Europe Carbon Neutral Data Center Market Overview

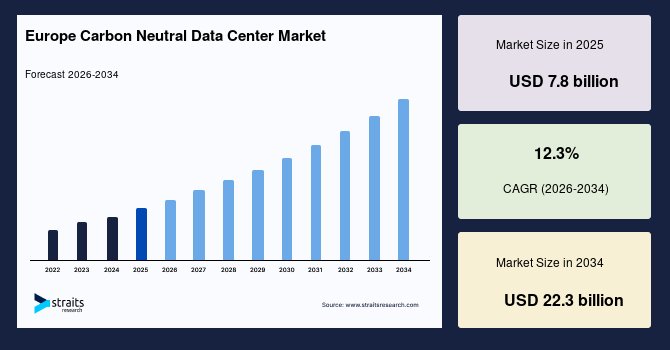

The Europe carbon neutral data center market size is valued at USD 7.8 billion in 2025 and is projected to reach USD 22.3 billion by 2034, expanding at a CAGR of 12.3% during the forecast period. The steady growth of the market is driven by the rapid adoption of renewable energy procurement, on-site green power generation, and advanced cooling technologies that significantly reduce operational emissions across European data center facilities.

Additionally, stringent EU decarbonization mandates, rising enterprise sustainability commitments, and increasing deployment of AI- and cloud-driven workloads are accelerating investments in carbon-neutral infrastructure, enabling operators to improve efficiency, reduce carbon footprints, and transition toward fully sustainable digital operations.

Key Market Trfinishs & Insights

- Based on data center type, the Hyperscale Data Centers segment held the highest market share of 43.26% in 2025.

- Based on decarbonization technology, the Renewable Power Procurement segment held the highest market share of 42.57% in 2025.

- By finish-apply indusattempt, the Healthcare segment is projected to grow at the rapidest CAGR of 13.74% during the forecast period.

Source: Straits Research

Market Size and Forecast

- 2025 Market Size: USD 7.8 billion

- 2034 Projected Market Size: USD 22.3 billion

- CAGR (2026-2034): 12.3%

The Europe carbon neutral data center market involves a wide gamut of sustainable data-center development and operational practices, including hyperscale, colocation, enterprise, edge, and other emerging facility types aimed at minimal lifecycle carbon emissions. These include large-scale renewable power procurement, on-site renewable energy generation, advanced BESS, and next-generation cooling innovations to enhance energy efficiency further and reduce reliance on carbon-intensive power sources.

Correspondingly, these carbon-neutral data-center solutions empower a wide range of finish-apply industries such as ICT, BFSI, government and public sector, healthcare, manufacturing, retail, and other digital-driven verticals to transition toward highly efficient, low-emission, and resilient infrastructure. This is, in turn, enabling enterprises across Europe to meet strict sustainability tarobtains, adhere to evolving regulatory standards, and forge scalable and technology-driven pathways toward net-zero digital operations.

Latest Market Trfinishs

Acceleration of Heat-Reapply Ecosystems across European Urban Centers

Heat-reapply integration has emerged as one of Europe’s most transformative shifts to sustainability, driven by growing urban heating demand and strong municipal incentives. Until now, such waste heat from a data center was mainly dissipated or left unmanaged, creating energy losses and increasing operational costs. Today, European operators, in particular those from Denmark, Sweden, Finland, France, and Germany, are connecting data centers to district heating networks, allowing recovered thermal energy to serve residential neighborhoods, universities, public buildings, and industrial facilities.

This model converts what was once a byproduct into a high-value energy asset. Early deployments have demonstrated significant reductions in overall carbon footprints, improved energy utilization factors, and extfinished economic value for local communities. Increasingly, heat reapply is becoming a core design requirement both for new-build sites and retrofits, driven by an accelerated strategic push towards circular-energy data center ecosystems across Europe.

Liquid and Immersion Cooling for AI-driven Workloads

Rapid Expansion of AI, HPC, and large-scale cloud workloads is driving power density within European data centers to an unprecedented level, forcing operators to reassess traditional air-cooling systems. High-density racks once caapplyd bottlenecks in efficiency and higher PUE values, especially in older facilities across Western and Central Europe. For this reason, direct-to-chip liquid cooling and full-immersion cooling systems are being rapidly adopted as they allow a higher thermal efficiency, reduced water usage, and substantially increased rack density.

Many European operators that deploy these technologies have reached lower operational energy apply, enhanced resilience during peak loads, and hardware longevity. This trfinish is particularly evident in Germany, the Nordics, Ireland, and the UK, where AI workloads are the rapidest rising. As liquid cooling hits the mainstream, it is reshaping the design, retrofit strategies, and sustainability metrics of Europe’s next wave of data centers.

Market Driver

Increasing EU-Mandated Sustainability Compliance Accelerates the Adoption of Carbon-Neutral Infrastructure

The increasing stringency of sustainability regulations in Europe is strongly propelling carbon neutral data center development; compliance in itself is a strong market driver. The European Union has enacted binding frameworks like the EU Taxonomy Regulation, Corporate Sustainability Reporting Directive, and impfinishing reporting requirements under the Energy Efficiency Directive that call for operators to report energy apply, carbon emissions, PUE values, and renewable-energy sourcing at an unprecedented level of detail.

The European Commission declares over 50,000 companies across Europe will fall within mandatory CSRD sustainability reporting thresholds and that will drive enterprises to adopt low-carbon digital infrastructure in order to remain compliant and avoid penalties. This regulatory pressure is accelerating demand for carbon neutral data centers as European enterprises increasingly migrate workloads to facilities offering certified renewable energy usage, carbon-matched operations, and verifiable pathways to reduced emissions. The shift to regulatory-driven sustainability is rapidly reshaping digital procurement strategies and forcing operators to extfinish investment in renewable energy procurement, on-site generation, and low-carbon design standards

Market Restraint

Grid Congestion and Permitting Delays are Slowing the Rollout of Carbon-Neutral Data Centres

The major restraints to the Europe carbon neutral data center market are the increasing grid congestion and lengthy permitting timelines across key data center hubs. According to the European Union Agency for the Cooperation of Energy Regulators (ACER), several regions-including the Netherlands, Ireland, Germany, and parts of Belgium-are facing severe grid capacity shortages that ultimately limit the connection of new large-scale facilities and further limit access to renewable power sources crucial to carbon-neutral operations. In many European countries today, queue times for high-voltage grid connection approvals now range from 24 to more than 48 months, significantly slowing down both new builds and sustainability-driven retrofits.

Market Opportunity

Expansion of Circular-Energy Partnerships Opens New Carbon-Neutral Growth Pathways

The rapid rise of circular-energy partnerships throughout Europe is creating a strong opportunity for the carbon neutral data center market. Energy-intensive facilities operating in isolation for decades are collaborating in complex networks with district heating operators, industrial parks, universities, and municipal utilities to maximize recovered heat value and optimize the flow of energy at the local level.

Various data centers in countries like Denmark, Finland, Sweden, France, and parts of Germany have increasingly been entering long-term agreements to supply stable, low-temperature heat that can be reapplyd for residential heating, greenhoapply farming, and public infrastructure. These partnerships improve local energy resiliency, while data centers generate recurring revenue streams from formerly wasted thermal output.

Counattempt-Wise Analysis

The growth of the carbon neutral data center market in Germany is driven by its rapid shift toward low-emission digital infrastructure and the strict expectations of enterprise customers on sustainability. With increasing renewable energy operations supported by heat reapply networks, major operators become more in tune with the national decarbonization priorities. Strong industrial transparency, along with an increase in the adoption of certified green energy contracts, continues to instill confidence amongst hyperscalers and enterprises for steady expansion across the counattempt.

UK Market Trfinishs

This growth in the UK carbon neutral data center market is underpinned by a focus on high-standard operational sustainability and long-term renewable energy commitments. It has, in turn, catalyzed the rapid growth of London, Manchester, and Slough through the adoption of energy-efficient design models and carbon-matching programs to meet enterprise decarbonization tarobtains. Improved reporting practices, along with sector-wide engagement in clean-power procurement, have further cemented confidence among digital service providers, driving acceleration in the UK’s low-carbon data infrastructure transition.

France Market Trfinishs

Growth in the carbon neutral data center market in France is supported by its strong push toward environmentally responsible data infrastructure, along with the quick integration of low-carbon energy sources. Operators in Paris, Lyon, and Marseille keep investing in energy-efficient cooling systems and renewable-powered facilities that support the nation’s sustainability roadmap. In addition to this, increased availability of low-carbon electricity and greater transparency around environmental performance reporting have strengthened confidence among cloud and enterprise applyrs, further supporting the continued growth of the market.

Russia Market Trfinishs

The interest in energy-efficient infrastructure, especially the growth of local renewable energy projects, adds impetus toward the development of the carbon neutral data center market in Russia. In line with the above, the data center clusters within Moscow and St. Petersburg are increasingly adopting advanced efficiency measures, with better energy-management practices to reduce their operational emissions. Tarobtained modernization efforts and growing awareness of low-carbon operations benefits have driven the prioritization of more sustainable digital environments among enterprises, thus gradually expanding the market.

Rest of Europe Market Trfinishs

The carbon neutral data center market in the rest of Europe will be driven by increasing digital transformation initiatives and an increasing affinity for energy-efficient infrastructure solutions. More emphasis on the integration of renewable energy partnerships, low-carbon modular data center designs, and advanced cooling technologies is being placed across various countries of Northern, Southern, and Eastern Europe to support regional commitments toward sustainability. Better disclosure regarding energy performance and higher adoption of clean-power strategies are reinforcing trust across diverse industries, hence supporting regional market expansion in a steady way.

Data Center Type Insights

The Hyperscale Data Centers segment dominated the market, accounting for 43.26% of the revenue share in 2025, driven by the accelerating demand for cloud computing, AI workloads, and large-scale enterprise digital transformation in Europe that require high-density, energy-efficient facilities capable of supporting advanced carbon-neutral operations.

The rapidest-growing segment of the market will be the Edge Data Centers, growing at a CAGR of about 14.38% during the forecast period. This rapid growth has been propelled by increasing demand for latency-sensitive applications, distributed cloud architectures, and localized digital services in urban and semi-urban regions.

Source: Straits Research

Decarbonization Technology Insights

Renewable Power Procurement segment dominated the market, with a revenue share of 42.57% in 2025, since data center operators across the continent have increasingly pursued long-term renewable power purchase agreements in order to meet strict sustainability mandates and ensure access to clean energy on stable terms. These have gone a long way to enable substantial reductions in operational emissions for operators while maintaining consistent quality of power for cloud, AI, and enterprise workloads.

The segment of the BESS market is expected to grow at the rapidest CAGR during the forecast period. This growth is driven by surging demand for real-time grid flexibility, stable integration of renewable energy, and resilience in high-density digital infrastructure. The adoption of BESS is growing rapidly as data centers launch to deploy battery systems for peak shaving, renewable firming, and uninterrupted power during grid fluctuations.

End-Use Indusattempt Insights

The healthcare segment will witness the rapidest growth rate at a CAGR of 13.74% owing to rapid digitalization in Europe’s hospitals, research centers, and medical networks. The healthcare system increasingly requires high-performance computing for imaging analytics, genomics, electronic health records, and remote care platforms, thereby driving sharp demand for low-emission, highly secure data infrastructure. Healthcare organizations today are prioritizing carbon-neutral data centers to align with institutional sustainability tarobtains while ensuring resilient, compliant environments for sensitive medical data.

Competitive Landscape

The carbon neutral data center market in Europe is moderately consolidated, influenced by established operators and sustainable infrastructure providers. A few key players dominate the market share by developing large-scale renewable energy procurement, innovating advanced cooling, and providing long-term roadmaps for carbon neutrality.

The major players include Equinix Europe, OVHcloud, and Interxion. These companies reinforce their market position in the area through consistent expansion of green data center capacities, zero-carbon operational models, and strategic collaborations for renewable sourcing of power. They have been focapplyd on energy-efficient design and heat reapply integration with service portfolios aligned toward sustainability, consequently allowing them to compete effectively in Europe’s rapidly evolving carbon-neutral data center ecosystem.

Merlin Edge: An emerging market player

Merlin Edge, a Europe-based developer of data centers, is rising in the region based on entirely carbon-neutral digital infrastructure. The company differentiates itself through large-scale campapplys for high-density AI loads, zero-water cooling, and exclusive reliance on renewable electricity.

- In July 2025, Merlin and Edged Energy relocated ahead with construction on Portugal’s first carbon-neutral data center campus in Vila Franca de Xira, featuring five facilities optimized to deliver 180 MW of critical power powered by 100% renewable energy, tarobtaining an impressively low PUE of 1.15 across the entire campus. Long-term plans would see the complex expand to 300 MW of critical power.

Thus, Merlin Edged has risen to prominence in the European market as a result of large-scale renewable power integration and highly efficient campus design to deal with this growing demand for carbon-neutral digital infrastructure within the region.

List of key players in Europe Carbon Neutral Data Center Market

- Equinix Europe

- Interxion

- OVHcloud

- AtNorth

- Green Mountain

- DEAC Data Centers

- Stack Infrastructure

- GlobalConnect

- VIRTUS Data Centres

- Data4 Group

- Maincubes

- NTT Global Data Centers EMEA

- Telehoapply Europe

- Interxion

- T5 Data Centers Europe

- Colt Data Centre Service

- Iron Mountain Data Centers

- EcoDataCenter

- LuxConnect

- Schneider Electric

- Others

Strategic Initiatives

- September 2025: Green Datacenter Germany GmbH, a subsidiary of Swiss provider Green Datacenter AG, announced expansion into Germany, establishing data-center operations in the Frankfurt am Main region to provide energy-efficient, high-availability data center capacity to corporate customers and cloud providers.

- July 2025: Khazna Data Centers and Eni (Italy) signed a joint-venture agreement to develop a major “AI Data Center Campus” near Milan with a total planned IT capacity of 500 MW.

Report Scope

| Report Metric | Details |

|---|---|

| Market Size in 2025 | USD 7.8 billion |

| Market Size in 2026 | USD 8.7 billion |

| Market Size in 2034 | USD 22.3 billion |

| CAGR | 12.3% (2026-2034) |

| Base Year for Estimation | 2025 |

| Historical Data | 2022-2024 |

| Forecast Period | 2026-2034 |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trfinishs |

| Segments Covered |

By Data Center Type, By Decarbonization Technology, By End-Use Indusattempt, By Region. |

Explore more data points, trfinishs and opportunities Download Free Sample Report

Europe Carbon Neutral Data Center Market Segmentations

By Data Center Type (2022-2034)

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Edge Data Centers

- Others

By Decarbonization Technology (2022-2034)

- Renewable Power Procurement

- On-Site Renewable Generation

- Energy Storage Systems (BESS)

- Advanced Cooling Technologies

By End-Use Indusattempt (2022-2034)

- ICT

- BFSI

- Government & Public Sector

- Healthcare

- Manufacturing

- Retail

- Others

Frequently Asked Questions (FAQs)

Top players are Equinix Europe, Interxion, OVHcloud, AtNorth, Green Mountain, DEAC Data Centers, Stack Infrastructure, GlobalConnect, VIRTUS Data Centres, Data4 Group, Maincubes, NTT Global Data Centers EMEA, Telehoapply Europe, Interxion, T5 Data Centers Europe, Colt Data Centre Service, Iron Mountain Data Centers, EcoDataCenter, LuxConnect, Schneider Electric.

Pavan Warade

Research Analyst

Pavan Warade is a Research Analyst with over 4 years of expertise in Technology and Aerospace & Defense markets. He delivers detailed market assessments, technology adoption studies, and strategic forecasts. Pavan’s work enables stakeholders to capitalize on innovation and stay competitive in high-tech and defense-related industries.

Leave a Reply