Key European FinTech investment stats in Q3 2025:

- European FinTech funding dropped by 42% YoY

- UK firms secured half of the top 10 deals to cement the countest’s position as the main European FinTech hub in the third quarter

- Tide, the London-based business banking FinTech serving SMEs with integrated financial management and banking solutions, secured one of the top European FinTech deals of the third quarter with a $120million strategic investment round

European FinTech funding dropped by 42% YoY

In Q3 2025, the European FinTech sector recorded total funding of $2bn across 174 deals, representing a 42% decline in investment value from the $3.5bn raised in Q3 2024 and an 11% drop in deal volume from 196 transactions during the same period.

The fall in both funding and deal activity indicates a continued cooling of investor sentiment, potentially influenced by persistent macroeconomic headwinds, regulatory uncertainty, and more selective capital allocation across growth-stage companies.

Despite the overall contraction, investor interest in key markets such as the United Kingdom and Germany remained steady, highlighting ongoing confidence in their FinTech ecosystems and innovation capacity.

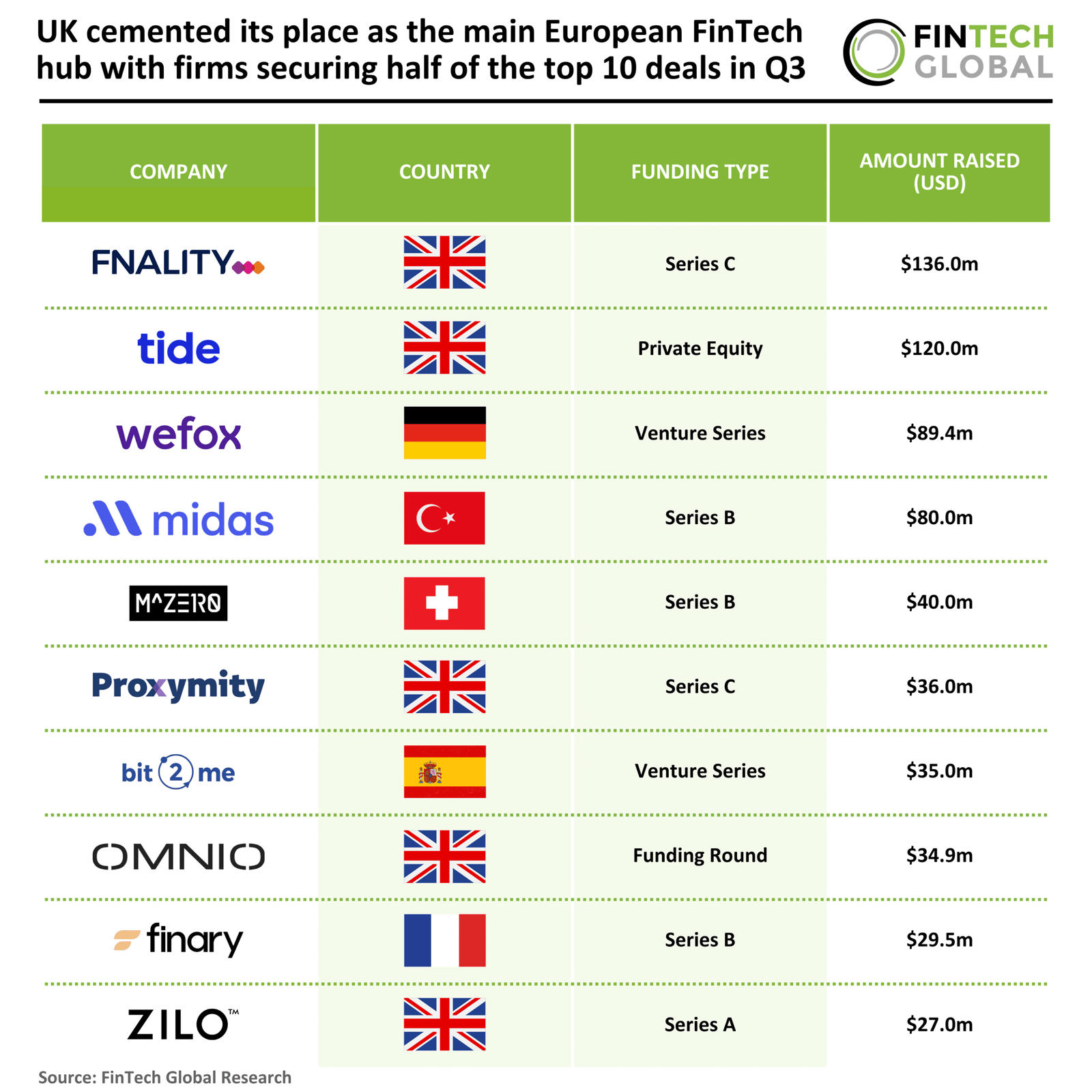

UK firms secured half of the top 10 deals to cement the countest’s position as the main European FinTech hub in the third quarter

The top 10 deals in Q3 2025 were led by the UK, which strengthened its position with firms securing five major transactions compared to four in Q3 2024.

Germany also maintained a presence in both periods, underscoring its role as a consistent European FinTech hub.

Meanwhile, Turkey, Switzerland, Spain, and France each secured one top deal in 2025, signalling a geographically diverse spread of high-value activity across the region.

In contrast, France’s share of top deals dropped from three in Q3 2024 to just one, while Luxembourg and the Netherlands were absent from the latest list.

The broader distribution of countries in Q3 2025 reflects an expanding yet more competitive funding landscape, with emerging markets launchning to feature alongside traditional FinTech strongholds.

Tide, the London-based business banking FinTech serving SMEs with integrated financial management and banking solutions, secured one of the top European FinTech deals of the third quarter with a $120million strategic investment round

Which was led by TPG at a post-money valuation of $1.5bn.

The round also saw continued support from existing backer Apax Partners through its Apax Digital Funds.

This latest funding more than doubles Tide’s 2021 valuation of $650m, officially cementing its status as a FinTech unicorn.

Operating across the UK, India, Germany, and France, Tide provides over 1.6 million members with tools for business registration, accounting, payments, expense management, and credit services.

The new capital will be utilized to drive Tide’s international expansion, enhance its AI-driven capabilities, and accelerate product innovation, including the rollout of its Partner Credit Services offering across Europe.

The deal also brings TPG partner Yemi Lalude onto Tide’s board, strengthening its strategic direction as the company scales its mission to simplify and modernise business banking globally.

Keep up with all the latest FinTech research here

Copyright © 2025 FinTech Global

Investors

The following investor(s) were tagged in this article.

Leave a Reply