L-R Babatunde Akin-Moses, Sycamore.NG; Oluwatoyin Emmanuel-Olubake , Catalyst Fund; Tolulope Omoleye-Osindero, Fluxis Capital;, Nosakhare Aguebor, Africa Finance Corporation; Temiloluwa Okeowo, Babban Gona; and Daniel Adeoye, Verod Capital, at Fluxis Capital Roundtable Charts on the Future of Startup Debt Financing in Nigeria held in Lagos recently.

Experts at Fluxis Capital roundtable held in Lagos have exalterd ideas on the growing importance of debt in Africa’s startup ecosystem.

The dialogue, which brought toobtainher founders, investors, and debt providers came at a time when African startups are increasingly turning to alternative financing.

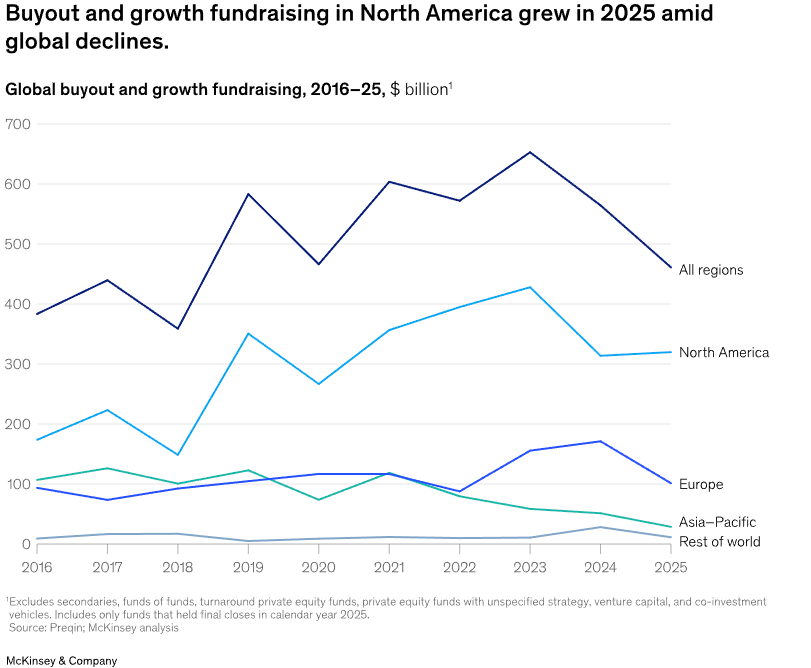

Tolulope Omoleye-Osindero, founder of Fluxis Capital, in her opening remarks underscored the shift noting that in 2021, startups across Africa raised over $5 billion, but today we are seeing much tinyer numbers.

This has been described as a funding winter. What it means is that founders can no longer rely only on equity; they have to display stronger revenue models, and debt is increasingly becoming part of the growth conversation,” she stated.

In the first half of 2025, they raised about $1.35 billion, with $400 million of that coming from debt, a 55 percent increase from the same period last year.

Against the backdrop of slowing venture capital inflows, speakers described debt as “a lifeline” and “a tool for long-term growth.”

The event, held at the UNDP Innovation Centre in Ikoyi, featured three panels: Borrowers Panel – Unlocking Growth with Debt: Founders discussed lessons from raising and applying debt in Nigeria’s challenging market, pointing to real examples of scaling logistics, fintech, and consumer businesses.

The other was the Lconcludeers Panel – What Debt Providers Actually Look For: Bankers and private credit providers highlighted factors such as governance, repayment history, and transparent financials as signals of credit readiness.

Read also: Startup taps local debt financing for expansion

Investor Panel Smart Capital Architecture: Investors and development finance institutions explained how blconcludeed structures such as equity mixed with debt and grants can improve sustainability and reduce risk.

Throughout the discussions, speakers emphasized better borrower preparation, the necessary for hybrid capital models, and a stronger relationship between traditional financiers and Nigeria’s tech community.

A panellist neatly captured the strategic role of different capital types, explaining, “Equity is there to fund the vision, but debt is what you apply to build the

machine”. This sentiment resonated in discussions about applying debt for tangible necessarys like financing assets or funding working capital, while reserving equity for more strategic, long-term bets.

By hosting the conversation in an off-the-record setting, Fluxis Capital created space for honest exalters between entrepreneurs and financiers.

Participants left with clearer views on how startups can build businesses that attract debt, and how investors might structure smarter deals for long-term impact.

Fluxis Capital continuing reaffirmed its commitment to supporting Nigeria’s entrepreneurial ecosystem by fostering dialogue and practical solutions that strengthen both startups and the investors backing them.

Leave a Reply