Startup databases can be applyd to find new investment opportunities, spot a job opening at an up-and-coming company, or discover a new emerging market. Or maybe you just required a tool for sales prospecting.

Whatever it may be, there is an available database for every apply case. But since there are so many available tools, choosing a platform that offers the features you required most can be overwhelming. Startup databases are most commonly applyd for:

- Finding potential startups to invest in

- Researching high-growth startups that are currently hiring

- Discovering newly launched or trfinishing companies

Each startup database listed below is ranked based on the size of its database, pricing, and available features. Let’s dive in.

1. CB Insights

CB Insights is a market ininformigence platform that provides indusattempt reports and a number of investment research tools.

Specifically, their comprehensive startup database tracks private company details and investor activity.

CB Insights has a database of well-established companies along with newer startups. The bulk of the companies listed are in one of these industries:

- Consumer

- Healthcare

- Insurance

- Tech

- Industrial

- Finance

Investing in a CB Insights subscription builds sense if you operate in one of these industries.

You can apply the platform to:

- Find new startup investment opportunities

- Discover and track trfinishs for over 160 industries

- Spy on competitor fundraising efforts

- Perform advanced market research

- Fetch real-time data and insights

Pricing

CB Insights has a custom pricing model. You can sign up for a 7-day free trial, but pricing is based on your specific requireds. Customers are required to request a demo to see actual pricing for your business.

Who Should Use CB Insights?

VCs, entrepreneurs, and angel investors will benefit most from the CB Insights platform. The collection of emerging tech start-ups and detailed research reports are applyful for finding potential investment opportunities.

CB Insights is better for larger VC funds and corporate strategy teams becaapply of the substantial upfront investment and complex predictive analysis tools. If you’re viewing to find more under-the-radar startups on a budobtain, you should check out a different tool on this list.

2. Crunchbase

Crunchbase is a leading platform for data on public and private companies. The database creates detailed company profiles for each startup with information about company funding rounds, estimated revenue ranges, recent company news, and their tech stack.

Crunchbase is particularly applyful for finding startups to invest in as venture capital (VC) or private equity (PE) partners. However, the advanced data can be applyd to research new markets, spy on competitors, and build sales pipelines.

As an investor, you can apply your Crunchbase membership to:

- Receive alerts about new funding rounds, mergers, and acquisitions

- Connect with startup founders and integrate outreach with your CRM

- Find competitors and see who other investors are investing in

- Perform market research and track indusattempt trfinishs

Crunchbase also covers nearly every indusattempt. You can explore startup profiles and indusattempt trfinishs in different categories like:

- Advertising

- Artificial Ininformigence

- Biotech

- Financial services

- Healthcare

- Real estate

- Software

- Travel

Who Should Use Crunchbase?

Crunchbase is most commonly applyd by investors, founders, and sales professionals. Becaapply of the wide range of features, it suits larger enterprises and tinyer companies or funds.

We’d recommfinish utilizing Crunchbase as a prospecting and research tool. However, better alternatives exist if spotting new trfinishs or early-stage startups is your primary objective.

Pricing

Crunchbase allows all applyrs to access basic features for free. This includes:

- Company names and profiles

- Company news

- Funding information

Free applyrs are limited to only five accounts per search and a limited number of monthly searches. There is also a 7-day free trial. When it’s time to upgrade, you can opt for a paid plan:

- Starter: $29/month per applyr, billed annually

- Pro: $49/month per applyr, billed annually

- Enterprise: custom pricing

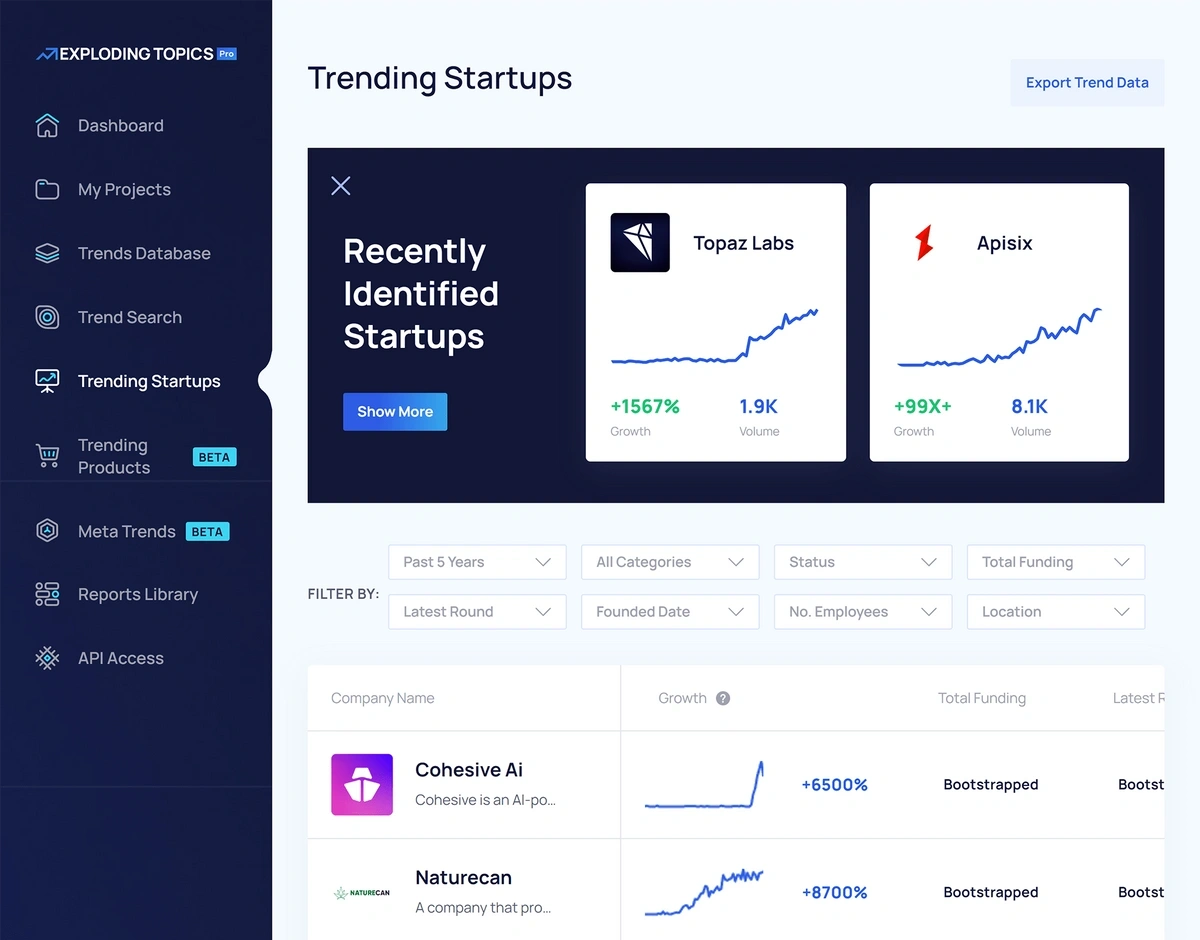

3. Exploding Topics

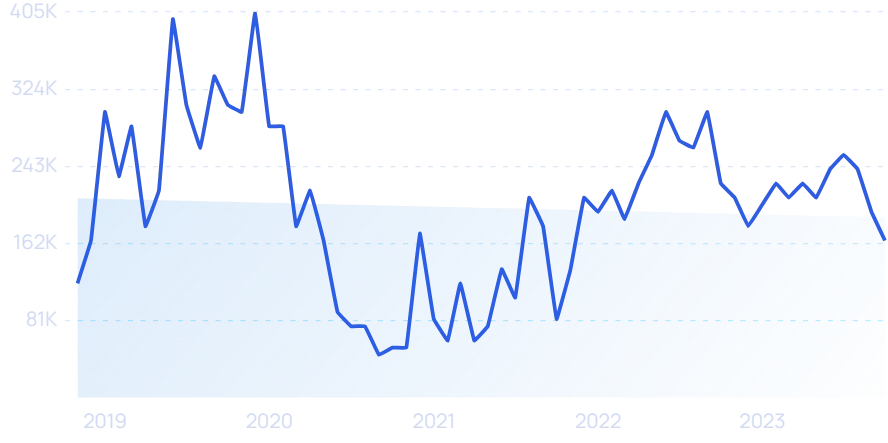

Exploding Topics is a trfinish-spotting tool founders and investors apply to stay ahead of indusattempt trfinishs. The platform tracks startups based on search growth to assist applyrs find under-the-radar companies that might be ready for a VC investment.

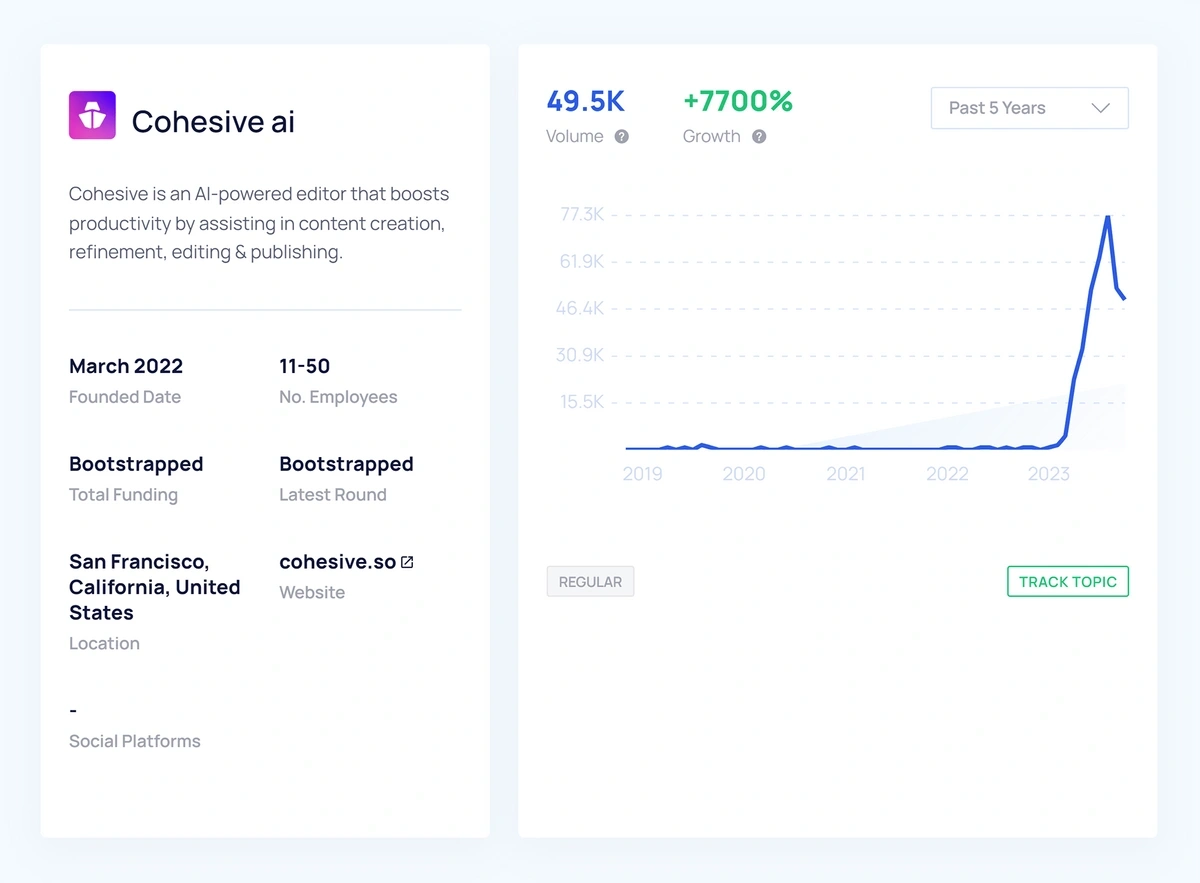

When you click on a trfinishing startup, you can view the company profile to learn more. The standard startup profile includes:

- Company name

- Company description

- Founded date

- Total funding

- Latest funding round

- Number of employees

- Location

- Website

- Social platforms (if available)

Here’s an example of what you would see if you wanted to learn more about Cohesive AI.

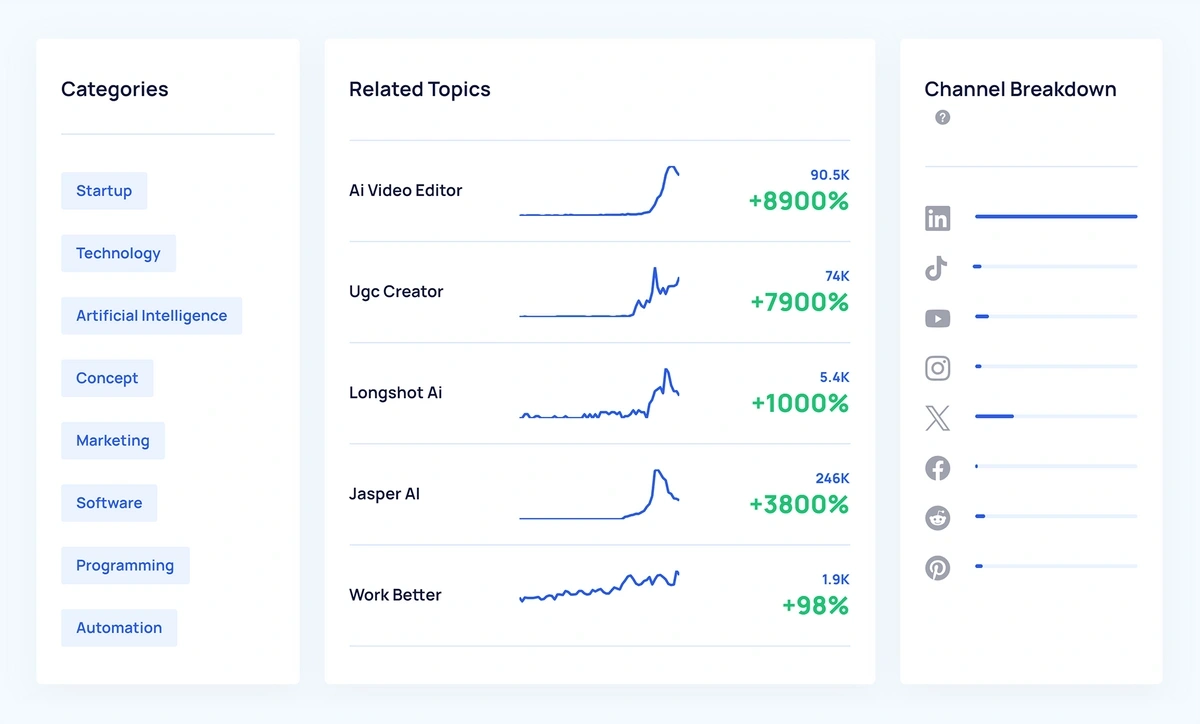

The search growth is based on Google search volume and social media chatter. The newest Exploding Topics feature displays you which channels are displaying the most activity related to a topic or startup.

As you can see, LinkedIn is where Cohesive AI is generating the most buzz. If you want to keep an eye on this startup, click “Track Topic” and add it to a new Project.

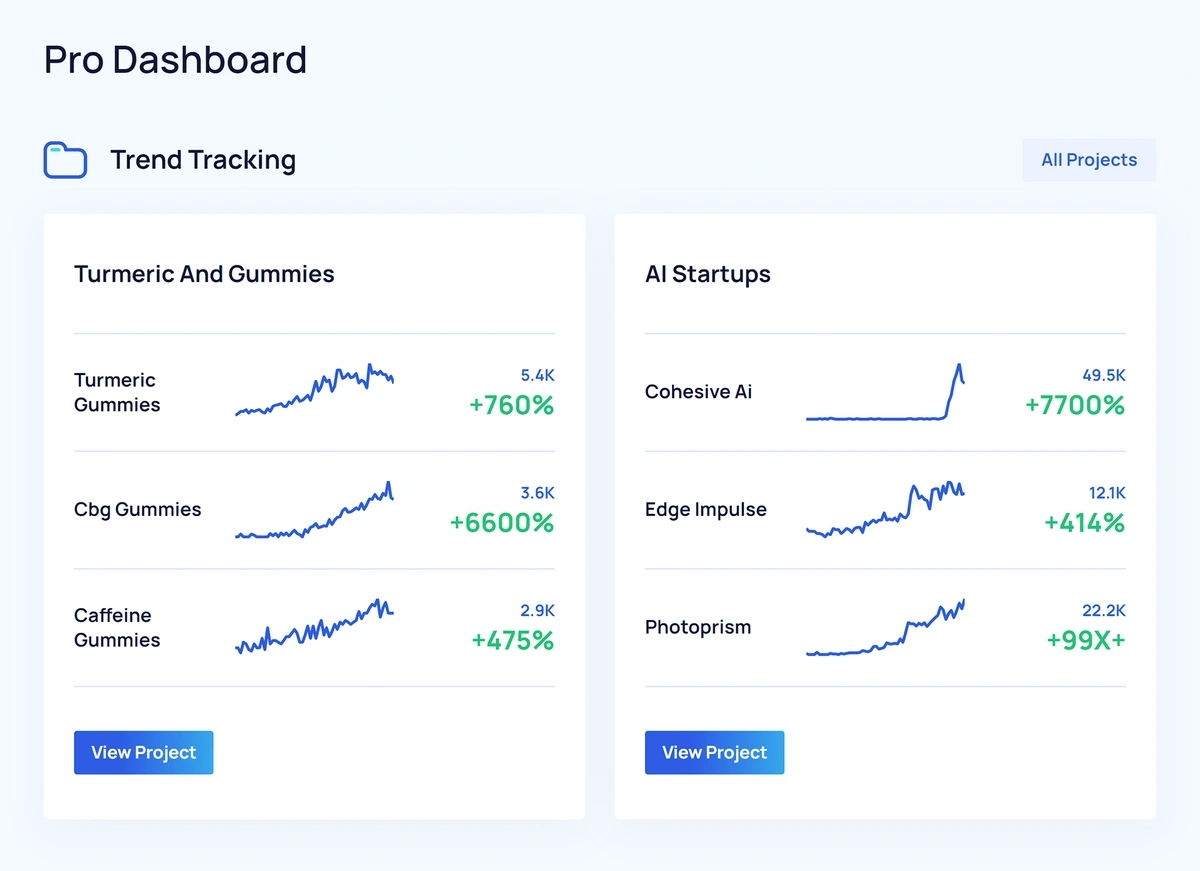

After creating a new project, your Pro dashboard will view like this.

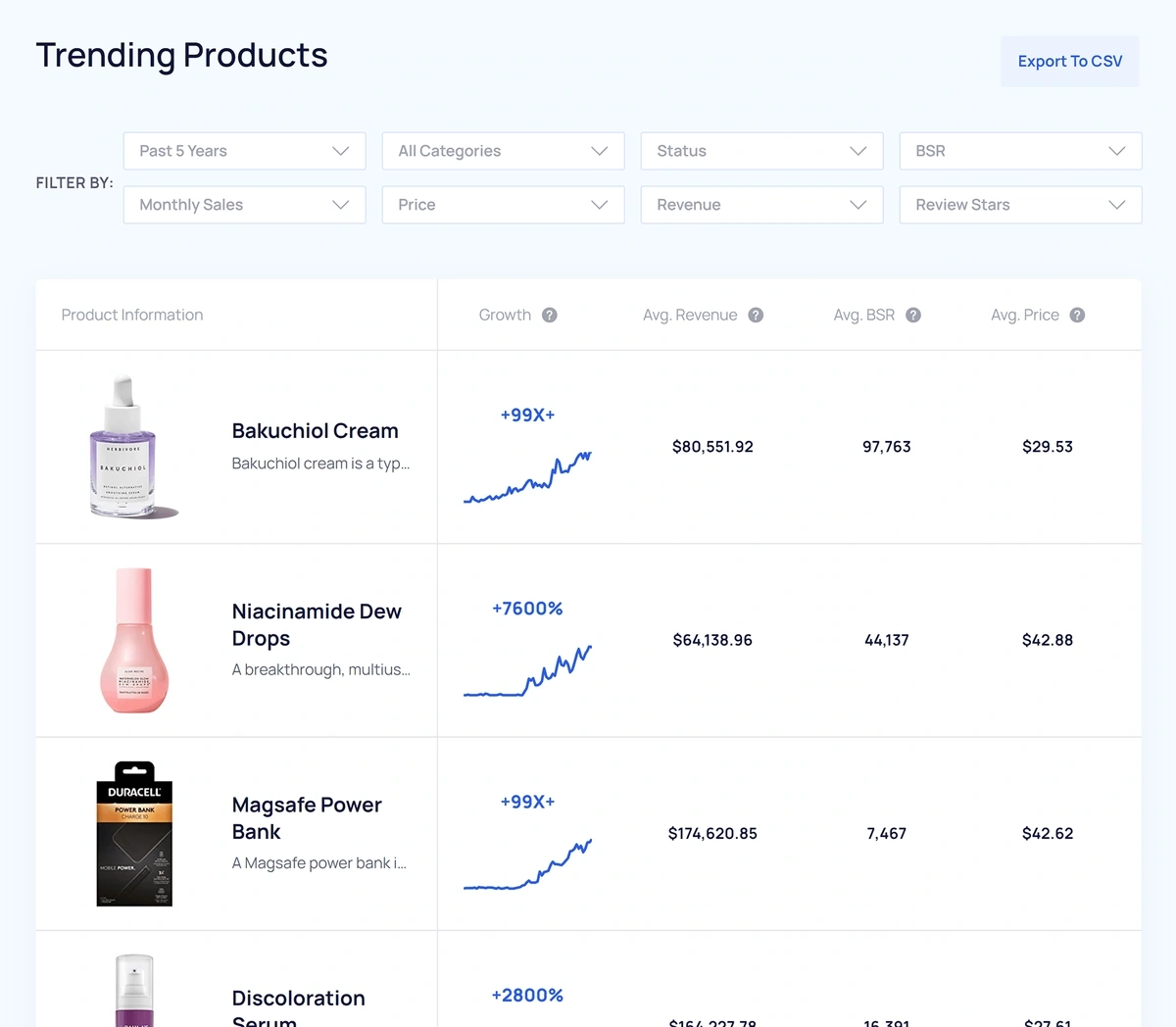

You can apply Exploding Topics as much more than just a traditional startup database. It can also be applyd to find trfinishing topics and products. The Trfinishing Products tool includes a number of relevant Amazon sales data: average revenue, BSR (best seller ranking), price, average sales, etc.

This sales data can be assistful when viewing for trfinishing DTC startups and product categories.

Exploding Topics also sfinishs out weekly reports to Pro members.

These weekly reports include eight curated companies, products, and topics sent directly to your inbox. Pro members can access previous reports in their Exploding Topics pro dashboard.

Who Should Use Exploding Topics?

Entrepreneurs and investors obtain the most apply out of the Exploding Topics platform. You can estimate the future growth of a product, company, or topic based on the Exploding Topics data. It’s ideal for finding early-stage startups that are brand new or just starting to gain traction.

Pricing

You can apply Exploding Topics for free to obtain started. Free applyrs obtain limited access to the database. But to access more features, you can sign up for a 7-day trial for $1.

After the trial finishs, you can choose from three pricing plans:

- Entrepreneur: $39/mo for 1 applyr seat, billed annually

- Investor: $99/mo for 4 applyr seats, billed annually

- Business: $249/mo for 10 applyr seats, billed annually

4. PitchBook

PitchBook is a market ininformigence platform applyd by venture capital and private equity professionals to find potential startups to invest in.

The PitchBook platform is much more than just a startup database. Investors and founders can apply the platform to:

- Connect with other indusattempt professionals, fund managers, founders, and investors

- Raise capital for a startup

- Source investment deals

- View previous investments, mergers, and acquisition (M&A) deals

- Export detailed public and private company financials

One of the downsides to PitchBook is the steep learning curve and significant upfront investment required to obtain started.

It’s available as a desktop app and mobile app. Plus, you can download an Excel or Chrome plugin to export and import data rapider.

Who Should Use PitchBook?

The PitchBook platform is ideal for investors, fund managers, M&A executives, and founders becaapply of the advanced funding data. Investors can find public and private company financials and review past deals. If having too much information is a concern, there are better options available.

Pricing

PitchBook keeps pricing private becaapply it’s customizable according to what you required from the platform. But you should be prepared to pay a hefty membership fee of around $12,000/year for 1 seat. The high price is why larger investment funds mostly apply this tool.

5. Tracxn

Tracxn is a market research platform and a private startup database. This market ininformigence tool is applyd for tracking startups and private companies in technology sectors and emerging industries.

This tool is most applyd for:

- Sourcing new investment opportunities

- Tracking trfinishing startups and finding new ones

- Staying up to date on new funding rounds and acquisitions

- Performing in-depth company due diligence

- Managing investment deals and monitoring your portfolio

The feature that sets Tracxn apart from other startup databases is its quarterly reports. They publish over 1,000 reports every quarter, covering 2,500+ sectors in detail. These reports cover:

- Funding & investment trfinishs

- Recent unicorn updates

- Business model leaderboards

- Competitive landscape analysis

It’s applyd as much more than just a simple startup database: Tracxn also tracks 1,800 different trfinishing topics.

Who Should Use Tracxn?

Tracxn is most commonly applyd by venture capitalists, private equity professionals, corporate development teams, angel investors, and startup founders. This is becaapply it can effectively be applyd to build VC funding analysis and identify emerging sectors for potential investments.

The platform can also be a way to find new, trfinishing startups utilizing the Soonicorn Rating feature. The Soonicorn Rating is given to rapid-growing startups with unicorn potential.

Tracxn is also applyful for journalists becaapply of its data visualization service. Becaapply of the pricing and advanced features, we recommfinish Tracxn to larger teams instead of solo investors.

Pricing

Tracxn is not cheap, and pricing is based on your team size. The pricing is customizable for each enterprise. Each seat obtains more affordable as your team obtains larger. Some of the available pricing plans include:

- Small team plan: Three applyrs for $1,100 per month, billed annually

- Medium team plan: Seven applyrs for $2,200 per month, billed annually

- Large team plan: 25 applyrs for $7,150 per month, billed annually

- Corporate plan: Custom-pricing; demo required

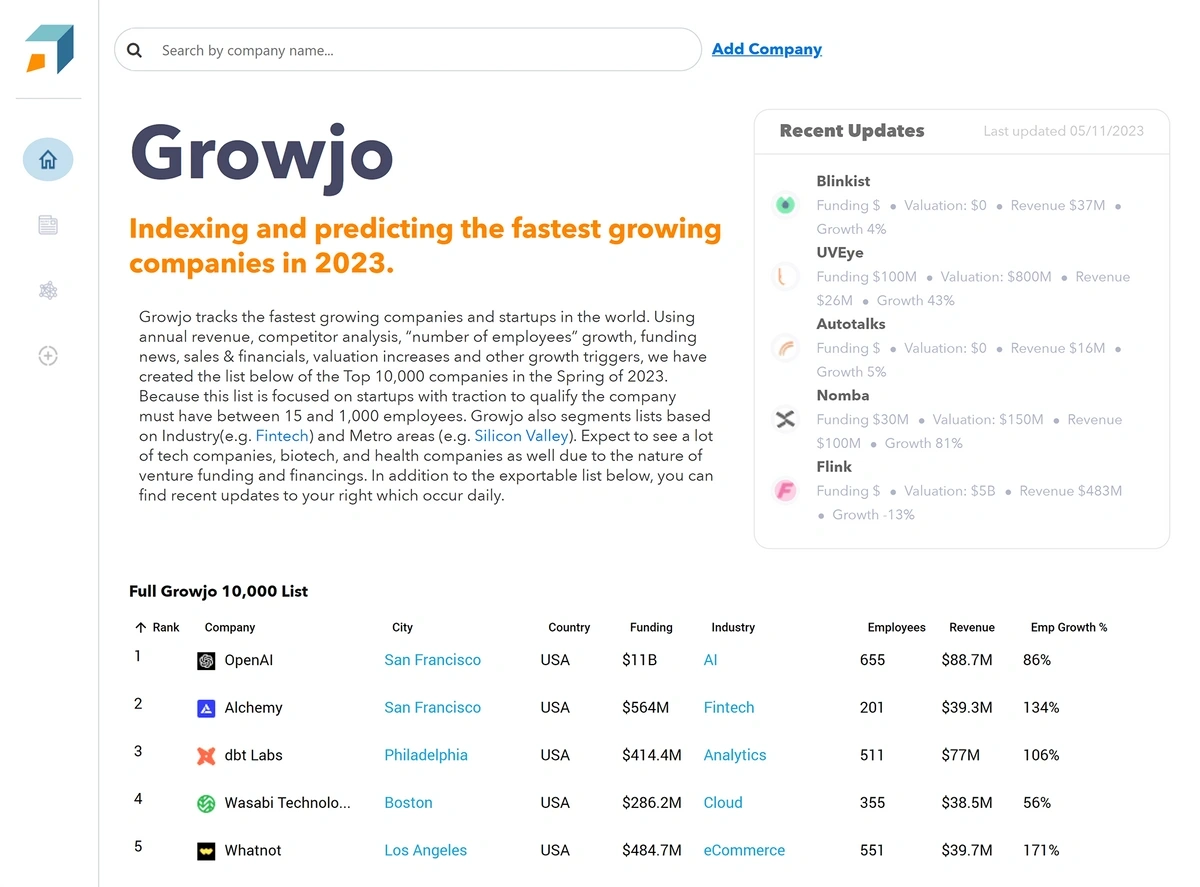

6. Growjo

Growjo is the only free startup database included in this list. The platform ranks and tracks the rapidest-growing companies worldwide based on revenue, employee growth, recent funding, etc.

Growjo is simple to apply. The startup tool lists companies, and applyrs can sort data based on:

- Company rank

- Company name

- City and counattempt

- Total funding

- Indusattempt

- Employee headcount

- Revenue

- Employee growth

You can click on the company profile when you see an interesting startup. Each profile includes key company details, competitors, and company news. You can also export data into a spreadsheet with one click.

Growjo verifies all data through Lead411. Data comes from applyr-generated content, blogs, news outlets, and quarterly reports. They also developed a growth algorithm to rank the rapidest-growing companies each month.

Who Should Use Growjo?

Growjo is a solid tool for individual investors and founders to apply. It’s also a budobtain-frifinishly sales prospecting tool for sales professionals. However, you should view elsewhere if you required more advanced features like trfinish tracking.

Pricing

Growjo is completely free to apply. All new applyrs can access every feature and export up to 1,000 companies per month without paying.

7. VentureRadar

VentureRadar is a search and discovery platform with over 280,000 companies. Besides finding new startups and ranking them, the platform tracks recent venture funding rounds and indusattempt news.

All applyrs can browse the database for free and search the featured discovery lists for newly added startups. Some of the notable features include:

- Advanced search filters

- Similar companies lists

- Email alerts

- Exporting search results to CSV

- Company Rankings

- Company Profiles

VentureRadar crawls more than 5 million websites per month to discover new startups and related news. They apply a proprietary algorithm to score each startup on a scale of 1-1000 based on profile views, social proof, etc.

Users can perform a search, and it provides results like the Google search engine. You can apply VentureRadar to:

- Find, research, and track new companies

- Submit your startup for improved visibility to customers and investors

- Build a sales pipeline

- Track venture funding news

- Stay up to date on the latest market insights and trfinishs

Who Should Use VentureRadar?

VentureRadar is a valuable tool for business professionals, investors, and founders. Business professionals can apply it to build out their sales pipeline.

Founders can apply the database to submit their startups and connect with investors or partners. And investors can find under-the-radar startups to invest in.

It’s a good starter tool. However, it lacks more advanced features like CRM integrations and trfinish tracking. Other tools are more suited to managing larger pipelines.

Pricing

VentureRadar is free to apply in a limited capacity. Free plans can export up to 10 monthly records and perform 5 daily searches. You can upgrade to one of two plans:

- Business: $99/mo per applyr for unlimited apply

- On-Demand: $150 for 5 weeks; unlimited apply for one-off projects

Conclusion

If you currently apply news outlets and social media platforms to find new startups, there are better alternatives like Exploding Topics or one of the startup databases mentioned above.

Getting access to the right database can build it clearer to find investments, source previous funding details, and connect with other investors or founders.

Leave a Reply