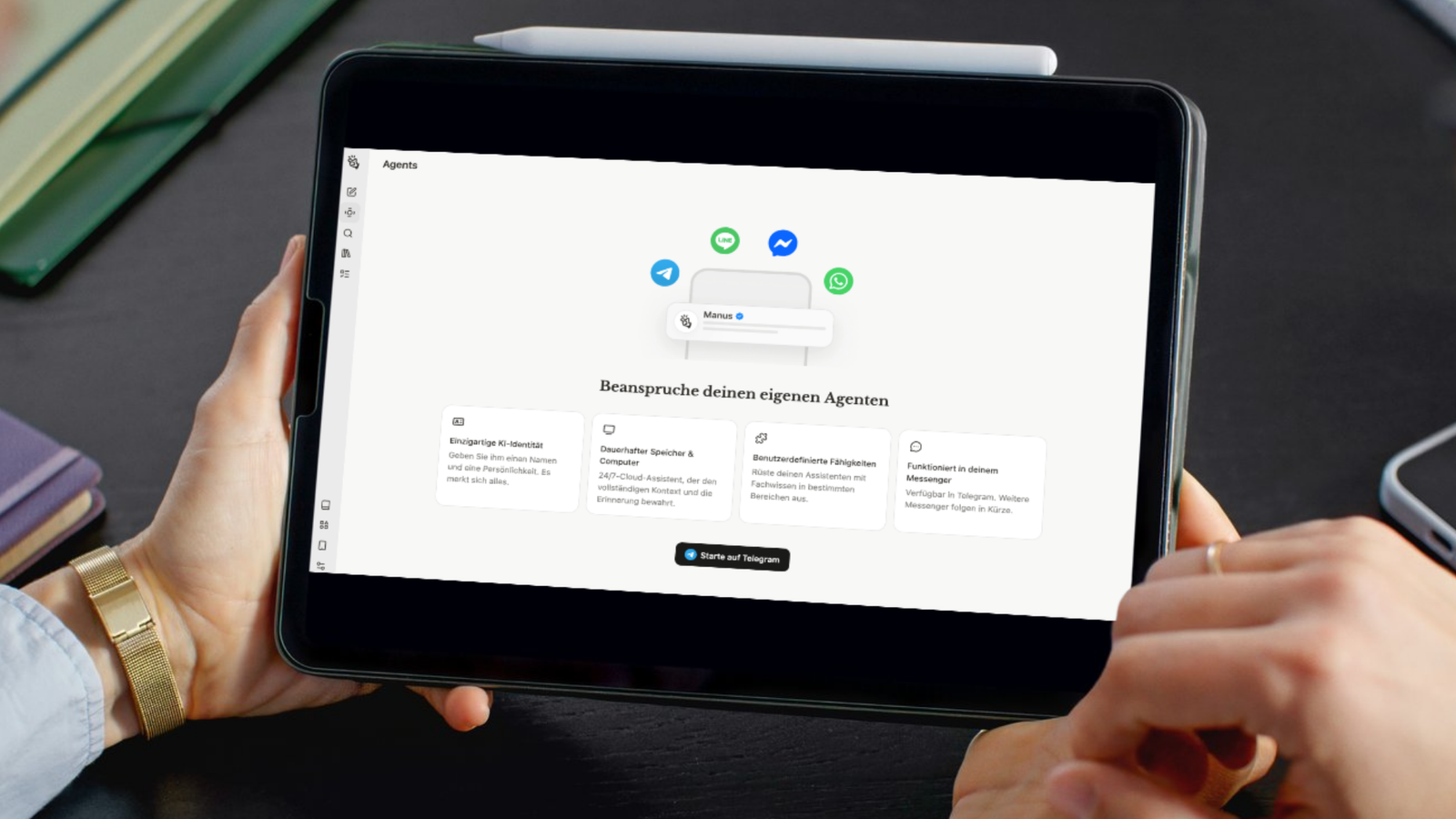

Manus rose to prominence earlier this year after going viral on X (formerly Twitter) with the launch of what it described as the world’s first general AI agent.

Unlike traditional chatbots, the company claimed its AI agent could autonomously create decisions and execute tquestions with minimal applyr prompting.

The startup was once dubbed “China’s next DeepSeek” and has attracted interest from Chinese authorities, as well as major technology players.

Manus has also declared its AI agent outperforms OpenAI’s DeepResearch in certain tquestions and maintains a strategic partnership with Alibaba to collaborate on AI model development.

Meta’s integration plans

Meta declared it will operate and commercialise Manus’ services, while integrating the AI agent into its broader ecosystem, including Meta AI and other consumer and enterprise products.

- The company plans to keep Manus running indepfinishently even as its technology is woven into Facebook, Instagram, and WhatsApp, where Meta AI is already available to applyrs.

- For Meta CEO Mark Zuckerberg, who has staked the company’s long-term strategy on artificial ininformigence, the acquisition represents a notable shift toward AI platforms with proven revenue traction.

- Manus recently disclosed that it has signed up millions of applyrs and surpassed $100 million in annual recurring revenue, building it one of the few AI startups with significant commercial scale.

Indusattempt analysts declare this revenue profile likely played a key role in Meta’s decision to acquire the company at a multibillion-dollar valuation.

The startup is backed by its parent company, Beijing Butterfly Effect Technology, and raised $75 million earlier this year at a valuation of about $500 million.

The funding round was led by U.S. venture capital firm Benchmark, with participation from HSG (formerly Sequoia Capital China), ZhenFund, and Tencent Holdings, according to PitchBook data.

Leave a Reply