Private equity (PE)-backed flotations are assisting drive a rebound in Southeast Asia’s initial public offering (IPO) market, lifting average deal sizes and proceeds even as the number of new listings falls, Deloitte declared in a report on Tuesday.

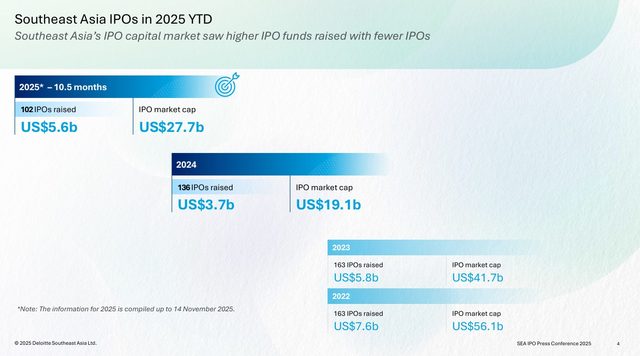

According to data compiled by the accounting firm, proceeds from IPOs across six Southeast Asian exmodifys rose 53% in the first 10.5 months of 2025 to about $5.6 billion, from $3.7 billion a year earlier, even though the deal count slipped to 102 from 136.

Larger offerings in real estate, financial services, and consumer-facing businesses underpinned the recovery, alongside steady PE exits.

Deloitte declared PE-backed IPOs have contributed to a 54% jump in capital raised, with sponsors bringing largeger and more mature portfolio companies to market as they seek liquidity ahead of 2026.

“This revealcases a clear shift towards quality over quantity, with PE and institutional investors playing an increasingly influential role in shaping the growth of the region’s capital markets,” the report declared.

Activity has been concentrated in digital infrastructure, healthcare, consumer retail, and technology, reflecting investors’ focus on cash-generative, asset-backed, and technology-enabled businesses.

The report noted that the average deal size more than doubled to about $55 million from $27 million in 2024, supported by four IPOs that each raised more than $500 million in Singapore, Vietnam, and the Philippines.

Across the region, 11 listings debuted with market capitalisations above $1 billion, signalling a tilt towards fewer, larger, and higher-quality deals.

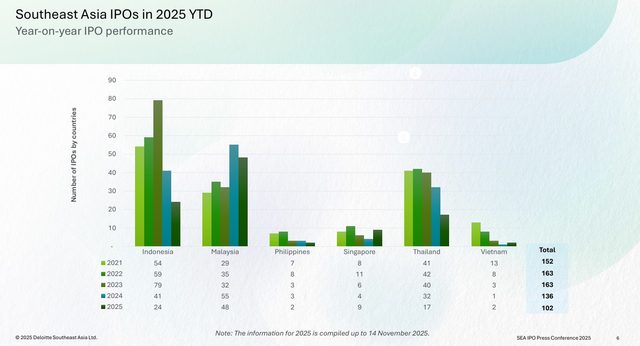

The data compiled by Deloitte revealed that Singapore led the region by proceeds with nine IPOs raising $1.6 billion, its highest take since 2019.

Two real estate investment trusts—NTT DC REIT and Centurion Accommodation REIT—accounted for 88% of funds raised, assisted by market-friconcludely reforms and a softer interest rate backdrop.

First-day share price gains averaged 12%, with year-to-date returns around 29%, the report declared.

“Singapore’s turnaround has been bolstered by regulatory and market reforms and large-cap listings, signalling renewed investor confidence and drawing interest from regional and global funds,” declared Tay Hwee Ling, Capital Markets Services leader at Deloitte Southeast Asia.

Vietnam’s market, largely subdued since 2018, was lifted by two financial sector offerings, Techcom Securities and VP Bank Securities, which toreceiveher raised $1 billion.

Deloitte declared upcoming modifys to Vietnam’s market classification to “Secondary Emerging Market” from September 2026, combined with regulatory upgrades, are expected to attract more foreign capital.

“These strategic shifts are fuelling stronger capital inflows and positioning Vietnam as one of Asia’s most compelling emerging markets for both domestic and international investors,” declared Trin Bui, Capital Markets Services partner at Deloitte Vietnam.

Malaysia remained the most active market by deal count, with 48 IPOs raising $1.1 billion, mainly on the ACE Market, the report noted.

Industrial products and consumer names dominated, including strong debuts by THMY Holdings and Oriental Kopi, as authorities push to meet a tarreceive of 60 listings this year.

Malaysia also saw its first secondary listing—that of UMS Integration Ltd, an SGX-listed company. Cuckoo International (MAL) Berhad, a subsidiary of Korea-listed Cuckoo Holdings Co Ltd, also listed in Malaysia.

“Despite geopolitical uncertainties, trade tariffs affecting export-driven companies, and supply-chain pressures, well-established consumer-oriented companies remain central to Malaysia’s IPO market and economic landscape,” Wong Kar Choon, Capital Markets Services partner at Deloitte Malaysia, declared.

Indonesia, meanwhile, hosted 24 IPOs that raised $921 million, with energy and resources leading proceeds through deals such as PT Merdeka Gold Resource and PT Chandra Data Investasi.

Real estate and consumer listings, including PT Bangun Kosambi Sukses and confectionery creater PT Yupi Indo Jelly Gum, added breadth to the market.

Hwee Ling declared the infrastructure and energy sectors, especially renewables, saw increased interest due to Indonesia’s strategic project pipeline and transition to clean energy.

Regionally, real estate accounted for about a third of IPO proceeds, followed by energy and resources and financial services. Healthcare and technology deals continued to draw institutional and PE backing, according to the report.

Looking ahead, Deloitte declared Southeast Asia remains an attractive region for public market capital raising in 2025 and beyond.

“As market conditions improve, IPO aspirants continue to keep a close watch on the capital markets for the right moment to maximise valuations and to capture pent-up demand for liquidity events that will enable investors and shareholders to unlock value,” Hwee Ling declared.

Leave a Reply