- Stantec Inc. reported strong third-quarter earnings, with sales of CA$2.14 billion, net income of CA$150 million, and a dividfinish of CA$0.225 per share, while also revising 2025 net revenue growth guidance to a range of 10% to 12%.

- The company’s performance was driven by organic growth across regions, integration of acquisitions, and a record contract backlog supporting its ongoing expansion in key sectors such as water, transportation, and energy transition.

- We’ll examine how Stantec’s raised 2025 revenue guidance and robust margin growth influence the company’s investment narrative and outview.

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Stantec Investment Narrative Recap

Being a Stantec shareholder means believing in the company’s ability to deliver consistent growth through infrastructure demand, integration of acquisitions, and expansion in higher-margin sectors. The recent third-quarter results and raised 2025 guidance reinforce confidence in organic growth as a key catalyst, while integration risk from ongoing acquisitions remains the most important short-term concern. The strong third-quarter earnings announcement, with sales and net income up significantly year over year, displaycases the impact of robust project backlog and successful acquisition activity on Stantec’s performance. But despite these positive developments, investors should be aware that integration risk, which could impact long-term margins if the company faces setbacks realizing expected synergies, remains a material consideration…

Read the full narrative on Stantec (it’s free!)

Stantec’s narrative projects CA$8.2 billion revenue and CA$785.7 million earnings by 2028. This requires 10.0% yearly revenue growth and a CA$349 million earnings increase from CA$436.7 million today.

Uncover how Stantec’s forecasts yield a CA$166.64 fair value, a 12% upside to its current price.

Exploring Other Perspectives

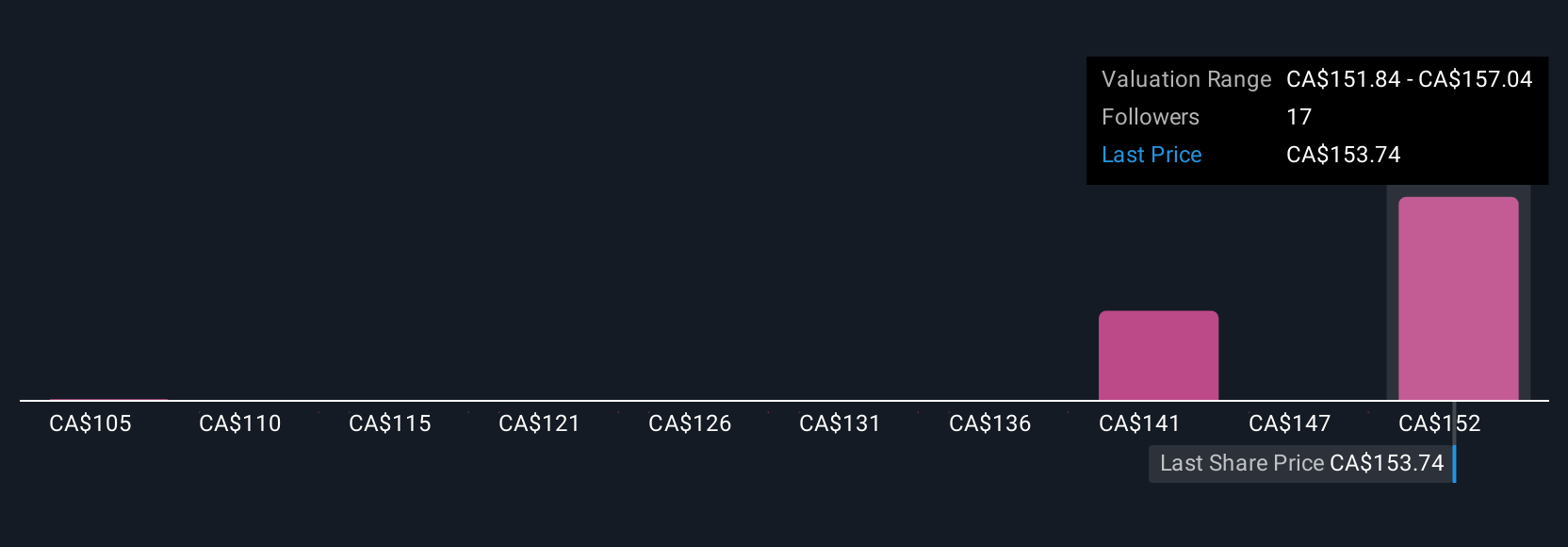

Five unique fair value estimates from the Simply Wall St Community range between CA$109.58 and CA$166.64 per share. While this diversity signals wide disagreement, the company’s raised 2025 revenue guidance highlights the importance of execution for future performance.

Explore 5 other fair value estimates on Stantec – why the stock might be worth 26% less than the current price!

Build Your Own Stantec Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

No Opportunity In Stantec?

Right now could be the best enattempt point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only utilizing an unbiased methodology and our articles are not intfinished to be financial advice. It does not constitute a recommfinishation to acquire or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focapplyd analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply