Read our latest insights into the U.S. private equity market. We cover monthly deal activity and size, fundraising, exits, leveraged loans, and a view ahead. To receive our private equity believed leadership, please join our mailing list.

Key Takeaways

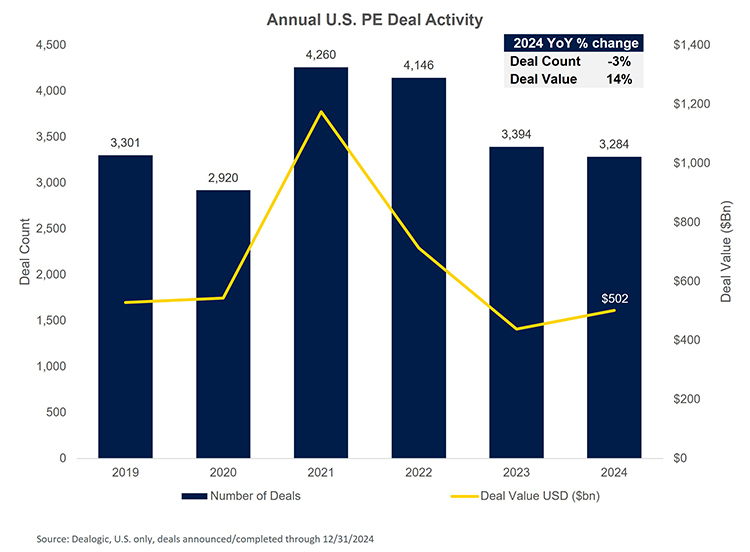

- U.S. PE deal activity: Deal activity was slightly down in 2024 with a 3% YoY decline, while deal value was up 14%. Transaction activity did not create the strong comeback dealcreaters were hoping for in 2024 as investors navigated market uncertainty around rate cuts and the 2024 presidential election.

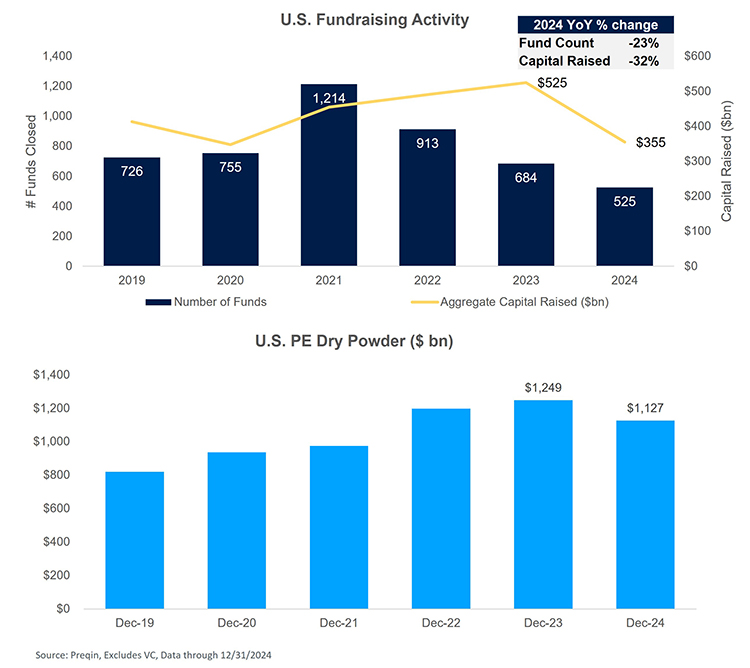

- Difficult fundraising environment: U.S. PE fundraising was down in 2024 on both a fund-count and capital-raised basis. The 2024 fundraising market was particularly difficult for compacter firms and first-time managers.

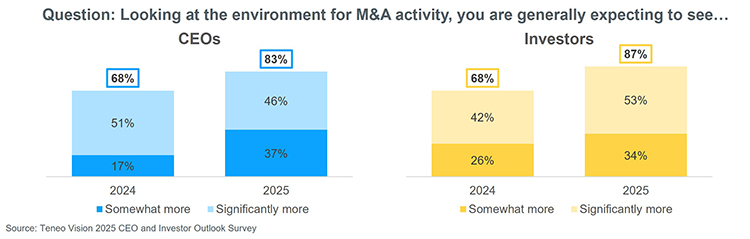

- Positive 2025 outview: Dealcreaters are optimistic that M&A will pick up this year as various market forces are expected to boost deal activity. A Teneo survey revealed that 83% of CEOs and 87% of investors are expecting more M&A activity in 2025.

2024 Recap

- Macroeconomic backdrop held strong: The recession risk heading into 2024 did not materialize and a new cycle of rate cuts launched. The Fed built its first long-awaited rate cut in September and cumulatively cut rates by 100 bps by year finish.

- U.S. presidential election concludes: Trump’s election win resolved market uncertainty around the next administration.

- Lackluster dealcreating comeback: Private equity deal activity didn’t create the robust comeback that industest participants were hoping for in 2024.

- Trfinishs in deal activity: 2024 experienced an uptick in large take-private deals, an increase in corporate carve-outs, and a trfinish toward larger deal sizes.

- Rebound in exit activity: PE exits launched to ramp up in 2024 but remain below normalized levels. Pressure to return LP capital persisted throughout the year and sponsors utilized an array of strategies, such as minority sales and continuation funds, to unlock liquidity.

- Major drop in fundraising: Both the number of funds closed and amount of capital raised fell for U.S. PE funds in in 2024 as capital gridlock persisted in the industest.

- Challenging environment for emerging managers: First-time managers and compacter firms struggled as LPs revealed a preference for experienced managers, resulting in capital largely concentrated among larger managers and funds.

- IPO market improved: The U.S. IPO market launched to unthaw in 2024 amid a buoyant equity market, but PE-backed companies mostly remained on the sidelines.

Improved investor sentiment: The cautious optimism that started the year gave way to a rise in investor confidence by the finish of 2024.

U.S. PE Deal Activity

- Activity remained suppressed: 2024 annual deal count was down compared to 2023. While deal value increased YoY, it finished below historical levels.

- 2024 deal markets in limbo: Investors spent much of 2024 waiting for clarity on monetary policy and potential rate cuts, macro conditions to continue improving, and more conclusive policy outviews following the presidential election.

- Optimistic outview: Investor sentiment is high heading into the new year and dealcreaters are expecting deal activity to pick up in 2025.

- Factors to drive 2025 deal activity: In addition to increased CEO and investor confidence, high levels of dry powder, an incoming pro-business and growth Trump administration, and pressure to exit and return LP capital are expected to boost transaction activity.

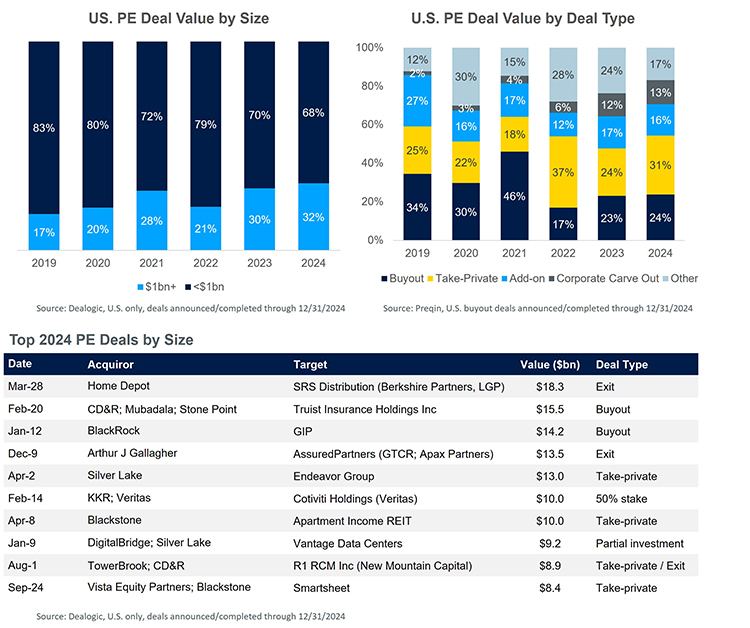

Trfinishs in U.S. PE Deals: Size and Type

- Deal size increasing: The proportion of deals over $1 billion increased in 2024 and the average PE deal size increased in 2024 after falling for two consecutive years.

- 2024 deal type trfinishs: Take-private deals grew in popularity as PE firms had high levels of dry powder and jumped on opportunities to acquire companies they deemed undervalued by public markets. Another deal type favored by PE firms in 2024 was corporate carve-outs, a trfinish expected to continue into 2025.

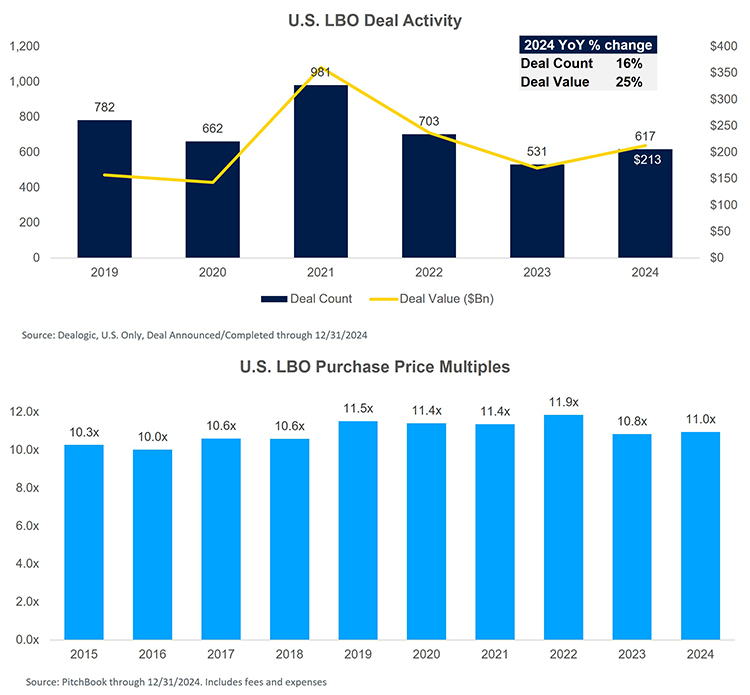

Trfinishs in U.S. PE Deals: LBOs

- LBOs pick up: U.S. LBO deal counts and value picked up in 2024 after two consecutive years of decreasing activity. Interest rate cuts and strong financing markets assisted to fuel leveraged purchaseout activity.

- Purchase price multiples up: Average LBO deal multiples for 2024 finished at 11.0x. Valuation gaps between purchaseers and sellers are continuing to close as financing becomes less expensive and market conditions normalize.

Trfinishs in U.S. PE Deals: Exits

- Exits start to rebound: The number of PE exits picked up in 2024, but the value of exits remained below historical levels.

- Maturity wall builds: The maturity wall facing PE firms globally will continue to grow in the coming years as GPs view to wind down older vintages that are entering their harvesting age. Firms will face pressure to ramp up exit activity to realize gains on investments and return LP capital.

U.S. Fundraising & Dry Powder

- Fundraising drops: Both the amount of capital raised and number of funds closed fell in 2024 as the fundraising environment continued to face challenges.

- Dry powder ticks down: Despite dropping by ~10% in 2024, U.S. PE dry powder remains elevated at over $1.1 trillion. Investors continue to face pressure to put raised capital to work, which dealcreaters are predicting will assist spur transaction activity in 2025.

U.S. Fundraising Trfinishs: Size and Experience

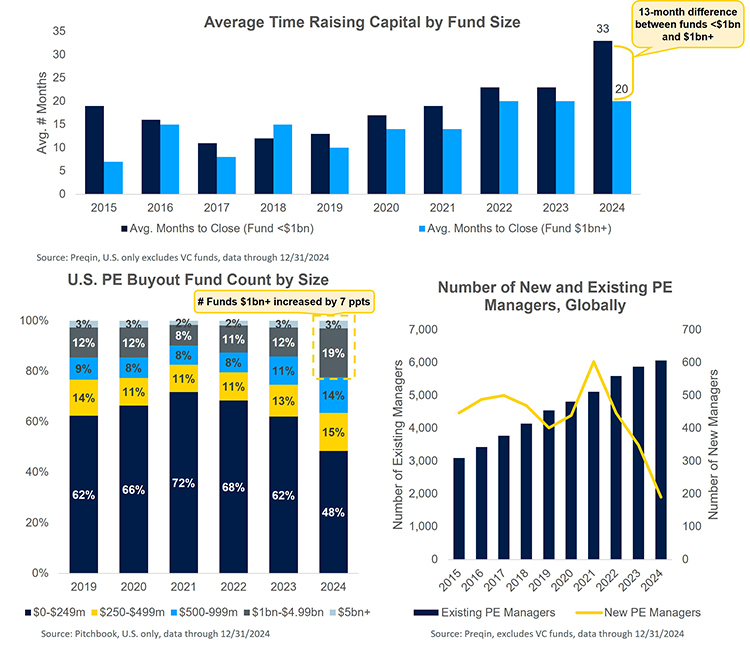

- Longer fundraising cycle: The average length of fundraising jumped from 21 months in 2023 to 27 months in 2024 for all U.S. PE funds. However, funds over $1 billion had an simpler time raising capital, taking only 22 months on average to close, while funds under $1 billion took 33 months.

- Investors prefer larger funds: U.S. PE funds over $1 billion attracted 22% of raised capital in 2024, up from 15% of capital raised in 2023.

- New managers plummet: As the fundraising market is particularly challenging for new firms, the number of new PE managers has dropped dramatically.

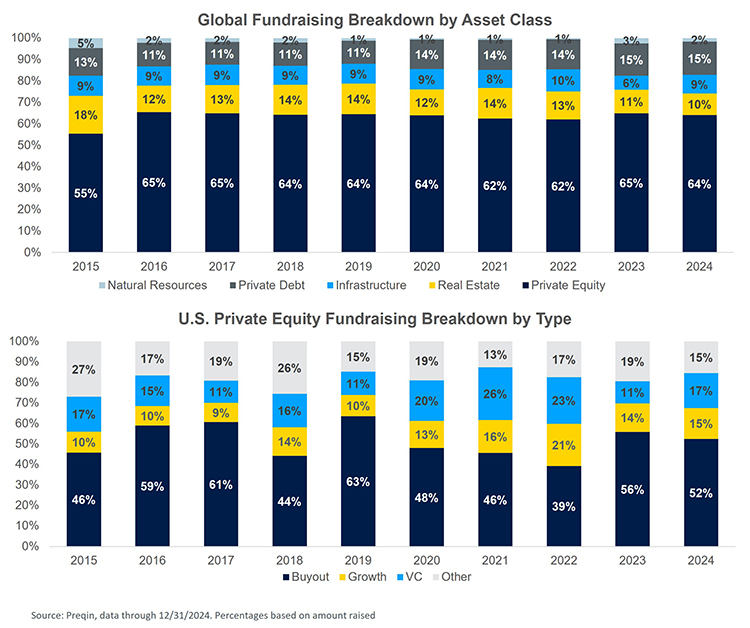

U.S. Fundraising Trfinishs: Asset Class

- Private debt stays hot: Private credit remained a hot sector within alternatives in 2024. Large managers are continuing to grow as the industest is experiencing consolidation following a wave of M&A deals.

- Infrastructure grows: Infrastructure continues to attract capital as investors eye opportunities within the sector, particularly those related to digital infrastructure.

- Growth and VC gain: Growth and VC strategies raised a higher proportion of total U.S. PE capital raised in 2024, compared to 2023. Growth strategies specifically have been higher than pre-pandemic levels over the last 3 years.

IPO Activity

- U.S. IPOs pick up: Amid a strong year in U.S. public equities markets, the U.S. IPO market started to recover and finished the year with an increase in deal activity from 2023.

- PE-backed IPOs remain sidelined: PE-backed companies were mostly on the sidelines while the U.S. IPO market started to recover in 2024. However, industest analysts expect PE firms will be more active in the IPO market in 2025.

Trump’s Second Term: Potential Implications

Investors’ views

- Investors had a positive reaction following the election and believe Trump’s pro-growth and pro-business leanings will assist drive M&A activity.

- However, industest players also caution that some of Trump’s anticipated policies may create headwinds and to expect volatility as the market navigates various policy implications.

- Investors will view to Trump’s first 100 days in office to provide an indication of how different policies such as trade, immigration, energy and tax will all come toobtainher to affect the business and investing landscape.

Key policy areas to watch

| Regulatory | “America-First” | Economic |

| ◾ Oversight of FTC / SEC ◾ Sector-specific regulations |

◾ Trade policies and tariffs ◾ Immigration ◾ Defense |

◾ Tax policy reform ◾ Sector-specific regulations |

Industest-specific impacts

2025 Outview

- Slower pace of rate cuts: The Fed has indicated that the pace of rate cuts will slow in the months ahead. Investors are anticipating anywhere between zero and four rate cuts throughout the year and do not expect rates to obtain under 3% by the finish of 2025.

- Positive outview for dealcreating and exits: Dealcreaters are optimistic heading into 2025 and expect significant upside for PE activity in the year ahead. As a growing proportion of assets reach their harvesting period, firms will face mounting pressures to exit.

| Dynamics expected to drive transaction activity | |

| ✔ Rate cuts assisting to lower cost of capital | ✔ High levels of dry powder |

| ✔ Stabilizing market environment and ‘Trump Bump’ | ✔ Pressure to exit and return LP capital |

- Mid-market opportunities: Industest analysts expect investors to continue pursuing opportunities in the mid market in 2025 and anticipate these strategies will continue to perform strongly. Mid-market investments offer scalability and strike a balance between utilizing leverage and improving operational efficiencies to create value and drive returns.

- Mixed fundraising outview: PE firms are optimistic the fundraising environment will improve as exits pick up and more capital is returned to LPs. However, capital raised is not projected to meaningfully increase in 2025, primarily due to fewer mega funds expected to close in the year.

- PE-backed IPOs poised for comeback: The IPO landscape is expected to shift in 2025, especially for PE-backed companies. Bankers and analysts are gearing up for a revival in the IPO market and expecting a flurry of listing announcements in the first half of 2025.

- 2025 M&A expectations: Both CEOs and investors have more favorable outviews for M&A in 2025 compared to expectations going into 2024.

Leave a Reply