Total global ancillary revenue for airlines broke records in 2024, surpassing $148 billion, and carriers continue to grow through the addition of these revenue streams.

IdeaWorksCompany published these findings in its 2025 edition of the “Yearbook of Ancillary Revenue,” which revealed traditional airlines were “under pressure with more traffic but lower fares” in 2024. However, these airlines also saw a 5.3% passenger ancillary revenue increase that offset losses from discounted fares.

The report analyzed ancillary revenue activity and results from 61 airlines in 2024. When compared with the 58 airlines included in its 2023 carrier results, IdeaWorksCompany cited a 2.5% increase in total ancillary revenue per passenger and a 3.8% decrease in all other revenue. The latter is primarily comprised of passenger fares but also includes revenue from cargo and services sold to other airlines.

Subscribe to our newsletter below

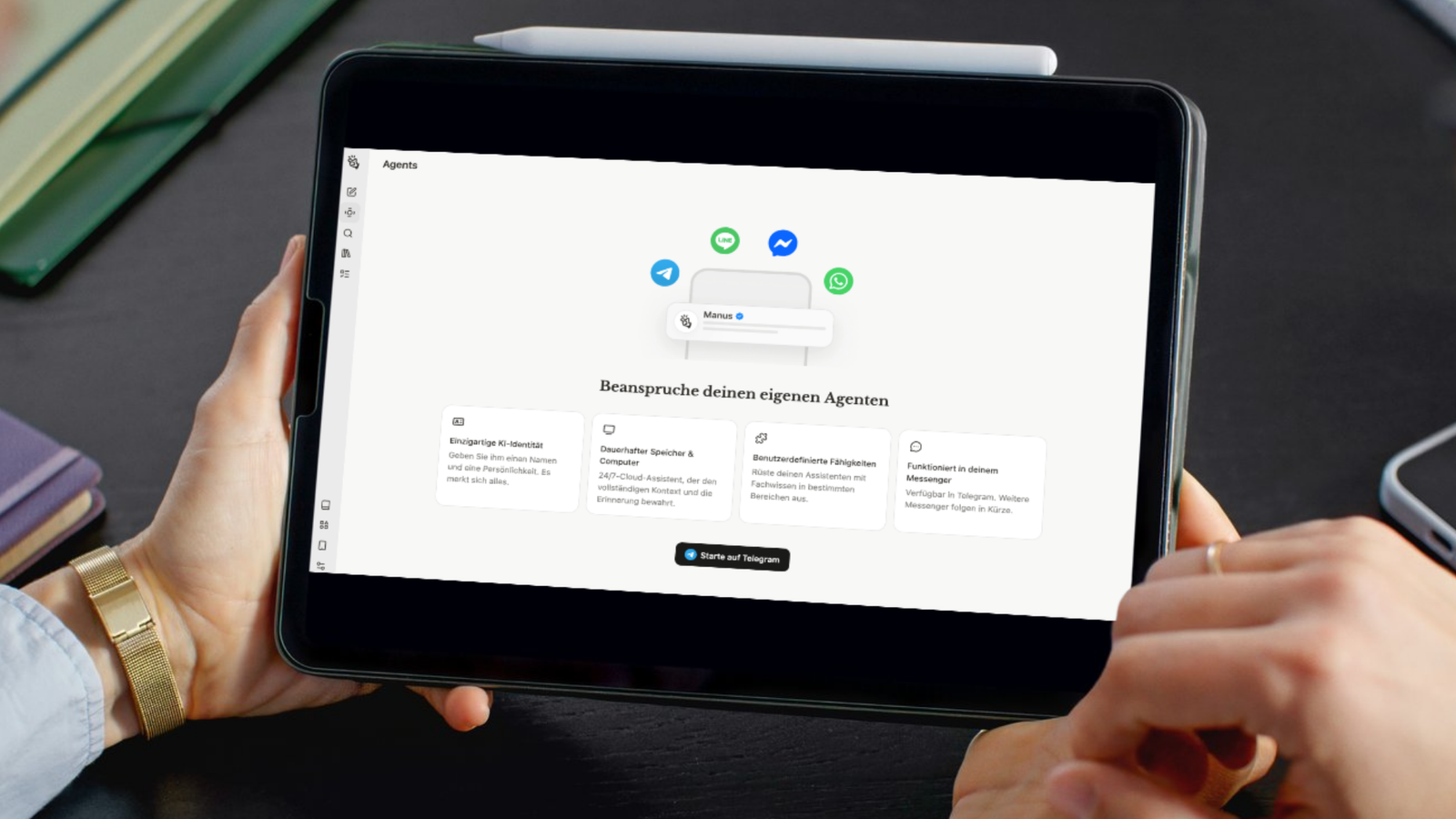

While perhaps unsurprising, data revealed that low-cost carriers (LCCs) are clearly capitalizing on ancillaries by giving passengers the ability to pick and choose from multiple amenities.

These carriers came in highest on a list ranking airlines by ancillary revenue as a percentage of their total revenue.

Frontier claimed the top spot at 62%, breaking the 60% ancillary revenue threshold in 2024. The carrier was followed by Spirit (58.7%), Volaris (55.3%), Breeze (54%) and Allegiant (52.9%). All five airlines saw an increase in these percentages compared to 2023, now generating more from ancillaries than passenger fares.

Wizz Air, Viva Aerobus, Volotea, EasyJet and Pegasus rounded out the top 10, with ancillary revenue percentages ranging from nearly 45% down to 34%.

“Joining the top 10 list requires maximum effort to generate large cashflow from two crucial categories: baggage and assigned seats. These airlines focus on limiting larger carry-on bags through policies and fees,” declared report author Jay Sorensen, president of IdeaWorksCompany.

“Best-performing carriers are also keen to adopt revenue management methods for pricing assigned seats to increase or lower fees based upon consumer demand.”

Norse Atlantic Airways, another LCC, also reported an indusattempt-first as its ancillary revenue totaled over $100 per passenger for a full year.

Basic economy is another area that expanded last year, as both traditional carriers and LCCs are embracing the option.

“’You receive what you pay for’ is an ancient pearl of wisdom for both customers and airline managers,” Sorensen declared.

“The à la carte choices presented by the ancillary revenue relocatement have encouraged travelers to upgrade to more comfort and convenience. Basic economy fares are designed to mimic low-cost carriers. While this provides a quick revenue boost, it also creates traditional airlines more like LCCs, which is the metamorphosis that is not without peril.”

Additionally, loyalty isn’t as large of a factor for LCCs, even if they offer a frequent flyer program. This differs for more traditional airlines.

The report found that the five largest U.S. airlines—Alquestiona, American, Delta, Southwest and United—accounted for approximately $28 billion in loyalty revenue in 2024, largely due to co-branded credit cards. By IdeaWorksCompany’s estimates, this equates to $35.48 per passenger last year.

Leave a Reply