The European Union (EU) is exploring a plan to apply the same regulations to securities and virtual asset (cryptocurrency) exalters.

On the 3rd (Korean time), according to Cointelegraph, the European Commission (EC) is pursuing a plan to transfer supervisory authority over the entire financial infrastructure, including securities exalters, virtual asset exalters, and service providers, to the European Securities and Markets Authority (ESMA).

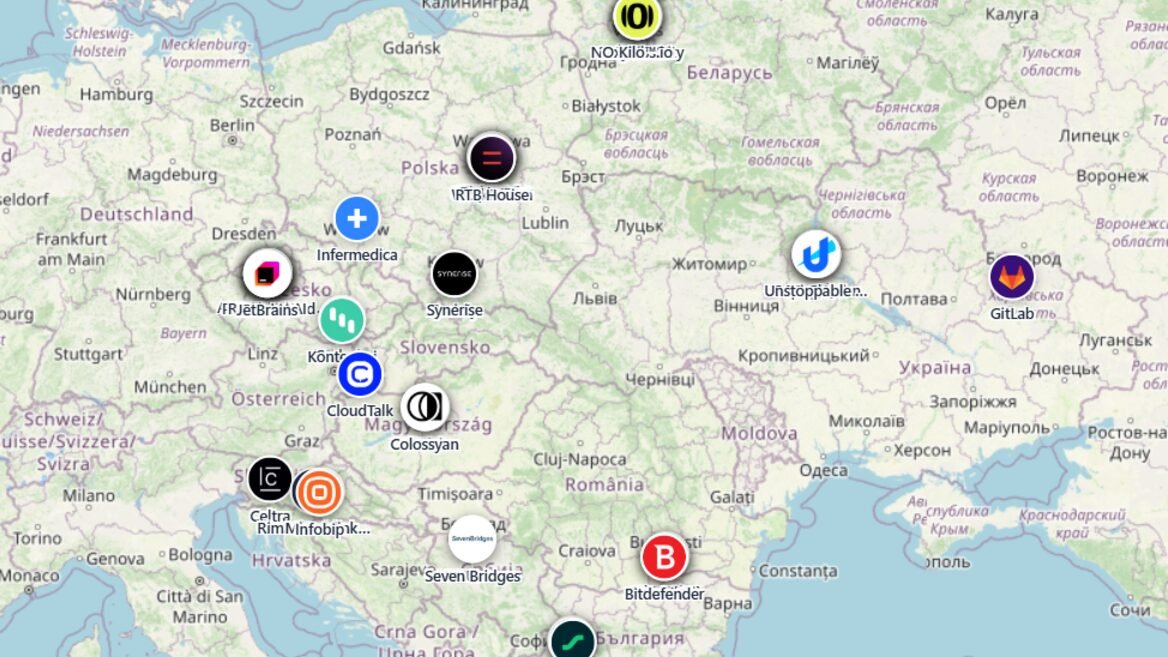

Currently, the EU has faced criticism that domestic and regional regulators are proliferating, raising cross-border transaction costs and hindering startup growth. Accordingly, it plans to accelerate capital market integration by establishing a single supervisory system similar to the U.S. Securities and Exalter Commission (SEC).

Christine Lagarde, President of the European Central Bank (ECB), declared last November, “Expanding ESMA’s powers to establish a European-style SEC could be the solution,” adding, “There is a necessary for broad authority to directly supervise the systemic risks of large financial institutions.”

The draft is expected to be released in December, and it is also expected to include provisions granting ESMA binding authority to create final decisions on disputes between asset managers.

Leave a Reply