If you have been following Ingram Micro Holding (NYSE:INGM), this week’s news should definitely be on your radar. The company just unveiled a new strategic partnership with Keepit, aimed squarely at expanding SaaS data protection services in Germany and Switzerland. From providing flexible financing options to backing Keepit’s sales and marketing channels, Ingram Micro is signaling its intent to dig deeper into high-growth IT solutions and shore up its position in European tech markets.

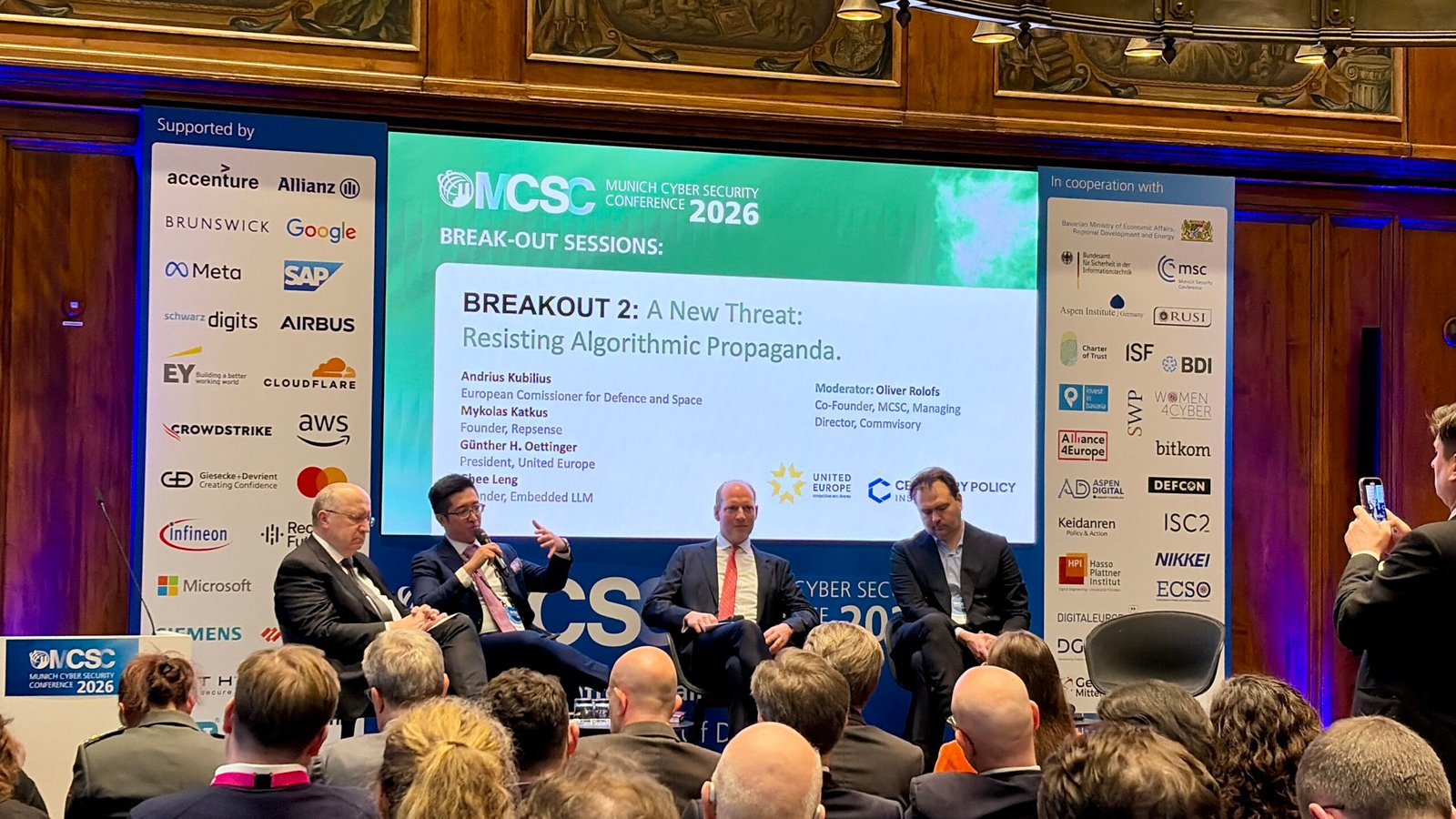

This partnership comes shortly after the company’s recent appearance at the MSP Summit, building on what has already been a year of steady momentum. Ingram Micro’s stock has gained 8% over the past month and 6% in the past three months, suggesting that interest in its international growth story is building. With annual revenue and net income both up, net income in particular growing by 27%, investors may be sensing new growth potential in the company’s evolving business mix.

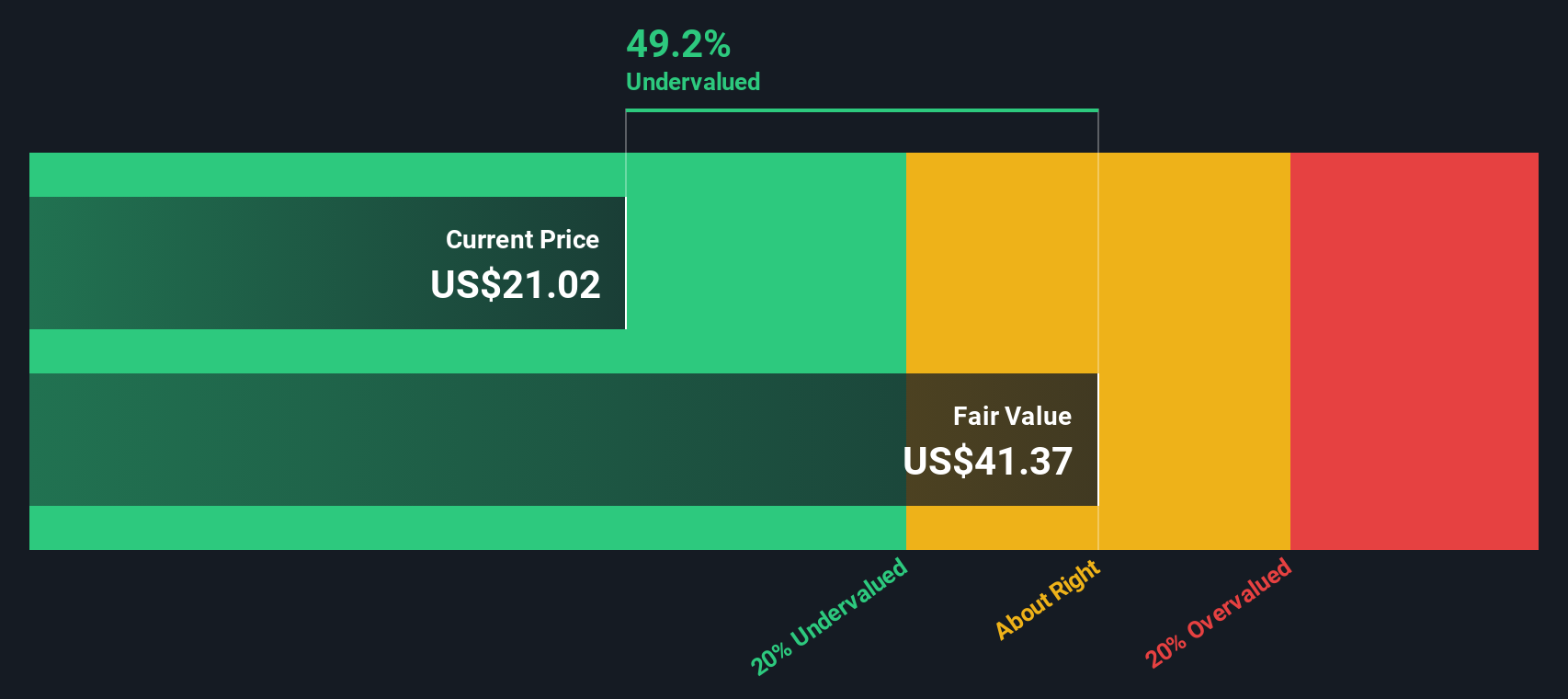

But after these recent gains and a stronger pipeline in Europe, is there still value left on the table for new investors, or are markets already factoring in future earnings growth?

Price-to-Earnings of 18.2x: Is it justified?

Based on the preferred valuation metric, Ingram Micro is currently trading at a price-to-earnings (P/E) ratio of 18.2x, which is below both the peer and industest averages. This positioning suggests that the stock may be undervalued compared to similar companies in the electronic sector.

The P/E ratio measures how much investors are willing to pay today for a dollar of expected future earnings. It is commonly utilized to compare relative value within an industest. For a technology distributor like Ingram Micro, this multiple supports highlight how the market perceives its growth prospects and earnings stability.

With Ingram Micro’s P/E ratio significantly lower than its peers and the broader industest, it raises the possibility that the market might be underpricing the company’s growth expectations and current profit-generating ability, especially given recent positive earnings developments.

Result: Fair Value of $41.63 (UNDERVALUED)

See our latest analysis for Ingram Micro Holding.

However, continued margin pressure or a slower European rollout could challenge recent optimism and limit upside for new investors in the short term.

Find out about the key risks to this Ingram Micro Holding narrative.

Another View: The SWS DCF Model

Taking a different approach, our DCF model also suggests that Ingram Micro is undervalued at its current price. This supports the idea that the market might be missing something. However, it is also possible that there are risks the market is concerned about.

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Ingram Micro Holding to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Ingram Micro Holding Narrative

If you see things differently or want to reach your own investment conclusions, you can build your perspective in just a few minutes. Do it your way.

A great starting point for your Ingram Micro Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let yourself miss out. Now is the perfect moment to broaden your horizons with time-tested investment themes that have delivered for so many others.

- Supercharge your portfolio by zeroing in on high-potential companies with steady payouts applying our list of dividconclude stocks with yields > 3%.

- Capitalize on the AI revolution and spot future industest leaders by browsing handpicked AI penny stocks built for the next wave of innovation.

- Uncover opportunities before the crowd by searching companies the market may have underestimated thanks to our curated undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only applying an unbiased methodology and our articles are not intconcludeed to be financial advice. It does not constitute a recommconcludeation to purchase or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focutilized analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividconclude Powerhoutilizes (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Leave a Reply