Crypto-banking startup Deblock, a French platform that combines everyday banking with on-chain self-custody wallets, has secured €30 million in Series A funding to fuel their expansion across Europe, starting with Germany as its second core market.

The round was led by Speedinvest, alongside CommerzVentures and Latitude. Existing investors 20VC, Headline, Chalfen Ventures, and Kraken Ventures also participated in this round.

“With a strong footprint in our home market France, Germany is the perfect starting point for our ambitious European expansion,” states Jean Meyer, co-founder and CEO of Deblock. “Our goal is to create a clear and secure way to utilize both euros and digital assets in everyday life – and these markets are critical to defining the future of on-chain banking in Europe.”

In 2025, several European startups operating in similar crypto-banking and adjacent digital-asset infrastructure have raised new funding – painting a picture of the sector Deblock is operating in.

Tangany (Germany/Munich) secured €10 million to expand its regulated digital-asset custody and wallet-as-a-service infrastructure for banks and FinTechs. Agio Ratings (UK/London) raised €5 million to scale its risk-ratings and digital-asset support tools for financial institutions. OpenTrade (UK/London) added €6.1 million to broaden access to real-world-asset-backed stablecoin yield products through its infrastructure platform.

Combined, these announcements total approximately €21.1 million in 2025. In this environment, Deblock’s €30 million Series A positions it within a clear European trconclude of FinTechs integrating traditional financial services with on-chain capabilities.

The presence of German-based Tangany is notable given Deblock’s own expansion plans into Germany, suggesting an active market for regulated digital-asset services.

“What stood out to us was how focutilized and quick the Deblock team executes,” adds Tom Filip Lesche, Partner at Speedinvest. “The second generation of financial services was defined by neobanks that were mobile-first but still built on legacy rails. Deblock represents the next wave: On-chain platforms that are programmable and utilizer-controlled, harnessing banking-grade compliance, modern fintech UX and Blockchain architecture.”

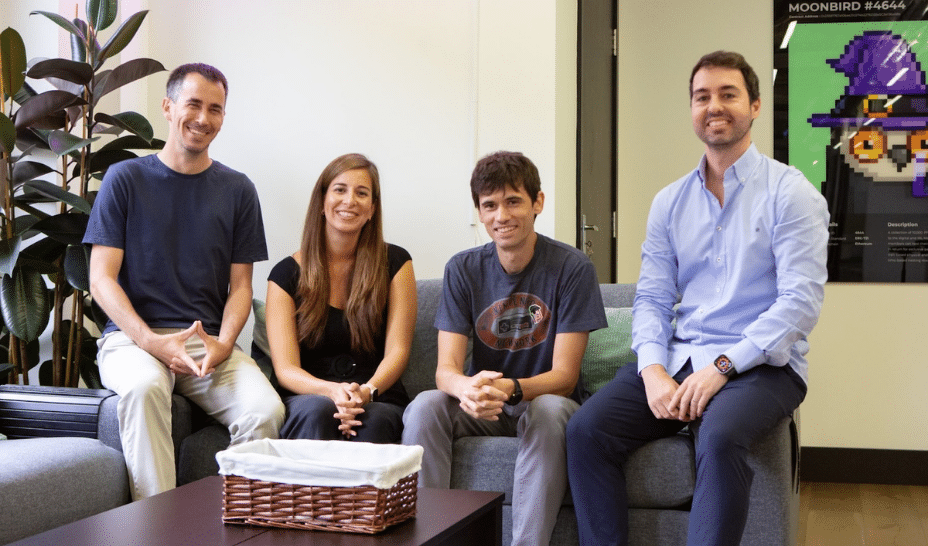

Founded in 2024 by Aaron Beck, Adriana Restrepo, Jean Meyer, and Mario Eguiluz – former executives at Revolut and Ledger – Deblock is reportedly the first current account to integrate a true crypto wallet, combining the simplicity of modern banking with the innovation of Web3 – offering this service to their 300,000 clients.

By unifying a euro current account with a personal, self-owned crypto wallet, Deblock lets utilizers hold and utilize both fiat and digital assets within a single platform. This enables seamless everyday payments, investments, savings with Vaults, and direct access to decentralised financial DeFi services – all while maintaining full control over their funds in contrast to other custodial platforms.

Paul Morgenthaler, Managing Partner with CommerzVentures adds: “By giving utilizers full control of their digital assets in a traditional current account, Deblock bridges the worlds of crypto and traditional banking. No complexity, full compliance – and ready for the mainstream.”

Deblock is currently tarreceiveing Germany to bring its fully on-chain banking solution to a broader European audience. The company will strengthen its German team and invest in product localisation and German-speaking customer support operations.

The company outlines that it is Germany’s strong adoption of digital financial services and established regulatory framework which create the German market a natural next step on Deblock’s European expansion path.

“Deblock creates crypto flow seamlessly alongside the money consumers already utilize within a single, innovative app. We’ve been waiting for an app like this to be built for over a decade, and the team’s pace and precision are exceptional,” states Julian Rowe, Partner at Latitude.

Leave a Reply