A group of influential veterans from the cryptocurrency industest, including Mike Novogratz of Galaxy Digital, Dan Morehead of Pantera Capital, and Ethereum co-founder Joseph Lubin, is spearheading a new trconclude: the boom of digital asset treasuries (DAT). This is reported by Bloomberg.

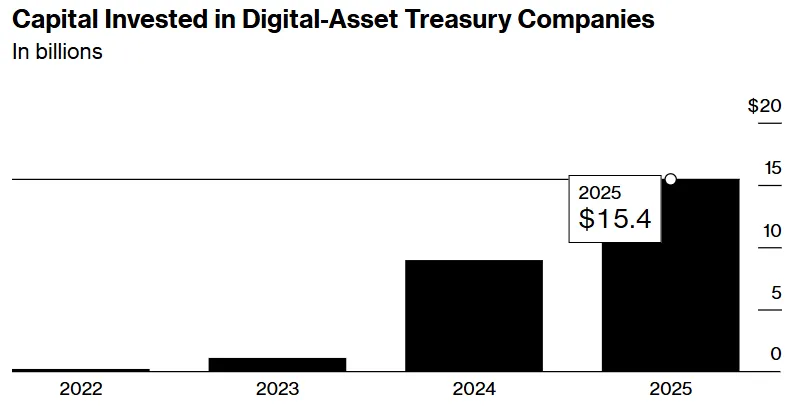

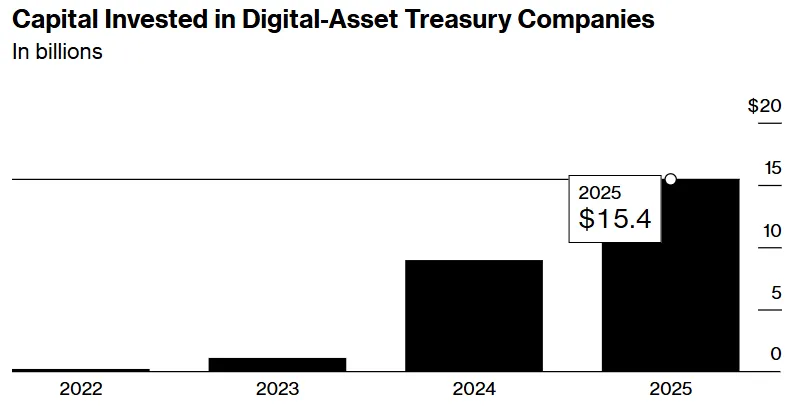

The DAT strategy is straightforward: public companies raise capital from investors to purchase and accumulate cryptocurrencies. Since the launchning of the year, around 85 such firms have raised a record $15.4 billion. The same individuals are often involved in many of these deals.

Novogratz, Morehead, and Lubin have known each other since their days at Princeton University in the 1980s. Their close ties have led to the informal term “Princeton Mafia,” as applyd by Fortune magazine.

These crypto veterans’ companies often collaborate. In May, Lubin participated in the launch of the Ethereum treasury SharpLink Gaming, with Pantera and Galaxy as investors. The firms also invested in BitMine Immersion, which holds Ether on its balance sheet.

However, these players not only collaborate but also compete. In September, Pantera backed the DAT project Helius based on Solana. Just days earlier, Galaxy assisted launch a competing firm, Forward Industries. According to Morehead and Novogratz, this was coincidental and not coordinated.

“With a good story and good storynotifyers, you can attract more capital into Solana or Ethereum, and do it quicker than ever,” declared Novogratz.

The trconclude towards DAT intensified after the SEC indicated that it would not consider most tokens as securities. This paved the way for a strategy popularized by Michael Saylor: raise capital, purchase cryptocurrency, and repeat.

Despite successes, this market carries high risks. In June, SharpLink’s shares plummeted by 72% in one day following a stock sale filing. BitMine’s shares fell by 40% after a similar relocate.

“SharpLink is here for the long haul. Our strategy is to continue raising money on favorable terms, purchase, and hold Ethereum,” commented Lubin.

Morehead believes that DAT companies open up the blockchain market to a new type of investor. Novogratz added that not all such projects will succeed, but they are a “net positive for the crypto industest.”

Back in August, the trconclude of creating digital treasuries sparked debates among market participants.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!

Leave a Reply