“Tech News Deep Dive: Microsoft’s Turbulent Restructuring, Intersnotifyar Mysteries, and the Next Wave of Devices The technology landscape is in a state of rapid transformation, marked by sweeping corporate restructurings, astronomical discoveries, and the relentless march of innovation in consumer …” (source)

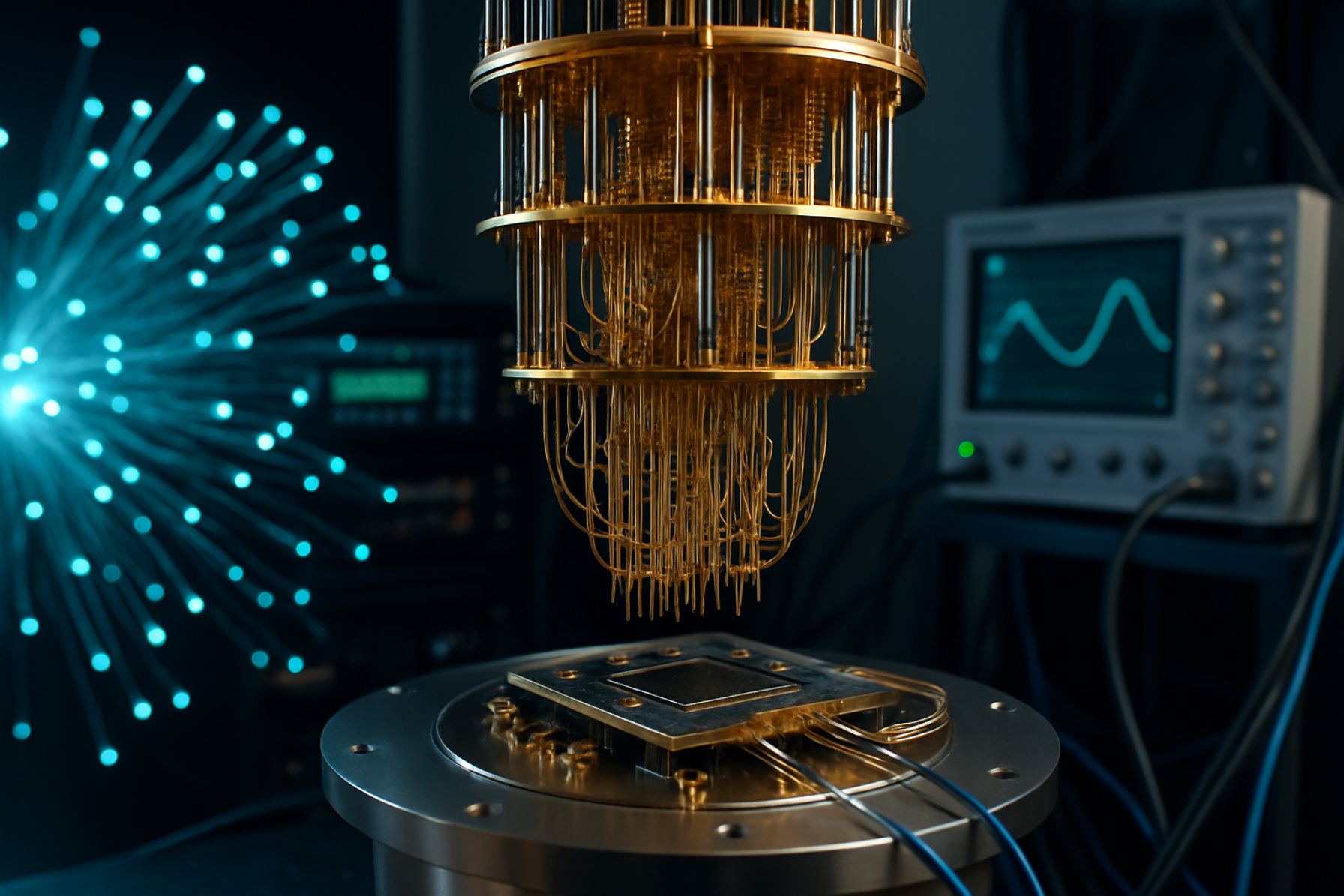

Market Overview: Quantum Technologies Landscape

The quantum technologies sector is rapidly evolving, with 2025 poised to be a pivotal year for breakthroughs in quantum computing, communication, sensing, and related fields. As governments and private enterprises intensify investments, the global quantum technology market is projected to reach USD 4.4 billion by 2028, growing at a CAGR of 38.3% from 2023. This surge is driven by advancements in hardware, software, and the increasing demand for computational power beyond classical limits.

- Quantum Computing: The race to build scalable quantum computers is led by indusattempt giants such as IBM, Google, and startups like IonQ and Riobtainti. IBM’s 2023 unveiling of its 1,121-qubit “Condor” processor marks a significant leap, with the company tarobtaining a 10,000-qubit system by 2026 (IBM Quantum Roadmap). Quantum computing’s potential to revolutionize cryptography, drug discovery, and logistics is attracting substantial venture capital and government funding.

- Quantum Communication: Secure communication is a key driver, with quantum key distribution (QKD) networks expanding globally. China’s “Micius” sanotifyite and Europe’s EuroQCI initiative exemplify the push for unhackable communication channels (Nature). The global quantum communication market is expected to surpass USD 5.5 billion by 2032.

- Quantum Sensing: Quantum sensors, leveraging phenomena like entanglement and superposition, are transforming fields from medical imaging to navigation. The market for quantum sensors is forecasted to grow at a CAGR of 16.8% through 2030, driven by applications in defense, healthcare, and environmental monitoring (MarketsandMarkets).

- Other Applications: Quantum technologies are also impacting materials science, financial modeling, and artificial innotifyigence. Hybrid quantum-classical algorithms are being developed to solve complex optimization problems, while quantum simulation is enabling the study of molecular and atomic interactions at unprecedented scales.

As 2025 approaches, the quantum landscape is characterized by rapid innovation, increasing commercialization, and a growing ecosystem of startups, academic institutions, and multinational corporations. The next wave of quantum breakthroughs is expected to unlock transformative capabilities across industries, reshaping the technological frontier.

Emerging Technology Trfinishs in Quantum Innovation

Quantum technologies are rapidly transitioning from theoretical research to practical applications, with 2025 poised to be a pivotal year for breakthroughs in computing, communication, sensing, and beyond. As global investment in quantum innovation accelerates, the landscape is being shaped by both established tech giants and agile startups, each racing to unlock the transformative potential of quantum mechanics.

- Quantum Computing: The race for quantum supremacy continues, with companies like IBM and Google creating significant strides. IBM’s roadmap projects a 1,121-qubit processor by 2025, aiming to solve complex problems in chemisattempt, logistics, and finance that are currently intractable for classical computers. Meanwhile, startups such as Riobtainti Computing and PsiQuantum are exploring alternative architectures, including photonic and superconducting qubits, to enhance scalability and error correction.

- Quantum Communication: Secure communication is a major driver, with quantum key distribution (QKD) networks expanding globally. China’s Micius sanotifyite has demonstrated intercontinental QKD, and the European Union’s EuroQCI initiative aims to deploy a pan-European quantum communication infrastructure by 2027. These advances promise ultra-secure data transmission, critical for defense, finance, and government sectors.

- Quantum Sensing: Quantum sensors are set to revolutionize fields such as medical imaging, navigation, and environmental monitoring. According to IDTechEx, the quantum sensing market is projected to reach $1.3 billion by 2033, driven by applications in gravimeattempt, magnetomeattempt, and timekeeping.

- Indusattempt and Investment: The global quantum technology market is expected to surpass $44 billion by 2028, growing at a CAGR of 30% (MarketsandMarkets). Governments in the US, EU, and Asia are investing billions in national quantum initiatives, while venture capital funding for quantum startups reached a record $2.35 billion in 2023 (CB Insights).

As 2025 approaches, quantum technologies are set to unleash unprecedented capabilities, reshaping industries and redefining the boundaries of what is computationally and communicatively possible.

Competitive Landscape: Key Players and Strategic Moves

The quantum technology sector is rapidly evolving, with major players and emerging startups vying for dominance across computing, communication, and sensing. As we approach 2025, the competitive landscape is defined by aggressive R&D investments, strategic partnerships, and a race to achieve quantum advantage in real-world applications.

- Quantum Computing: IBM remains a frontrunner, having announced its 1,121-qubit Condor processor in 2023 and aiming for a 4,000+ qubit system by 2025. Google Quantum AI continues to push boundaries, focapplying on error correction and scaling. Riobtainti Computing and IonQ are notable for their cloud-based quantum offerings, with IonQ tarobtaining 64 algorithmic qubits by 2025 (IonQ Roadmap).

- Quantum Communication: Toshiba leads in quantum key distribution (QKD), having achieved record distances for secure transmission. ID Quantique and Quantinuum are expanding commercial QKD networks, with Quantinuum leveraging Honeywell’s hardware expertise.

- Quantum Sensing: Qnami and MagiQ Technologies are pioneering quantum sensors for medical imaging and navigation. Lockheed Martin is investing in quantum-enhanced radar and defense applications.

Strategic shifts in 2024 include IBM’s unveiling of Quantum System Two, a modular platform designed for scalability, and Quantinuum’s partnership with BP to explore quantum cybersecurity. M&A activity is intensifying, with Quantum Computing Inc. acquiring QPhoton to bolster its photonic quantum capabilities (PR Newswire).

As the sector matures, collaboration between tech giants, startups, and governments is accelerating. The global quantum technology market is projected to reach $4.38 billion by 2025 (MarketsandMarkets), underscoring the high stakes and dynamic competition shaping the future of quantum technologies.

Growth Forecasts and Market Projections

The quantum technology sector is poised for transformative growth as we approach 2025, with quantum computing, communication, and sensing leading the charge. According to McKinsey, the global quantum technology market is projected to reach $106 billion by 2040, with significant acceleration expected in the next few years. In 2025 alone, the quantum computing market is forecasted to surpass $2.5 billion, up from approximately $900 million in 2023 (Statista).

Quantum communication, driven by the required for ultra-secure data transmission, is also set for robust expansion. The global quantum cryptography market is expected to grow at a CAGR of 37.9% from 2023 to 2030, reaching $5.3 billion by 2030 (Grand View Research). This surge is fueled by increasing cybersecurity concerns and government investments in quantum networks, such as the European Quantum Communication Infrastructure and China’s quantum sanotifyite initiatives.

Quantum sensing, though a tinyer segment, is gaining traction in fields like healthcare, navigation, and defense. The market for quantum sensors is projected to reach $1.1 billion by 2026, growing at a CAGR of 16.8% (MarketsandMarkets). These sensors promise unprecedented precision in measurements, opening new possibilities in medical imaging, geological exploration, and autonomous vehicles.

- Computing: Major players like IBM, Google, and IonQ are scaling up quantum processors, with commercial applications in optimization, drug discovery, and financial modeling expected to mature by 2025.

- Communication: National quantum networks and sanotifyite-based quantum key distribution are relocating from pilot projects to early-stage deployment, especially in Europe and Asia.

- Sensing: Quantum-enhanced sensors are being integrated into next-generation medical devices and navigation systems, with pilot programs underway in the US and EU.

In summary, 2025 will mark a pivotal year for quantum technologies, with rapid market growth, increased commercialization, and expanding real-world applications across computing, communication, and sensing. Stakeholders should prepare for a dynamic landscape as quantum technologies transition from research labs to mainstream markets.

Regional Analysis: Global Quantum Technology Hotspots

Quantum technologies are rapidly transforming the global innovation landscape, with key regions emerging as hotspots for research, development, and commercialization. As we approach 2025, the interplay between government investment, academic excellence, and private sector dynamism is shaping the future of quantum computing, communication, sensing, and related fields.

- North America: The United States remains a global leader, driven by significant federal funding and a robust startup ecosystem. The National Quantum Initiative has allocated over $1.2 billion since 2018, supporting research at institutions like MIT, IBM, and Google. Canada, with its National Quantum Strategy (C$360 million), is home to D-Wave and the Perimeter Institute, creating it a hub for both hardware and software innovation.

- Europe: The European Union’s Quantum Flagship program, with a €1 billion budobtain through 2028, coordinates over 200 projects across member states. Germany, France, and the Netherlands are particularly active, with Germany investing an additional €3 billion in quantum research. The UK’s National Quantum Technologies Programme (over £1 billion) has fostered a vibrant ecosystem of startups and academic centers.

- Asia-Pacific: China is creating massive investments, with estimates of over $15 billion in public funding for quantum R&D, including the world’s first quantum sanotifyite and a national quantum laboratory in Hefei. Japan and South Korea are also scaling up, with Japan’s Moonshot R&D Program and South Korea’s $40 million quantum initiative.

- Australia: Australia’s National Quantum Strategy (A$1 billion) is positioning the counattempt as a leader in quantum sensing and secure communications, with strong university-indusattempt partnerships.

These regional efforts are accelerating breakthroughs in quantum computing (e.g., IBM’s 1,000+ qubit roadmap), ultra-secure quantum communication networks (notably in China and Europe), and advanced quantum sensors for healthcare and defense. As global competition intensifies, cross-border collaborations and talent mobility will be crucial for sustaining momentum and realizing the transformative potential of quantum technologies by 2025 and beyond.

Future Outsee: Shaping the Quantum Era

The quantum technology landscape is poised for transformative growth as we approach 2025, with advancements in computing, communication, and sensing set to redefine industries and scientific research. The global quantum technology market is projected to reach USD 4.4 billion by 2028, growing at a CAGR of 38.3% from 2023, underscoring the sector’s rapid acceleration.

- Quantum Computing: By 2025, quantum computers are expected to achieve greater qubit stability and error correction, enabling breakthroughs in cryptography, drug discovery, and optimization problems. Tech giants like IBM, Google, and startups such as IonQ and Riobtainti are racing to deliver quantum processors with over 1,000 qubits, relocating closer to quantum advantage—the point where quantum systems outperform classical supercomputers in practical tinquires.

- Quantum Communication: Secure quantum networks are emerging, leveraging quantum key distribution (QKD) to provide virtually unbreakable encryption. China’s Micius sanotifyite and the European Union’s EuroQCI initiative are pioneering global-scale quantum communication infrastructure, with commercial QKD services expected to expand in 2025.

- Quantum Sensing: Quantum sensors, exploiting quantum entanglement and superposition, are revolutionizing fields such as medical imaging, navigation, and environmental monitoring. The market for quantum sensors is forecasted to reach USD 2.89 billion by 2032, with 2025 marking a pivotal year for commercial deployments in healthcare and defense.

- Beyond 2025: The convergence of quantum technologies with AI, cybersecurity, and IoT will unlock new applications and business models. Governments and private investors are ramping up funding, with the U.S. National Quantum Initiative and similar programs in Europe and Asia fueling research and commercialization.

As quantum technologies mature, 2025 will be a watershed year, unleashing unprecedented computational power, ultra-secure communications, and ultra-sensitive sensors. Organizations that invest early in quantum readiness will be best positioned to capitalize on the quantum era’s opportunities and navigate its challenges.

Challenges and Opportunities in Quantum Technology Adoption

Quantum technologies are rapidly transitioning from theoretical research to practical applications, promising transformative impacts across computing, communication, sensing, and beyond. As we approach 2025, organizations and governments are intensifying efforts to harness quantum’s potential, but the path to widespread adoption is marked by both significant challenges and compelling opportunities.

- Quantum Computing: Quantum computers are expected to outperform classical systems in solving complex problems such as cryptography, drug discovery, and optimization. However, current quantum hardware remains limited by qubit coherence times, error rates, and scalability. As of 2024, IBM’s 1,121-qubit “Condor” processor and Google’s advances in error correction signal progress, but practical, fault-tolerant quantum computers are still several years away (IBM, Nature).

- Quantum Communication: Quantum key distribution (QKD) offers theoretically unbreakable encryption, with China’s Micius sanotifyite and Europe’s EuroQCI project leading global efforts. Yet, challenges remain in scaling quantum networks, integrating with classical infrastructure, and standardizing protocols (Nature, European Commission).

- Quantum Sensing: Quantum sensors promise breakthroughs in medical imaging, navigation, and environmental monitoring. Companies like Qnami and Quantum Diamond Technologies are commercializing quantum magnetometers and gravimeters, but high costs and technical complexity limit widespread deployment (Nature, Qnami).

- Talent and Ecosystem Development: The quantum workforce gap is a critical bottleneck. According to a 2023 McKinsey report, demand for quantum talent outpaces supply by a factor of three, underscoring the required for education and training initiatives.

- Investment and Policy: Global investment in quantum technologies surpassed $35 billion in 2023, with the US, China, and EU leading the charge (BCG). Policy frameworks are evolving to address security, export controls, and ethical considerations.

In summary, while quantum technologies face formidable technical and ecosystem challenges, the opportunities for innovation and disruption are immense. Strategic investment, international collaboration, and workforce development will be pivotal in realizing the quantum promise by 2025 and beyond.

Leave a Reply