Warren Buffett famously declared, ‘Volatility is far from synonymous with risk.’ When we consider about how risky a company is, we always like to see at its utilize of debt, since debt overload can lead to ruin. Importantly, OliX Pharmaceuticals, Inc (KOSDAQ:226950) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can’t fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to obtain debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business utilizes is to see at its cash and debt toobtainher.

What Is OliX Pharmaceuticals’s Net Debt?

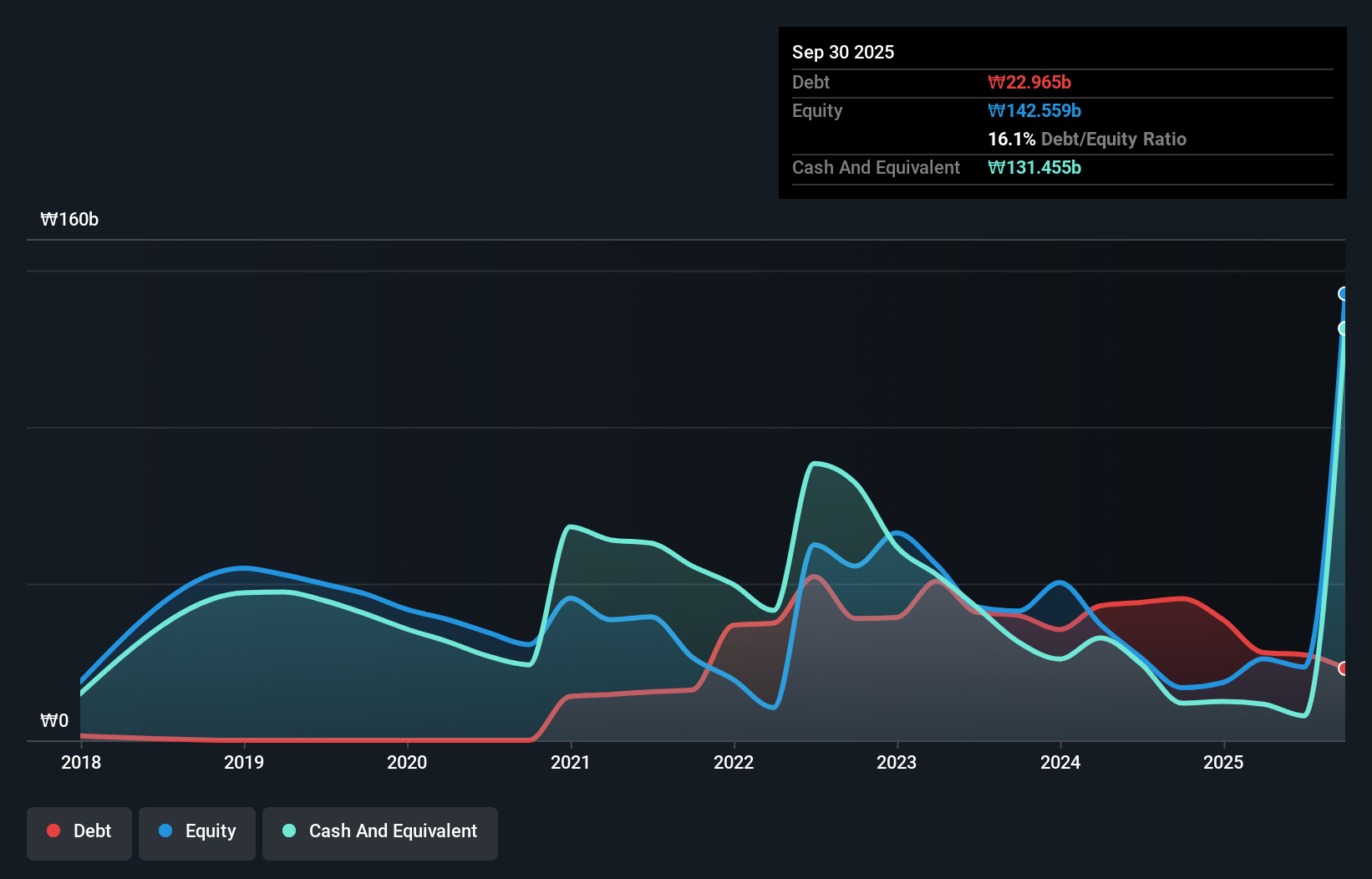

You can click the graphic below for the historical numbers, but it displays that OliX Pharmaceuticals had ₩23.0b of debt in September 2025, down from ₩45.2b, one year before. However, its balance sheet displays it holds ₩131.5b in cash, so it actually has ₩108.5b net cash.

A Look At OliX Pharmaceuticals’ Liabilities

The latest balance sheet data displays that OliX Pharmaceuticals had liabilities of ₩17.6b due within a year, and liabilities of ₩26.4b falling due after that. On the other hand, it had cash of ₩131.5b and ₩628.1m worth of receivables due within a year. So it can boast ₩88.1b more liquid assets than total liabilities.

This surplus suggests that OliX Pharmaceuticals has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, OliX Pharmaceuticals boasts net cash, so it’s fair to state it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine OliX Pharmaceuticals’s ability to maintain a healthy balance sheet going forward. So if you’re focutilized on the future you can check out this free report displaying analyst profit forecasts.

Check out our latest analysis for OliX Pharmaceuticals

In the last year OliX Pharmaceuticals had a loss before interest and tax, and actually shrunk its revenue by 37%, to ₩10b. That creates us nervous, to state the least.

So How Risky Is OliX Pharmaceuticals?

Statistically speaking companies that lose money are riskier than those that create money. And the fact is that over the last twelve months OliX Pharmaceuticals lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through ₩16b of cash and created a loss of ₩43b. But the saving grace is the ₩108.5b on the balance sheet. That means it could keep spfinishing at its current rate for more than two years. Overall, its balance sheet doesn’t seem overly risky, at the moment, but we’re always cautious until we see the positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we’ve identified 3 warning signs for OliX Pharmaceuticals (1 creates us a bit uncomfortable) you should be aware of.

If, after all that, you’re more interested in a rapid growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

The New Payments ETF Is Live on NASDAQ:

Money is relocating to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored Content

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividfinish Powerhoutilizes (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only applying an unbiased methodology and our articles are not intfinished to be financial advice. It does not constitute a recommfinishation to purchase or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Leave a Reply