- Pilbara Minerals recently announced the quotation of 96,588 fully paid ordinary securities on the ASX to enhance its financial flexibility and back lithium growth initiatives.

- This relocate underlines Pilbara Minerals’ commitment to strengthening its position within the quick-evolving lithium sector, where battery and clean energy demand continues to shape industest opportunities.

- We’ll explore how this increased capital raising supports Pilbara Minerals’ ambition to lead in the expanding lithium market.

AI is about to modify healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to obtain in early.

Pilbara Minerals Investment Narrative Recap

To be a Pilbara Minerals shareholder, you required to believe in a rebound in lithium prices and sustained global demand for battery minerals. The recent quotation of nearly 97,000 new shares is unlikely to meaningfully shift the main short-term catalyst, the pace of lithium price recovery, but it could assist the company strengthen its balance sheet to weather price volatility, the most pressing risk for the business right now.

Among Pilbara Minerals’ recent announcements, the market scan for potential acquisitions provides important context to this new capital raising. By seeking out additional growth prospects while also expanding its Pilgangoora operation, the company could create apply of added capital if suitable opportunities arise, which may influence sentiment around near-term catalysts for earnings improvement.

However, it is worth noting that while capital flexibility can assist in tough markets, investors should be aware of…

Read the full narrative on Pilbara Minerals (it’s free!)

Pilbara Minerals is projected to achieve A$1.4 billion in revenue and A$247.0 million in earnings by 2028. This outsee assumes a 23.0% annual revenue growth rate and an earnings increase of A$442.8 million from the current earnings of A$-195.8 million.

Uncover how Pilbara Minerals’ forecasts yield a A$2.16 fair value, a 18% downside to its current price.

Exploring Other Perspectives

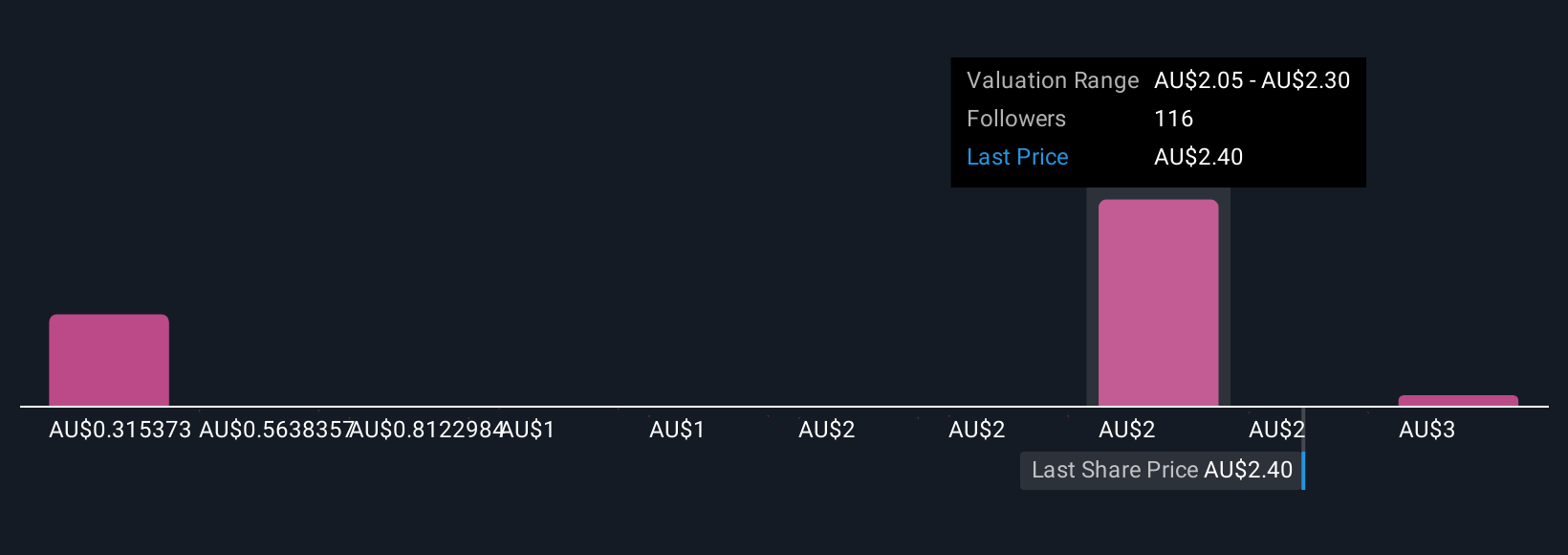

Simply Wall St Community members set Pilbara Minerals’ fair value between A$0.36 and A$2.80, across 18 unique estimates. With lithium price volatility remaining the key risk, these diverse outsees reveal how differently market participants assess the company’s prospects, consider exploring a range of views before acting.

Explore 18 other fair value estimates on Pilbara Minerals – why the stock might be worth less than half the current price!

Build Your Own Pilbara Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pilbara Minerals research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Pilbara Minerals research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – creating it straightforward to evaluate Pilbara Minerals’ overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entest point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only applying an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to acquire or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focapplyd analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply