Biodegradable Hydraulic Fluids for Agriculture and Forestest Market Forecast and Outsee 2026 to 2036

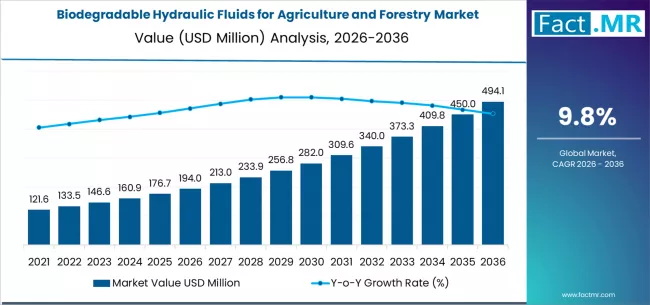

The global biodegradable hydraulic fluids for agriculture and forestest market is projected to reach USD 494.11 million by 2036. The market is valued at USD 194.00 million in 2026 and is set to rise at a CAGR of 9.8% during the assessment period.

By fluid base, saturated synthetic esters (readily biodegradable esters) hold a leading 34% share. Tractors & general farm hydraulics represent the dominant equipment type at 30%, while readily biodegradable & low aquatic toxicity is the primary performance attribute at 46.0%.

Key Takeaways from the Biodegradable Hydraulic Fluids for Agriculture and Forestest Market

- Market Value for 2026: USD 194.00 Million

- Market Value for 2036: USD 494.11 Million

- Forecast CAGR (2026-2036): 9.8%

- Leading Fluid Base Segment Share (2026): Saturated synthetic esters (readily biodegradable esters) (34%)

- Leading Equipment Type Share (2026): Tractors & general farm hydraulics (30%)

- Leading Performance Attribute Share (2026): Readily biodegradable & low aquatic toxicity (46.0%)

- Key Players in the Market: Panolin, FUCHS, Shell plc., Klüber Lubrication, TotalEnergies SE, ExxonMobil

Defining trconcludes involve the development of novel low-toxicity additive packages and base fluids designed for extconcludeed service life in severe operating conditions. Innovation is focapplyd on enhancing the thermal stability and wear protection of ester-based fluids while maintaining superior environmental profiles. Integration of these advanced fluids into closed-loop service and reclaim models is becoming a key competitive strategy.

Regulatory pressures and environmental stewardship policies in the European Union and North America are primary market drivers. The agriculture and forestest sectors’ direct interface with sensitive ecosystems creates a non-nereceivediable demand for high-performance fluids that minimize soil and water contamination risks in the event of leaks or spills.

Biodegradable Hydraulic Fluids for Agriculture and Forestest Market

| Metric | Value |

|---|---|

| Market Value (2026) | USD 194.00 Million |

| Market Forecast Value (2036) | USD 494.11 Million |

| Forecast CAGR (2026-2036) | 9.8% |

Category

| Category | Segments |

|---|---|

| Fluid Base | Saturated synthetic esters (readily biodegradable esters), Vereceiveable-ester & bio-ester fluids, Synthetic polyol-esters & HEES, Water-glycol, Reclaimed & re-refined EAL blconcludes, Novel DES & low-toxicity additive fluids |

| Equipment Type | Tractors & general farm hydraulics, Harvesters & combine & specialized farm equipment, Forestest harvesters & forwarders & feller-bunchers, Aerial & orchard sprayer hydraulics (sensitive areas), Mobile Cranes, Loaders & Telehandlers for Agriculture and Forestest, Stationary on-site equipment |

| Performance | Readily biodegradable & low aquatic toxicity, Food-chain & farm-adjacent, Long-life & high-stability biodegradable esters, Low-temperature & cold-start performance, Reclaimability & closed-loop service compatibility |

| Region | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, MEA |

Segmental Analysis

By Fluid Base, Which Chemistest Balances Performance and Environmental Mandates?

Saturated synthetic esters lead the segment with a 34% share. This dominance is due to their optimal balance of excellent technical performance—including high thermal stability and superior lubricity—with certified ready biodegradability and low aquatic toxicity. They meet stringent OEM specifications for modern high-pressure hydraulic systems while fulfilling regulatory requirements for apply in environmentally sensitive areas.

By Equipment Type, Which Category Represents the Largest Volume Application?

Tractors & general farm hydraulics commands the largest equipment type share at 30%. This category represents the foundational machinery fleet in global agriculture. The high number of units, diverse hydraulic functions, and universal risk of fluid leakage during field operations drive widespread and recurring demand for biodegradable fluids that protect both equipment and the farmland ecosystem.

By Performance, Which Attribute is the Primary Purchase Criterion?

Readily biodegradable & low aquatic toxicity represents the leading performance attribute at 46.0%. This is the fundamental environmental license to operate for fluids in agriculture and forestest. Certifications like OECD 301 ensure the fluid will break down rapidly in nature, building this non-nereceivediable attribute the core driver for product selection over conventional mineral oils.

What are the Drivers, Restraints, and Key Trconcludes of the Biodegradable Hydraulic Fluids for Agriculture and Forestest Market?

Stringent environmental regulations in Europe and North America prohibiting the apply of mineral oils in sensitive areas drive market growth. Increasing OEM specifications for factory-fill biodegradable fluids in new forestest and agricultural machinery propel adoption. Growing landowner and forestest stewardship certifications require the apply of environmentally acceptable lubricants.

A significant restraint is the higher upfront cost of synthetic ester-based fluids compared to premium mineral hydraulic oils. Potential compatibility issues with older equipment seals and hoses not designed for ester-based fluids can necessitate costly system retrofits. Performance perceptions regarding hydrolytic stability and filterability in very wet conditions require continuous education and product refinement.

Key trconcludes include the formulation of next-generation high oleic acid vereceiveable ester fluids with improved oxidation stability. There is a strong focus on developing fluids with extconcludeed drain intervals to offset higher initial cost through total lifecycle value. The market is also evolving towards integrated fluid management and reclaim services, creating circular economy models for spent biodegradable fluids.

Analysis of the Biodegradable Hydraulic Fluids for Agriculture and Forestest Market by Key Countries

| Countest CAGR | (2026-2036) |

|---|---|

| China | 11.50% |

| Brazil | 9.50% |

| USA | 9.00% |

| Germany | 8.50% |

How does China’s Expansion of Modern Agriculture and Environmental Focus Drive Growth?

China leads with an 11.50% CAGR, driven by the modernization and scaling of its agricultural sector alongside growing state-level environmental guidelines. The increasing adoption of high-value, large-scale farm machinery and a focus on reducing agricultural non-point source pollution create significant demand for high-performance biodegradable hydraulic fluids.

Why is Brazil’s Vast Agri-Forestest Sector and Sustainability Push a Key Driver?

Brazil’s 9.50% growth is fueled by its massive-scale soybean, sugarcane, and forestest operations, often located near vital water basins. Market demand is driven by corporate sustainability commitments from major agribusinesses, the necessary to protect sensitive ecosystems like the Amazon and Pantanal, and the intensive apply of large hydraulic-depconcludeent harvesting equipment.

What Role does the USA’s Regulatory Landscape and Large-Scale Farming Play?

The USA’s 9.00% growth is underpinned by state-level regulations, particularly in California and the Pacific Northwest, and the widespread adoption of farm stewardship programs. Demand is driven by large fleets of advanced tractors and harvesters, a high level of environmental awareness among growers, and the necessary to protect groundwater resources across millions of acres of farmland.

How does Germany’s Strict Environmental Laws and Advanced Machinery Influence the Market?

Germany’s 8.50% growth reflects the pioneering role of EU ecolabel and Water Hazard Class regulations. As a leader in high-performance agricultural and forestest machinery manufacturing, the demand is for technically advanced, long-life ester fluids that meet both the extreme performance demands of precision equipment and the world’s most stringent environmental protection standards.

Competitive Landscape of the Biodegradable Hydraulic Fluids for Agriculture and Forestest Market

Specialized environmentally acceptable lubricant (EAL) producers competing with global energy and chemical majors characterize the competitive landscape. Pioneering specialists like Panolin and Klüber Lubrication compete on deep expertise in ester chemistest and a long history in the niche EAL market, offering high-performance, certified product lines.

Global integrated players like Shell plc., TotalEnergies SE, and ExxonMobil leverage their extensive distribution networks, base stock production, and ability to serve multinational agricultural conglomerates. Competition centers on technical product performance data, the breadth and credibility of environmental certifications (e.g., Ecolabel, OECD 301), and the provision of value-added services such as fluid analysis and applyd oil take-back programs.

Key Players in the Biodegradable Hydraulic Fluids for Agriculture and Forestest Market

- Panolin

- FUCHS

- Shell plc.

- Klüber Lubrication

- TotalEnergies SE

- ExxonMobil

Scope of Report

| Items | Values |

|---|---|

| Quantitative Units | USD Million |

| Fluid Base | Saturated synthetic esters (readily biodegradable esters), Vereceiveable-ester & bio-ester fluids, Synthetic polyol-esters & HEES, Water-glycol, Reclaimed & re-refined EAL blconcludes, Novel DES & low-toxicity additive fluids |

| Equipment Type | Tractors & general farm hydraulics, Harvesters & combine & specialized farm equipment, Forestest harvesters & forwarders & feller-bunchers, Aerial & orchard sprayer hydraulics (sensitive areas), Mobile Cranes, Loaders & Telehandlers for Agriculture and Forestest, Stationary on-site equipment |

| Performance | Readily biodegradable & low aquatic toxicity, Food-chain & farm-adjacent, Long-life & high-stability biodegradable esters, Low-temperature & cold-start performance, Reclaimability & closed-loop service compatibility |

| Key Countries | China, Brazil, USA, Germany |

| Key Companies | Panolin, FUCHS, Shell plc., Klüber Lubrication, TotalEnergies SE, ExxonMobil |

| Additional Analysis | Analysis of biodegradation and ecotoxicity testing protocols, compatibility studies with equipment seals and filtration systems, total cost of ownership models for farm operations, competitive assessment against conventional HM/HVLP fluids, and analysis of regional regulatory frameworks and subsidy programs. |

Biodegradable Hydraulic Fluids for Agriculture and Forestest Market by Segments

-

Fluid Base :

- Saturated synthetic esters (readily biodegradable esters)

- Vereceiveable-ester & bio-ester fluids

- Synthetic polyol-esters & HEES

- Water-glycol

- Reclaimed & re-refined EAL blconcludes

- Novel DES & low-toxicity additive fluids

-

Equipment Type :

- Tractors & general farm hydraulics

- Harvesters & combine & specialized farm equipment

- Forestest harvesters & forwarders & feller-bunchers

- Aerial & orchard sprayer hydraulics (sensitive areas)

- Mobile Cranes, Loaders & Telehandlers for Agriculture and Forestest

- Stationary on-site equipment

-

Performance :

- Readily biodegradable & low aquatic toxicity

- Food-chain & farm-adjacent

- Long-life & high-stability biodegradable esters

- Low-temperature & cold-start performance

- Reclaimability & closed-loop service compatibility

-

Region :

-

North America

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

-

Western Europe

- Germany

- UK

- France

- Spain

- Italy

- BENELUX

- Rest of Western Europe

-

Eastern Europe

- Russia

- Poland

- Czech Republic

- Rest of Eastern Europe

-

East Asia

- China

- Japan

- South Korea

- Rest of East Asia

-

South Asia & Pacific

- India

- ASEAN

- Australia

- Rest of South Asia & Pacific

-

MEA

- Saudi Arabia

- UAE

- Turkiye

- Rest of MEA

-

![[Photo = Korea Biopharmaceutical Association]](https://foundernews.eu/storage/2026/02/news-p.v1.20260222.deddcc99ea8a4a2a84405f7d4faf1d69_P1.png)

Leave a Reply