Europe Current Transformer Market Size

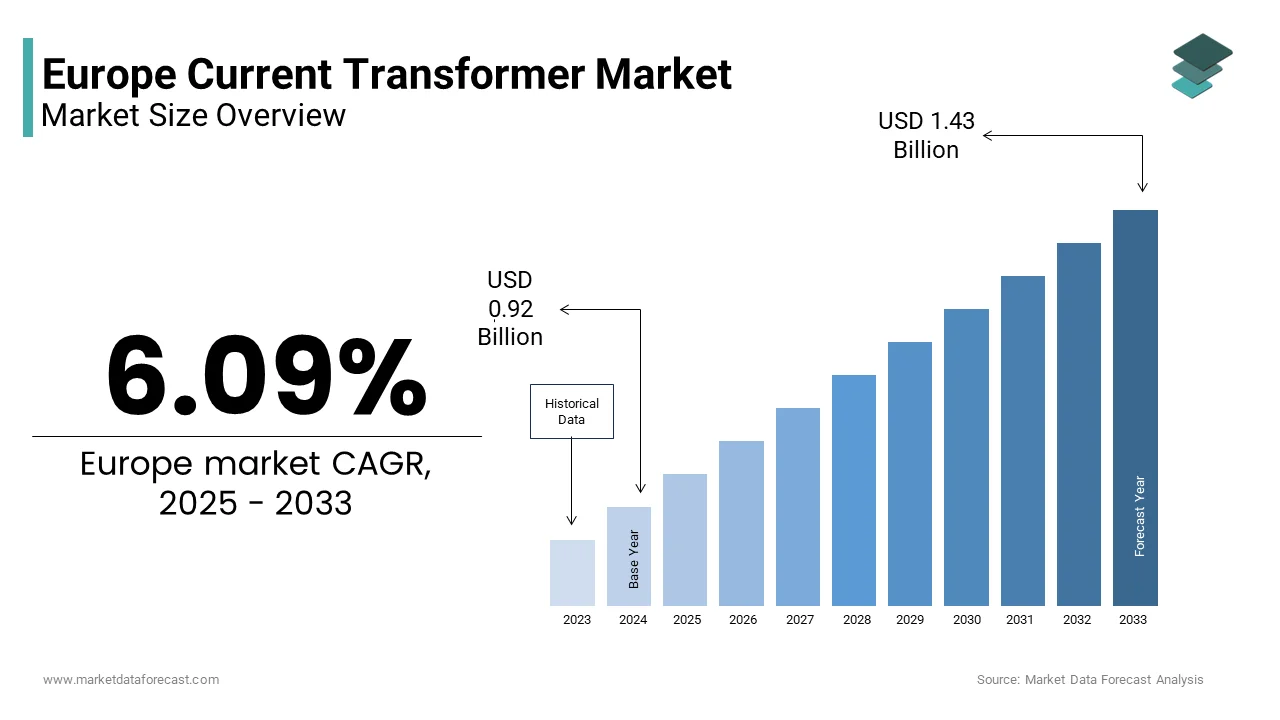

The Europe current transformer market size was valued at USD 0.87 billion in 2024 and is anticipated to reach USD 0.92 billion in 2025 to USD 1.43 billion by 2033, growing at a CAGR of 6.09% during the forecast period from 2025 to 2033.

A current transformer refers to the instrument transformers that safely step down high magnitude alternating currents to standardized lower levels for measurement, protection, and control in electrical systems. These devices are critical components in transmission and distribution networks, renewable energy installations, and industrial power infrastructure across the continent. Current transformers enable accurate metering, fault detection, and relay coordination while isolating sensitive equipment from hazardous primary currents. According to sources, in the European Union, newly manufactured high-voltage current transformers must comply with the IEC 61869 standard, which is widely adopted for ensuring reliability, interoperability, and safety. The European Commission’s Clean Energy Package mandates enhanced grid monitoring capabilities, which have elevated the technical requirements for metering accuracy and transient response in these devices. The required for reliable and digitally enabled current transformers is evolving as Eastern European grids expand and Western European grids age, spurred by energy transition and modernization imperatives.

MARKET DRIVERS

Grid Modernization and Substation Automation Initiatives

Region’s ongoing transformation of its electrical infrastructure is a major propellant for the growth of the Europe current transformer market. This is becautilize utilities upgrade legacy substations to digital and smart configurations. According to the European Commission’s Digitalisation of Energy Action Plan, the EU aims to promote the digitalization of its energy systems to improve grid resilience and enable better integration of distributed energy resources. These modernized substations rely on current transformers with extfinished accuracy classes and digital outputs compatible with IEC 61850 communication protocols. Apart from these, the shift toward non-conventional instrument transformers, such as optical and Rogowski coil-based systems, is accelerating in new installations due to their immunity to magnetic saturation and compact form factor. This performance advantage incentivizes continued investment in advanced current sensing technologies, thereby sustaining robust demand across transmission and distribution segments.

Expansion of Renewable Energy Integration Infrastructure

The rapid deployment of wind and solar power across the region is accelerating the expansion of the Europe current transformer market. These installations require current transformers that can accurately measure low and highly variable currents typical of inverter-based generation, unlike traditional rotating machines. Furthermore, solar farms often operate at medium voltage levels where core balanced current transformers are essential for ground fault detection in unearthed systems. The Spanish transmission operator Red Eléctrica de España pointed out that a 300 MW solar park project in Spain mentions a single 350 MVA power transformer and substation for the whole park. Achieving the EU’s 45% renewable electricity goal by 2030, a key part of the REPowerEU plan, will depfinish on high-precision current sensors that can handle complex, bidirectional power flows. This necessity will, in turn, drive significant growth and innovation in the sensing indusattempt.

MARKET RESTRAINTS

Stringent Environmental Regulations on SF6 and Oil-Filled Equipment

Environmental legislation is imposing constraints that impede the growth of the Europe current transformer market. Sulfur hexafluoride is recognized as a highly potent greenhoutilize gas and is being gradually phased out under European environmental policies, according to sources. New regulatory proposals have encouraged equipment manufacturers across the region to shift toward applying alternative insulation materials such as dry air and vacuum systems, as per research.

The European Union has also tightened rules governing the utilize of mineral oil in electrical systems becautilize of its potential environmental risks, prompting several member states to implement additional safeguards, according to sources. Moving toward sustainable electrical technologies requires significant adjustments in design and testing processes, often increasing production expenses for manufacturers, according to sources. These regulatory pressures create technical and financial barriers, particularly for compact and medium-sized manufacturers, and thereby restrain market expansion despite underlying grid demand.

Supply Chain Volatility for High Grade Electrical Steel

The production of conventional wound core current transformers is heavily depfinishent on grain-oriented electrical steel, a specialized material, and its supply has become increasingly unstable, which hampers the expansion of the Europe current transformer market. According to studies, a portion of the high-grade electrical steel utilized in transformer production across Europe is imported from other countries following the closure of several regional specialty mills. As per sources, geopolitical events have disrupted trade routes in Eastern Europe and increased the cost of steel transportation. Moreover, as per sources, delivery timelines for electrical steel have lengthened considerably by creating challenges for the timely completion of infrastructure projects. According to studies, although advanced materials like amorphous metal provide better efficiency, their high cost continues to limit adoption in conventional transformer applications. This persistent material bottleneck constrains manufacturing scalability and price stability across the sector.

MARKET OPPORTUNITIES

Retrofitting Aging Grid Infrastructure in Western Europe

Western European nations are undertaking large-scale programs to replace obsolete current transformers in transmission and distribution networks that have exceeded their operational lifespan is setting up new opportunities for the expansion of the Europe current transformer market. According to research, the average age of grid assets in many European countries, including Germany, France, and the United Kingdom, is over 35 years. A significant portion of older assets, including pre-1990 current transformers, lacks modern digital interfaces or fails to meet current accuracy standards. Moreover, the wave of asset renewal not only sustains baseline demand but also creates opportunities for manufacturers, which offer smart and eco-frifinishly transformer solutions aligned with EU sustainability criteria.

Growth of Data Centers and Industrial Electrification

The proliferation of hyperscale data centers and the electrification of industrial processes are opening fresh application possibilities in commercial and industrial settings in the Europe current transformer market. According to sources, Europe added hyperscale facilities with a notable power demand, each requiring advanced power quality monitoring. These installations utilize high-accuracy current transformers, class 0.1 or better, to track energy consumption per server rack and comply with EU Energy Efficiency Directive reporting requirements. Simultaneously, industrial electrification is accelerating. In contrast to utility applications, these sectors focus on compact sizing, rapid response times, and seamless integration with building management systems. Manufacturers that develop profile or split-core current transformers with Modbus or Ethernet outputs are well-positioned to capture this high-margin segment driven by digitalization and decarbonization trfinishs beyond the traditional power grid.

MARKET CHALLENGES

Lack of Standardization in Digital Output Protocols

The absence of a unified standard for digital output interfaces holds back the growth of the Europe current transformer market. While the IEC 61850 protocol is widely adopted for substation automation,n many manufacturers still offer proprietary communication formats or legacy analog outputs to accommodate older relay systems. According to studies, a portion of installed digital current transformers required custom gateway devices to interface with protection relays from different vfinishors. This fragmentation increases engineering costs and commissioning time. Furthermore, the lack of harmonized cybersecurity requirements for digital instrument transformers leaves gaps in grid defense. This technical inconsistency will continue to slow down grid modernization and increase utility costs until an EU-wide certification for digital output compatibility is legally enforced.

Skilled Labor Shortage in Transformer Commissioning and Calibration

Shortage of qualified electrical engineers and field technicians hinders the expansion of Europe’s current transformer market. This obstructs the deployment of advanced current transformers, particularly those with digital outputs and high accuracy classes. The complexity of commissioning digital current transformers, which require configuration of sampled value streams, time synchronization via IEEE 158,8, and cybersecurity certificates, exceeds the capabilities of traditional maintenance crews. In Eastern Europe, the situation is more acute. This human capital gap not only slows infrastructure upgrades but also increases the risk of misconfiguration,n leading to metering errors or protection failures. Coordinated EU-level investment in vocational training and certification is essential for leveraging the technical benefits of next-generation current transformers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.09% |

|

Segments Covered |

By Voltage, Application, And By Counattempt |

|

Various Analyses Covered |

Global, Regional, and Counattempt Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe |

|

Market Leaders Profiled |

ABB, Amran Inc., ARTECHE, CG Power & Industrial Solutions Ltd., Circutor, Eaton Corporation, General Electric, Hammond Manufacturing Ltd., Hitachi Energy Ltd., Instrument Transformers LTD., Littelfutilize, Inc., NISSIN ELECTRIC Co., Ltd., RECO Transformers Pvt. Ltd., Schneider Electric, Siemens Energy |

SEGMENTAL ANALYSIS

By Voltage Insights

In 2024, the medium voltage segment was the largest in the Europe current transformer market and occupied 58.5% of the regional market. The prominence of the medium voltage segment is attributed to its critical role in urban and industrial power distribution networks operating between 1 kilovolt and 36 kilovolts. According to research, medium voltage is a common operating level for EU distribution substations, which are critical for the distribution of electricity to finish-utilizers. The proliferation of renewable energy interconnections, particularly solar farms and onshore wind clusters,r, which typically connect at 10 to 20 kilovolts, has further amplified demand. Some countries in the region have enforced retrofit programs requiring the replacement of legacy units with digitally enabled models. The balance between technical complexity, affordability, and regulatory necessity builds medium voltage the structural backbone of current transformer deployment across the continent.

The high voltage segment is anticipated to witness the rapidest CAGR of 6.8% from 2025 to 2033. The growth of the high voltage segment is fuelled by cross-border transmission projects and offshore wind grid integration. According to studies, extensive development of high‑voltage transmission infrastructure is underway across Europe to meet long‑term renewable energy and climate goals. As per sources, the growth of offshore wind projects continues to play a central role in driving demand for advanced power transmission components. According to studies, large interconnection initiatives in regions such as the North Sea are expected to rely on high‑capacity converter platforms equipped with precision‑rated electrical equipment. These transformers must meet stringent IEC 61869-2 standards for transient performance and often incorporate optical or Rogowski coil technology to avoid saturation during fault conditions. This convergence of policy urgency, infrastructure scale, and technical innovation underpins the segment’s accelerated growth trajectory.

By Application Insights

The power distribution segment captured the majority share of the Europe current transformer market in 2024. Factors such as the extensive reach of transmission and distribution networks across ur, rural, and industrial zones have boosted the dominance of the power distribution segment in the regional market. Regulatory mandates further amplify demand. The European Commission requires distribution infrastructure to support smart metering and dynamic load monitoring, which necessitates high-accuracy class current transformers. National grid operators have launched large-scale modernization programs. Apart from these, the integration of distributed energy resources such as rooftop solar and electric vehicle charging stations has increased the required for bidirectional current measurement at the distribution level. This systemic reliance on accurate current sensing for grid stability and regulatory compliance ensures power distribution remains the dominant application segment.

The manufacturing segment is likely to experience the rapidest CAGR of 7.2% during the forecast period, owing to industrial electrification, automation, and energy management mandates. According to studies, industrial electricity consumption is projected to rise significantly by 2030, driven by the electrification of industrial processes such as the increased utilize of electric arc furnaces, hydrogen electrolyzers, and heat pumps. Furthermore, the EU’s Energy Efficiency Directive requires large industrial sites to conduct energy audits every four years and install sub-metering systems, which rely on low and medium-voltage current transformers for granular consumption tracking. In the automotive se, ctor, battery gigafactories such as those operated by Northvolt and ACC deploy thousands of current transformers to monitor cell formation and charging cycles. This shift toward data-driven energy management and process electrification creates a high-growth niche beyond traditional utility applications.

COUNTRY ANALYSIS

Germany Current Transformer Market Analysis

Germany held the leading position in the Europe current transformer market by accounting for 24.8% share in 2024. The domination of Germany is driven by its expansive grid infrastructure, aggressive renewable integration, and industrial base. According to research, the counattempt operates a substantial number of medium voltage substations and high voltage grid nodes requiring continuous transformer deployment and replacement. The Energiewfinishe policy has accelerated grid modernization. Apart from these, Germany’s manufacturing sector accounts for a portion of EU industrial electricity utilize, as per sources, which requires precision current sensing in automation and electrification projects. Regulatory mandates such as the Metering Point Operation Act enforce class 0.2S accuracy for distribution metering installations. This confluence of energy transition,n industrial demand, and regulatory rigor sustains Germany’s dominant market role.

France Current Transformer Market Analysis

France is expected to be the most lucrative region in the Europe current transformer market due to its state-led grid modernization and nuclear, renewable hybrid grid structure. France operates an extensive electricity transmission network supported by thousands of substations that rely on advanced transformer systems for protection and measurement, according to studies. The nation’s grid modernization initiatives aim to upgrade medium-voltage infrastructure through the integration of digital and smart transformer technologies, as per sources. Renewable power connections across the counattempt are subject to strict technical standards for metering accuracy, which continues to drive demand for high-precision electrical components, according to studies. Industrial decarbonization programs and investments in clean technologies, including battery and hydrogen production facilities, further contribute to the required for reliable current monitoring systems, as per sources. This blfinish of centralized grid planning, renewable expansion, nd industrial decarbonization ensures France’s strong and sustained demand.

United Kingdom Current Transformer Market Analysis

The United Kingdom was the second largest region in the Europe current transformer market by capturing 16.3% share in 2024. The growth of the United Kingdom is due to offshore wind integration and aging grid renewal. The United Kingdom continues to expand its offshore wind generation capacity, supported by advanced high-voltage systems that ensure efficient power transmission between offshore and onshore grids, according to studies. Extensive investments under national energy programs are directed toward upgrading grid infrastructure with digital substations and modern transformer technologies, as per sources. Regulatory bodies in the counattempt maintain strict performance and accuracy standards for metering and monitoring equipment to ensure reliability across the distribution network, according to studies. Besides, the UK’s industrial strategy supports electrification in steel and chemicals with projects decarbonization plan requiring advanced current sensing. Despite Brexit, the UK aligns with the IEC standard,,s ensuring interoperability and sustained infrastructure investment.

Italy Current Transformer Market Analysis

Italy is seeing moderate expansion in the Europe current transformer market, with distributed renewable growth and seismic resilience requirements for grid equipment. Furthermore, industrial clusters are adopting energy-intensive electrification processes such as induction heating, which require high-frequency current transformers. This unique combination of renewable decentralization, geological constraints, ts, and industrial modernization defines Italy’s distinct demand profile.

Spain Current Transformer Market Analysis

Spain is likely to grow in the Europe current transformer market from 2025 to 2033 due to solar dominance, grid interconnection projects, and industrial electrification. Apart from these, Spain’s automotive and battery manufacturing boom, led by projects like Snotifyantis’ electric vehicle plant in Vigo, requires precision current monitoring in production lines. This synergy of solar leadership, cross-border connectivity, and industrial transformation sustains Spain’s growing influence in the regional market.

COMPETITIVE LANDSCAPE

The Europe current transformer market features a competitive dynamic shaped by the interplay of global engineering giants, regional specialists, and regulatory pressures. Established players such as Siemens Energy, ABB, and Schneider Electric dominate through technological leadership, compliance with IEC standards, and deep integration into utility procurement frameworks. However, they face growing competition from Eastern European and Turkish manufacturers offering cost-competitive conventional units for distribution networks. The market is increasingly bifurcated between high-finish digitally enabled transformers for smart grids and basic units for rural electrification. Regulatory mandates on environmental safety, accuracy, and cybersecurity act as significant barriers to enattempt, favoring incumbents with certification expertise. At the same time, the shift toward non-conventional sensing technologies is lowering the importance of traditional manufacturing scale and elevating software and systems integration capabilities. This evolving landscape rewards companies that combine engineering excellence with agile adaptation to Europe’s decarbonization and digitalization imperatives.

KEY MARKET PLAYERS

A few of the market players in the Europe current transformer market

- ABB

- Amran Inc

- ARTECHE

- CG Power & Industrial Solutions Ltd.

- Circutor

- Eaton Corporation

- General Electric

- Hammond Manufacturing Ltd.

- Hitachi Energy Ltd.

- Instrument Transformers LTD.

- Littelfutilize, Inc.

- NISSIN ELECTRIC Co., Ltd.

- RECO Transformers Pvt. Ltd.

- Schneider Electric

- Siemens Energy

Top Players in the Market

- Siemens Energy AG is a leading provider of high-precision current transformers across Europe with a strong legacy in grid infrastructure and industrial power systems. The company supplies both conventional wound core and optical current transformers compliant with IEC 61869 standards for transmission utilities and renewable energy developers. The company also integrated digital interfaces supporting IEC 61850 sampled values to align with substation automation trfinishs. These innovations reinforce Siemens Energy’s role as a technology enabler in Europe’s energy transition.

- ABB Ltd maintains a significant presence in the Europe current transformer market through its comprehensive portfolio spanning low to high voltage applications for utilities and industrial clients. The company pioneered the utilize of Rogowskicoil-based current sensors in medium voltage switchgear, offering compact design and immunity to magnetic saturation. ABB also enhanced its Ability digital platform to include real-time diagnostics for instrument transformers, enabling predictive maintenance. Its close collaboration with offshore wind developers ensures its current transformers meet stringent marine environmental and accuracy requirements. These strategic shifts position ABB as a key partner in Europe’s decarbonized and digitalized power infrastructure.

- Schneider Electric SE plays a vital role in the European current transformer market by focapplying on low and medium-voltage solutions for commercial buildings, industrial automation, and distribution networks. Schneider also partners with European distribution system operators to retrofit legacy substations with digitally enabled metering units. A customer-centric approach strengthens its position in the growing segment of smart and efficient power management.

Top Strategies Used by the Key Market Participants

Key players in the Europe current transformer market are prioritizing the development of eco-frifinishly designs that eliminate SF6 and mineral oil in compliance with stringent EU environmental regulations. They are integrating digital output interfaces such as IEC 61850 and Modbus to support substation automation and smart grid initiatives. Strategic expansion of manufacturing capacity in Western Europe ensures supply chain resilience and reduces lead times for critical infrastructure projects. Companies are investing in R&D for alternative core technologies, including Rogowski coils and optical sensors, to address challenges of saturation and accuracy in renewable-rich grids. Partnerships with transmission and distribution operators facilitate the development of application-specific ssolutions foroffshore connconnectors industrial electrification. These strategies collectively enhance technical differentiation, regulatory alignment, and customer value in a rapidly evolving market landscape.

MARKET SEGMENTATION

This research report on the Europe current transformer market is segmented and sub-segmented into the following categories.

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Application

- Power Distribution

- Manufacturing

- Others

By Counattempt

- United Kingdom

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Rest of Europe

Leave a Reply