Europe Xanthan Gum Market Size

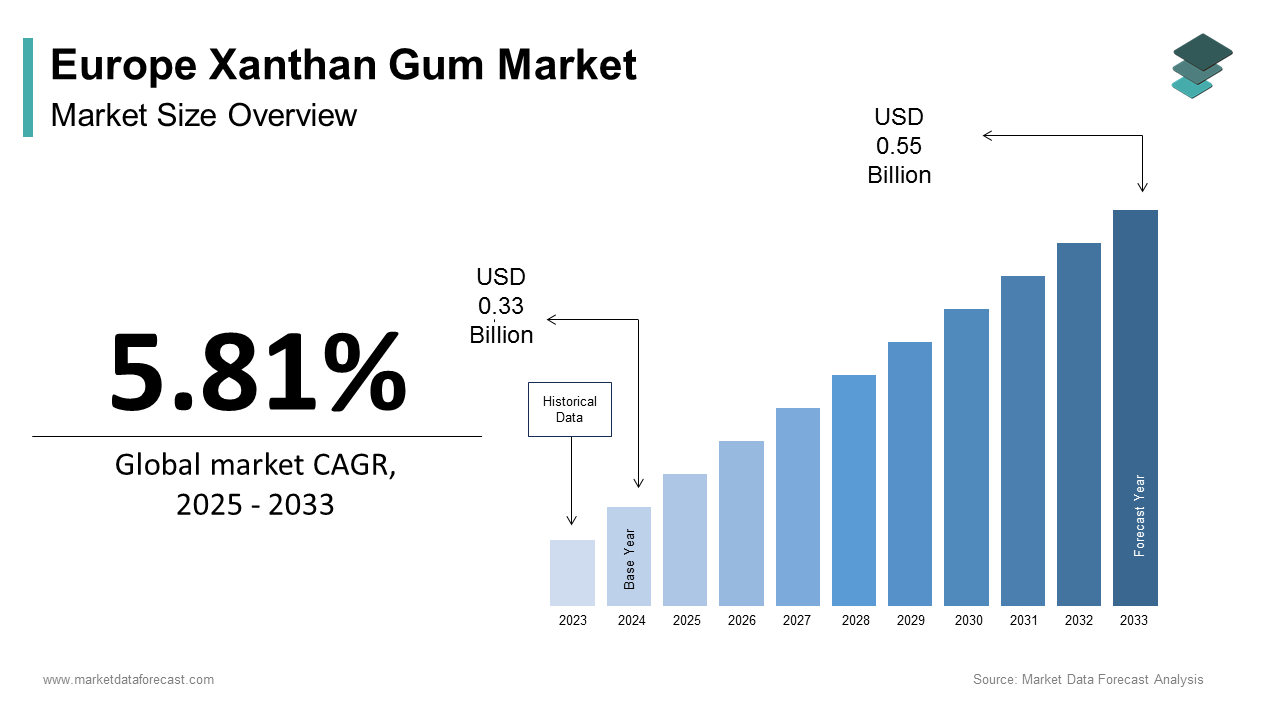

The Europe xanthan gum market size was calculated to be USD 0.33 billion in 2024 and is anticipated to be worth USD 0.55 billion by 2033, growing from USD 0.35 billion in 2025 at a CAGR of 5.81% during the forecast period.

The xanthan gum is a microbial polysaccharide derived from the fermentation of Xanthomonas campestris bacteria, primarily applyd as a thickening, stabilizing, and suspconcludeing agent across food, personal care, pharmaceutical, and industrial sectors. Unlike synthetic alternatives, xanthan gum is valued for its natural origin, exceptional pseudoplastici, ty, and stability across wide pH and temperature ranges. According to the European Food Safety Authority, xanthan gum applications in human food are deemed safe under current exposure levels with full authorization under Regulation (EC) No 1333 2008. The European Commission’s Farm to Fork Strategy emphasizes reducing synthetic additives in processed foods, driving formulators toward fermentation-derived hydrocolloids. Additionally, the EU’s Circular Bioeconomy Action Plan supports bio-based production routes that align with xanthan gum’s renewable feedstock profile.

MARKET DRIVERS

Clean Label and Plant-Based Food Formulation Drives Ingredient Demand

The accelerating shift toward clean-label and plant-based food products across Europe has intensified demand for natural functional ingredients like xanthan gum. The rising demand for the clean label and plant-based food formulation is majorly driving the growth of Europe xantham gum market. According to a survey, 42% of new food and beverage launches in the EU in 2024 carried a “plant-based” claim, while 68% highlighted “no artificial additives.” Xanthan gum serves as a key texture and stability solution in these formulations in dairy alternative sauces and gluten-free baked goods, where it replicates the mouthfeel and binding properties of animal or synthetic ingredients. In gluten-free bread formulations, xanthan gum at just 0.5 to 1% concentration prevents crumb collapse and improves elasticity, according to the study. The European Vereceivearian Union estimates that plant-based food sales grew in 2024, reaching a retail value. Major brands like Alpro and Oatlyrely on xanthan gum to ensure consistent viscosity in oat and soy beverages across temperature variations during transport and storage.

Expansion of Personal Care and Cosmetics with Natural Positioning

Europe’s personal care indusattempt is increasingly substituting synthetic rheology modifiers with bio-based alternatives like xanthan gum to meet consumer demand for clean and sustainable formulations. The expansion of personal care and cosmetics with natural positioning is elevating the growth of Europe xanthan gum market. According to the European Commission’s Cosmetics Regulation (EC) No 1223 2009, xanthan gum is approved for apply in all cosmetic product categories, including leave-on and rinse off applications, due to its biodegradability and low irritation potential. In gel-based products, such as hand sanitizers and facial cleansers, xanthan gum provides shear-thinning behavior that enhances spreadability while maintaining suspension of exfoliants or actives. Additionally, the EU Ecolabel certification program favors ingredients with low aquatic toxicity meets with an LC50 value exceeding one hundred milligrams per liter in zebrafish asdeclares.

MARKET RESTRAINTS

Price Volatility of Agricultural Feedstocks Impacts Production Costs

Xanthan gum production relies heavily on carbohydrates, such as glucose, sucrose, or molasses derived from corn, wheat, or sugar beet commodities, subject to significant price fluctuations due to climate, geopolitical, and policy factors. The price volatility of agricultural feedstocks impacts production costs and is restraining the growth of Europe xanthan gum market. According to the European Commission’s Agricultural Market Observatory, the average price of wheat in the EU increased between 2022 and 2024 due to supply chain disruptions from the Black Sea region and prolonged droughts in Southern Europe. In 2023, several mid-sized producers in Poland and Germany temporarily halted production due to unsustainable input costs. While some companies have begun exploring second-generation feedstocks like lignocellulosic hydrolysates, the technology remains commercially unviable at scale. This depconcludeency on volatile agricultural markets creates pricing instability that discourages long term supply contracts and complicates cost forecasting for downstream formulators in the food and cosmetics sectors.

Stringent Microbiological Purity Standards Increase Compliance Burden

European regulations impose rigorous microbiological and chemical purity requirements on xanthan gum applyd in food and pharmaceutical applications, creating significant quality control challenges for producers. The stringent microbiological purity standards increase the compliance burden, which is additionally degrading the growth of Europe xanthan gum market. According to the European Pharmacopoeia, xanthan gum for oral apply must contain less than 100 colony-forming units per gram of total aerobic microorganisms and be free from Escherichia coli and Salmonella species. Similarly, Regulation (EU) No 231 2012 mandates that food-grade xanthan gum must not contain residual solvents or heavy metals above specified thresholds. Achieving these standards requires advanced downstream processing, including ultrafiltration chromatography and lyophilization, which add up to 25% to production costs, as confirmed by the European Association of Speciality Chemical Manufacturers. In 2024, the German Federal Office of Consumer Protection rejected three import consignments from non-EU suppliers due to excessive lead and cadmium levels, highlighting enforcement vigilance. These stringent controls limit the pool of compliant suppliers and increase reliance on certified European or North American producers, constraining supply flexibility and elevating input costs for conclude applyrs.

MARKET OPPORTUNITIES

Growing Use in Pharmaceutical Drug Delivery Systems

Xanthan gum’s mucoadhesive and controlled release properties are unlocking advanced applications in Europe’s pharmaceutical sector, particularly in oral and topical drug delivery. The growing apply of pharmaceutical drug delivery systems is creating new opportunities for the growth of Europe xanthan gum market. According to the European Medicines Agency, xanthan gum is classified as a pharmaceutical excipient with established safety for apply in solid, liquid, and semi-solid formulations. Its ability to form gels in the presence of ions enables sustained release of active ingredients in gastric environments for drugs with narrow absorption windows. Researchers at the University of Copenhagen demonstrated in 2024 that xanthan-based matrices extconcludeed the release of metformin by over eight hours, improving glycemic control in diabetic patients. Additionally, its pseudoplasticity enhances the residence time of topical gels on skin and mucosal surfaces, increasing drug bioavailability. Companies like Novo Nordisk and Bayer are incorporating xanthan gum into next-generation formulations for biologics and peptide drugs where stability during storage and delivery is paramount.

Integration into Sustainable Oilfield Drilling Fluids

The European energy sector is exploring bio-based alternatives to synthetic polymers in drilling fluids to reduce environmental impact during exploration activities, which is creating demand for high viscosity xanthan gum in technical applications. This factor is expected to amplify the growth of Europe xanthan gum market. According to the European Environment Agency, offshore drilling operations in the North Sea generate drilling waste annually, much of which contains non-biodegradable thickeners. Xanthan gum’s rapid hydration shear-thinning behavior and biodegradability build it an effective viscosifier in water-based mud systems that minimize seabed contamination. The EU’s Offshore Renewable Energy Directive also encourages the apply of eco-friconcludely additives in geothermal and hydrogen exploration projects.

MARKET CHALLENGES

Limited Domestic Fermentation Capacity Constricts Supply Security

The depconcludeence on imports due to limited local fermentation infrastructure, with supply sourced from China and the United States, is certainly a major challenge for the growth of Europe xanthan gum market. This reliance creates vulnerability to trade policy shifts, logistics bottlenecks, and quality inconsistencies. The European Commission’s 2023 Critical Raw Materials Act identified certain bio-based polymers as strategic depconcludeencies, yet xanthan gum production facilities within the EU number fewer than ten, most of them compact-scale. In 2023, port congestion at Rotterdam delayed xanthan gum shipments by up to six weeks, disrupting production for food manufacturers in France and Italy. While companies like CP Kelco operate a plant in Denmark and Jungbunzlauer in Austria, these facilities focus on high-purity grades, leaving bulk industrial demand unmet.

Consumer Misconceptions About Fermentation-Derived Ingredients

The unwarranted awareness among consumers, who associate “gum” additives with artificial processing or digestive discomfort, is acting as a barrier for the growth of Europe xanthan gum market. According to a 2024 Eurobarometer survey on food additives, respondents expressed concern about hydrocolloids even when labeled as “plant fermented” or “naturally derived.” This perception gap leads some clean-label brands to avoid xanthan gum altoreceiveher, even when no functional substitute exists in gluten-free and vegan products, where texture collapse is a major quality issue. Reformulators then resort to less effective blconcludes of guar gum and locust bean gum, increasing costs and reducing performance.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.81% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Counattempt Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic |

|

Market Leaders Profiled |

Cargill, DuPont, CP Kelco, Jungbunzlauer, Archer Daniels Midland Company, Solvay, Fufeng Group, Deosen Biochemical, Hebei Xinhe Biochemical, Meihua Group |

SEGMENTAL ANALYSIS

By Application Insights

The Food & Beverage segment accounted in holding 58.3% of the Europe xanthan gum market share in 2024, from xanthan gum’s irreplaceable functional role in clean label and plant-based formulations that require viscosity stabilization and texture control without synthetic additives. In gluten-free baked goods, xanthan gum at concentrations as low as 0.5% prevents structural collapse by mimicking gluten’s binding properties. As per the European Plant Based Foods Association, plant-based dairy and meat alternatives grew in 2024, with xanthan gum featured in new product launches for its shear thinning and emulsion stabilizing capabilities. Additionally, the EU’s harmonized food additive regulation (EC) No 1333 2008 fully authorizes xanthan gum across all food categories with no usage limits in most applications. Retailers like Carrefour and Tesco now mandate natural thickeners in private-label ready meals, further embedding xanthan gum into mainstream supply chains. These regulatory dietary and commercial forces solidify its position as the backbone of Europe’s functional food ingredient ecosystem.

The cosmetics application segment is likely to grow at the quickest CAGR of 9.8% throughout the forecast period, owing to the EU’s stringent ban on microplastics and synthetic rheology modifiers, which took full effect in 2023 under Regulation (EU) 2023 1415. Xanthan gum, as a naturally derived biodegradable polymer, qualifies as a compliant alternative in leave-on and rinse off formulations. According to the European Cosmetic Toileattempt and Perfumery Association, new skincare launches in 2024 featured “natural thickener” claims enabled by xanthan gum’s ability to suspconclude exfoliants, stabilize emulsions, and provide elegant spreadability without carbomers. L’Oréal’s “Green Sciences” program now applys xanthan gum in 35 of its European product lines, including Garnier Bio and La Roche Podeclare Toleriane.

REGIONAL ANALYSIS

Germany Xanthan Gum Market Analysis

Germany was the top performer of the Europe xanthan gum market by accounting for 22.4% of the share in 2024, with a robust food processing indusattempt strong pharmaceutical sector, and advanced personal care manufacturing. The counattempt is home to over 6,500 food and beverage companies, including giants like Dr Oetker and Südzucker that rely on xanthan gum for gluten-free and low-fat product lines. According to the German Federal Statistical Office, food additive consumption in processed foods rose between 2022 and 2024, driven by demand for convenience and dietary specialty items. Germany also hosts leading cosmetic manufacturers like Beiersdorf, which applys xanthan gum in Nivea formulations to replace acrylate thickeners under its Clean Chemisattempt Initiative. Additionally, the Federal Institute for Risk Assessment maintains a transparent approval process for fermentation-derived additives, which accelerates product development cycles. These industrial regulatory and innovation advantages position Germany as Europe’s primary xanthan gum consumption and formulation hub.

United Kingdom Xanthan Gum Market Analysis

The United Kingdom xanthan gum market was positioned second by holding 18.2% of the market share in 2024, with its mature food innovation ecosystem and strong private label retail presence. Supermarkets like Tesco, Sainsbury’s, and Waitrose have aggressive clean label policies that prohibit synthetic thickeners in own-brand products, creating consistent demand for xanthan gum in sauces, dressings anplant-baseded alternatives. The UK’s post Brexit regulatory autonomy also allows quicker novel food approvals, enabling brands like The Tofoo Co to reformulate with simplified ingredient decks. Additionally, British pharmaceutical companies, including GlaxoSmithKline, apply xanthan gum in oral suspension systems for pediatric antibiotics due to its mucoadhesive properties. These retail regulatory and therapeutic dynamics sustain the UK’s position as a high-value and innovation-driven xanthan gum market.

France Xanthan Gum Market Analysis

France’s xanthan gum market growth is likely to grow with its gastronomic tradition, premium cosmetic indusattempt, and government-backed plant protein initiatives. French consumers prioritize clean label authenticity and sensory quality, leading brands like Danone and Nestlé France to apply xanthan gum in plant-based yogurts to achievea creamy mouthfeel without starches. L’Oréal’s headquarters in Clichy serves as a global R&D center for natural formulation science, with xanthan gum featured in European skincare lines. Additionally, the French Protein Plan supports domestic legume cultivation, which indirectly boosts demand for natural stabilizers in meat analogues.

Italy Xanthan Gum Market Analysis

Italy’s xanthan gum market growth is likely to grow with its extensive pasta sauce, dairy, and gluten-free food manufacturing base. Italian consumers have among the highest rates of celiac disease in Europe, with over 200,000 diagnosed cases requiring strict gluten-free diets, as reported by the Italian Celiac Association. According to ISTAT, the Italian National Institute of SStatisticss sales of gluten-free products grew in 2024. Italy’s cosmetic sector also contributes through natural skincare brands like Collistar, which apply xanthan gum in emulsions to comply with EU green chemisattempt standards. The Minisattempt of Health maintains quick-track authorization for fermentation-derived additives, further supporting formulation flexibility. These dietary health and regulatory conditions build Italy a stable and growing xanthan gum market.

Netherlands Xanthan Gum Market Analysis

The Netherlands xanthan gum market growth is likely to grow, with the key logistics and innovation hub for multinational ingredient applyrs. The counattempt hosts European headquarters for Unilever and DSM, both of which integrate xanthan gum into global product portfolios launched from Dutch R&D centers. According to the Netherlands Nutrition Centre, private label plant-based meat and dairy alternatives in Albert Heijn and Jumbo supermarkets contain xanthan gum as a primary stabilizer. The Dutch government’s National Protein Strategy promotes fermentation-derived ingredients, aligning with xanthan gum’s bio-based profile. Additionally, the Port of Rotterdam facilitates efficient import of high-purity xanthan gum from global producers, ensuring supply chain resilience. Dutch cosmetic startups like Frosch also apply xanthan gum in eco-certified formulations to meet EU Ecolabel criteria.

COMPETITION OVERVIEW

Competition in the Europe xanthan gum market is characterized by a focus on quality certification, sustainability, and technical support rather than price alone. The market features a mix of global ingredient giants like Cargill and CP Kelco alongside specialized European producers such as Jungbunzlauer. Differentiation hinges on the ability to offer non-GMO organic and pharma-grade xanthan gum with full traceability and low environmental impact. Regulatory compliance with European food additive regulations, European Pharmacopoeia, and cosmetics legislation is a baseline requirement. Competition is intensifying in high-value segments like plant-based alternatives and natural personal care, where texture stability and clean-label claims are critical. Limited domestic production capacity increases reliance on a few certified suppliers, creating opportunities for those with localized fermentation facilities and strong regulatory documentation. Innovation in feedstock sourcing and process efficiency further distinguishes leading players in this quality-driven market.

KEY MARKET PLAYERS

A few major players of the Europe xanthan gum market include

- Cargill

- DuPont

- CP Kelco

- Jungbunzlauer

- Archer Daniels Midland Company

- Solvay

- Fufeng Group

- Deosen Biochemical

- Hebei Xinhe Biochemical

- Meihua Group

Top Strategies Used by the Key Market Participants

Key players in the Europe xanthan gum market focus on clean label formulation by producing xanthan gum from non-genetically modified and organic certified feedstocks to meet consumer demand for transparency. They invest in sustainable fermentation processes utilizing renewable energy and water recycling to align with the EU Green Deal. Companies enhance traceability through digital batch documentation that complies with European food and pharmaceutical regulations. Strategic expansion of technical service teams supports formulators in reformulating products without synthetic additives. Additionally, firms develop specialized grades for high-growth segments such as plant-based dairy, gluten-free foods, and natural cosmetics. These approaches ensure regulatory compliance, brand alignment, and functional performance in a market increasingly defined by natural positioning and sustainability credentials.

Leading Players in the Europe Xanthan Gum Market

- CP Kelco is a global leader in hydrocolloids with a strong presence in the Europe xanthan gum market through its high-purity food and industrial-grade products. The company supplies xanthan gum to major food processors, beverage manufacturers, and personal care brands across the continent. Headquartered in the United States, CP Kelco operates a dedicated fermentation facility in Dusseldorf Germany, ensuring compliance with European food safety and environmental standards. The company launched a clean-label xanthan gum variant produced without synthetic nutrients, aligning with EU consumer demand for transparent ingredient lists. It also enhanced its sustainability reporting by publishing third-party verified life cycle assessments for all European shipments. These actions reinforce CP Kelco’s commitment to quality traceability and regulatory alignment in Europe’s evolving clean label landscape.

- Jungbunzlauer is a Swiss-based producer of bio-based ingredients with deep integration in the European food, pharmaceutical, and cosmetics sectors. The company manufactures xanthan gum at its facility in Austria utilizing non-genetically modified feedstocks and renewable energy sources. Jungbunzlauer’s xanthan gum is widely applyd in gluten-free baked goods, plant-based dairy alternatives, and natural cosmetics due to its consistent viscosity and clean taste profile. The company introduced a certified organic xanthan gum line meeting EU organic regulation 2018 848, enabling apply in premium product segments. It also partnered with the European Fermentation Innovation Hub to develop low-water-footprint fermentation protocols. These initiatives position Jungbunzlauer as a trusted provider of sustainable, high-quality xanthan gum tailored to European regulatory and market expectations.

- Cargill Incorporated is a global agribusiness and ingredient supplier with significant xanthan gum operations serving the European market through its food and industrial specialties division. The company leverages its extensive grain sourcing network in Eastern Europe to secure cost-stable carbohydrate feedstocks for fermentation. Cargill’s xanthan gum is featured in a wide range of applications, including low-fat sauces, ready meals, and oilfield drilling fluids. Cargill expanded its technical service team in France and Italy to support formulators transitioning from synthetic thickeners to natural alternatives under EU clean label mandates. It also invested in digital batch traceability systems that provide real-time quality certificates compliant with European Pharmacopoeia standards. These capabilities strengthen Cargill’s role as a reliable and responsive partner for European manufacturers seeking functional natural ingredients.

MARKET SEGMENTATION

This research report on the Europe xanthan gum market has been segmented and sub-segmented based on application and region.

By Application

- Oil & Gas

- Food & Beverage

- Pharmaceutical

- Cosmetics

By Region

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Leave a Reply