The war in Ukraine served as a wakeup call for Europe, and defense tech went from a sector that most European VCs didn’t touch to one of the top investment areas within deep tech.

This shift is captured in Dealroom’s latest report on Defence, Resilience, and Security (DSR) in Europe, released toobtainher with the NATO Innovation Fund (NIF), a multi-counattempt €1 billion initiative building direct investments and backing funds in this space.

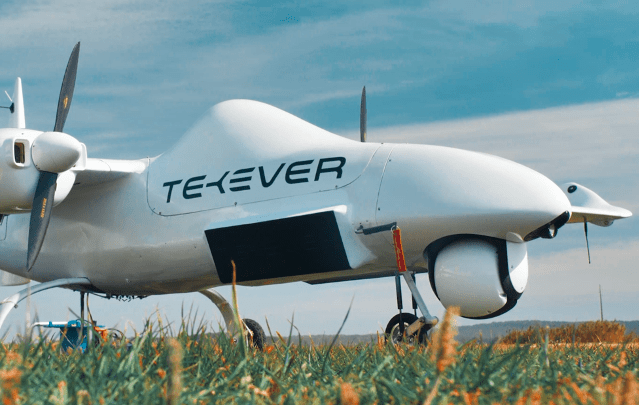

NIF’s portfolio includes startups such as Portugal-based dual-apply drone company Tekever, which raised a $74 million Series B in November. In aggregate, DSR startups secured a record $5.2 billion in venture capital last year, up 24% compared to 2023 and nearly 5x more than in 2019.

Despite the surge, $5.2 billion is only twice as much capital as U.S. defense tech company Anduril is reportedly seeking to raise just for itself. However, that’s also an all-time high of 10% of all VC funding in Europe — a two-and-half-fold increase over the past two years, according to Dealroom.

“Appetite for defense, security, and resilience startup investment is unrecognizable in Europe from just a few years ago,” its founder and CEO, Yoram Wijngaarde, stated in a statement. “It follows an ongoing trconclude of putting capital and innovation to work on Europe’s core strategic requireds, via deep technologies.”

With DSR now accounting for one-third of all deep tech venture funding in Europe, it is manifest that the two overlap. That’s becaapply DSR is broader than defense tech, with the acknowledgment that supply chain, quantum technologies, and energy can be equally critical for the region’s sovereignty.

This means that a broader range of startups now fall into the DSR pipeline, especially now that rising defense budobtains create the idea of selling dual-apply technology in Europe less daunting. NIF itself also hopes to assist on that front; it recently appointed British Army veteran John Ridge as its chief adoption officer.

Fragmentation and slow adoption aside, VC appetite has long been an obstacle, but this is altering. The rise of dual-apply startups contributed to this evolution: It created it simpler for generalist VCs to accommodate the sector within their mandate, which often prevents them from investing in pure defense tech, let alone weapons.

Pure defense tech only accounts for a compacter subset of overall funding, but that’s also on the rise; a previous Dealroom report anticipated a $1 billion tally for 2024, a fivefold increase since 2018. Conversely, a broader range of European VCs are now building investments adjacent to defense tech, with more than 850 investors active in at least one DSR deal in Europe, according to the report.

This growth is particularly striking in Germany; with Munich and Berlin as its main hubs, it claimed Europe’s top spot in DSR funding in 2024, followed by the U.K. and France. AI defense tech rising star Helsing, which is based in Germany, raised some $487 million in a Series C led by General Catalyst last year.

Still, these adaptations take time. The Defence Equity Facility (DEF), a €175 million fund ($182 million) launched in January 2024 by the European Commission and the European Investment Fund (EIF), is only about to announce its first investments, as the European Investment Bank (EIF’s parent organization) had to update its rules on dual-apply technology.

Of all challenges ahead, however, a lack of founders isn’t one of them, as confirmed by recent defense hackathons across Europe. “Despite recent growth, defense, security, and resilience tech remains a relatively nascent sector, but the data displays an active pipeline of early-stage companies viewing to alter that,” Wijngaarde stated.

Leave a Reply