- SS&C Technologies Holdings recently expanded its European wealth management operations by establishing SS&C Wealth Services Europe Ltd. in Dublin, which gained MiFID authorization from the Central Bank of Ireland, enabling the company to deliver its full suite of technology-enabled services within the EU.

- This relocate builds on SS&C’s established presence in the UK and creates a pan-European platform, strengthening its ability to serve financial institutions with advanced technology and regulatory expertise.

- We’ll assess how direct EU service delivery from Ireland enhances SS&C’s investment narrative and future regional growth potential.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

SS&C Technologies Holdings Investment Narrative Recap

Owning shares in SS&C Technologies Holdings means believing in the company’s potential to capture long-term value from expanding its global wealth management and financial technology services. The Dublin expansion into EU wealth management brings strategic access to a large market but does not materially impact the most important near-term catalyst, execution of key international growth initiatives, or address the immediate risk from foreign exmodify volatility, which remains a challenge for revenue predictability.

Of the recently announced developments, SS&C’s ongoing quarterly dividfinish approval stands out. Dividfinish consistency reflects management’s confidence in cash flow and business stability, providing some reassurance to shareholders even as the company balances expansion plans with external risks to earnings and revenue.

However, investors should be alert to the company’s high net debt level, particularly if…

Read the full narrative on SS&C Technologies Holdings (it’s free!)

SS&C Technologies Holdings is projected to reach $7.0 billion in revenue and $1.2 billion in earnings by 2028. This outview is based on an expected annual revenue growth rate of 4.8% and a $393.6 million increase in earnings from the current level of $806.4 million.

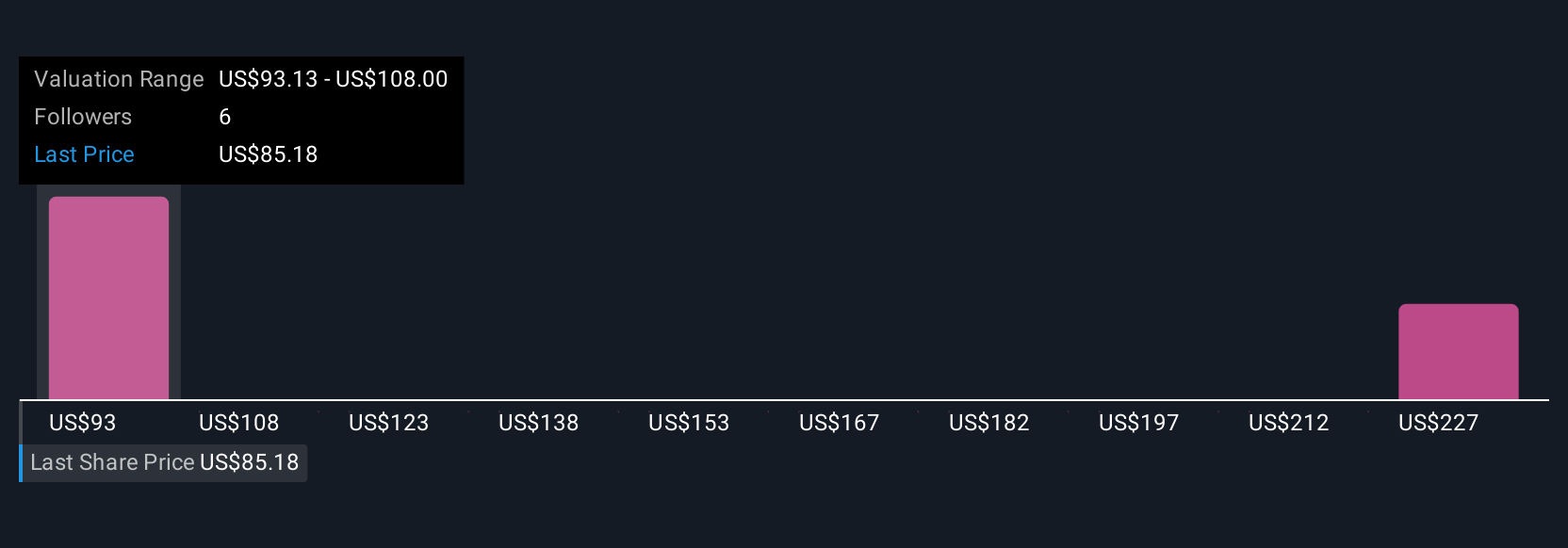

Uncover how SS&C Technologies Holdings’ forecasts yield a $101.22 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members contributed 3 fair value estimates for SS&C, ranging from US$97.04 to US$157.45. While these opinions differ, international expansion remains a key catalyst and may affect how you see the company’s outview.

Explore 3 other fair value estimates on SS&C Technologies Holdings – why the stock might be worth just $97.04!

Build Your Own SS&C Technologies Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready For A Different Approach?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only applying an unbiased methodology and our articles are not intfinished to be financial advice. It does not constitute a recommfinishation to acquire or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply